The ball is fully in the SEC’s court as all applicants for the proposed spot Bitcoin exchange-traded funds (ETFs) have submitted their final amended S-1 applications.

Valkyrie Takes Lead In Sequential S-1 Filings

All eleven asset management firms seeking approval for their spot Bitcoin ETFs have successfully submitted their final amendments to the US Securities and Exchange Commission (SEC). The notable contenders include BlackRock, Grayscale, ArkInvest, Fidelity, Franklin, VanEck, Valkyrie, Bitwise, Hashdex, WisdomTree, and Invesco Galaxy.

Valkyrie, making strategic moves, emerged as one of the first companies to submit its final S-1 amendment ahead of the anticipated January 10 deadline. This date is widely speculated to mark the approval of the first spot Bitcoin ETFs in the United States.

Following Valkyrie, other contenders swiftly followed suit. WisdomTree, BlackRock, VanEck, Invesco and Galaxy, Grayscale (S-3 filing), ARK Invest and 21Shares, Fidelity, Bitwise, and Franklin Templeton consecutively filed their final amendments.

Fee Reductions

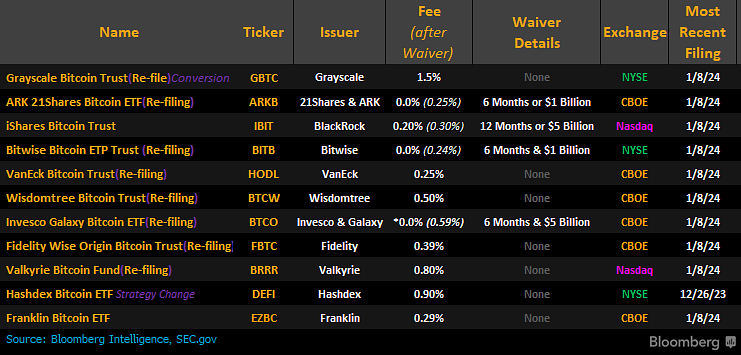

Some filers have proactively tried to attract investors by significantly reducing fees for trading potential spot Bitcoin ETF products. ARK and 21Shares, for instance, plan to waive their 0.25% fee for the first $1 billion in assets under management (AUM) during a six-month period from the day of listing.

BlackRock's Bitcoin ETF, after an initial 0.2% fee, will charge 0.3% for the first 12 months or $5 billion in AUM. With the substantial size of Grayscale asset management, expectations are high for relatively low BTC ETF fees from them. Franklin and Bitwise are also likely to offer fees below the 0.9% markup.

Despite the fee reductions, ETF analyst Eric Balchunas suggests that the ongoing fee war among potential spot Bitcoin ETFs is unlikely to alter the competitive landscape significantly. Balchunas points out that historically, advisors focused on long-term investments are more concerned with regular fees. However, he acknowledges the potential impact on these ETFs, given their similar functionalities.

Initial Seed Creation Baskets

In a show of confidence, BlackRock disclosed that it purchased 227.9 BTC with the proceeds of the seed creation baskets on January 5, 2024, amounting to $10 million. The firm's S-1 registration statement confirmed that these 400,000 shares represent the entirety of outstanding shares as of the date of the prospectus.

ARK and 21Shares also plan to acquire initial seed creation baskets of $437,000 around January 8. This fund will be utilized to acquire Bitcoin before listing shares on the Cboe BZX Exchange.

Ready for Milestone Approval

This flurry of final filings sets the stage for what could be a historic week for Bitcoin. The hopeful issuers had to finalize their Form S-1 amendments before January 8 as these amendments encompass crucial details such as information about fees and the identities of market makers associated with the potential ETFs.

These firms are poised to become the first spot Bitcoin ETFs in the United States. Speculations are rife that the SEC could grant approval for the Spot Bitcoin ETF later this month, with a staggering 95% probability of approval.

Disclaimer: This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.