Lift your glasses, albeit with a sardonic smile, for Samuel Bankman-Fried, once a crypto kingpin, is now well on his way to prison; a moment I am sure we’ve all been waiting for.

As we narrate the tale of a young visionary’s descent into ignominy, one must pause to consider the intoxicating blend of ambition and digital gold that once had Samuel Bankman-Fried at the crest of a financial revolution, only to plummet into the abyss of criminal conviction.

In the sobering chambers of justice on Manhattan’s 26th floor, the eerie silence around Bankman-Fried was punctuated by the chains of his reality, clinking against the cold, hard facts presented by former allies turned accusers.

A procession of erstwhile confidants depicted a breathtaking ascent fueled by subterfuge, as billions were spirited away through the digital backdoor of the FTX empire.

The Rise and Fall of Bankman-Fried, the Crypto “Icon”

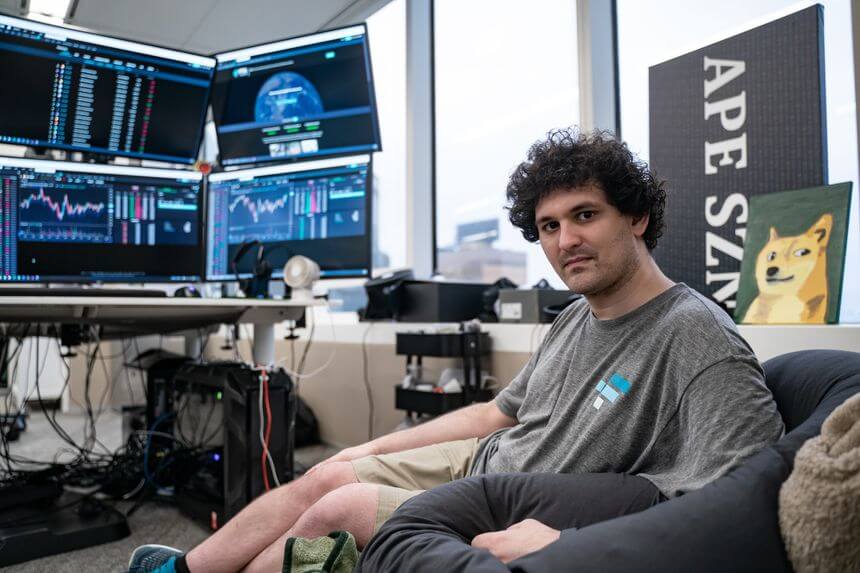

Bankman-Fried, in his unassuming attire and trademark disheveled appearance, had once been the darling of Capitol Hill, the prodigious architect behind a high-tech financial utopia.

Investors, bewitched by his vision, poured around $2 billion into FTX, ballooning its worth to a staggering $40 billion.

His path from MIT graduate to Jane Street trader, then a maverick crypto entrepreneur, was punctuated with the same casual indifference with which he donned his cargo shorts.

Yet, behind this façade of eccentric genius and philanthropic rhetoric—selling the dream of a business empire that would shepherd humanity through existential crises—lurked a more convoluted reality.

You Might Be Interested In: Now what happens to Caroline Ellison, Gary Wang, and Nishad Singh? – Cryptopolitan

The prodigal son of Stanford Law luminaries lived out a modern Gatsby tale in a Bahamian penthouse, where the lines between personal extravagance and corporate expense blurred into oblivion.

Behind the Curtain of Philanthropy

As the prosecution dissected the anatomy of FTX’s fall, they exposed a hemorrhaging of customer deposits into the voracious appetite of Alameda Research.

Here was a narrative of “unlimited borrowing” morphing into “unlimited stealing,” a scheme that hinged on the volatility of crypto markets, thriving until it didn’t.

It’s a tale not of caution, but of avarice, unchecked power, and the devastating collapse of a crypto Goliath. Bankman-Fried’s downfall wasn’t just the crumbling of a financial institution; it was the shattering of an ethos that promised revolution but delivered ruination.

His fall from grace is a specter that haunts the industry, raising existential questions about the nature of our digital financial guardians.

Caroline Ellison, once the heart to Bankman-Fried’s brain in their corporate romance, spoke of a philosophy gone rogue, where moral relativism justified ends so grand they dwarfed the means.

This “greater good” narrative, however, did not resonate in the cold, hard metrics of law. No, not even when the defense spun tales of a utopian crusader wrongfully cast as the antagonist in a tale of greed.

Bankman-Fried’s final act, a cross-examination that saw him retreating into a fortress of selective memory, was less an eloquent epilogue than a glaring exposition of his storytelling prowess, now a tragic flaw.

The jury, unpersuaded by his fables of good intentions gone awry, saw through the facade of a man who equated ethical lines with mere suggestions, resulting in a veritable financial heist.

The trial concluded, leaving a cryptic void where once stood a titan of tech and finance. The enigma of Bankman-Fried’s true intent—philanthropic visionary or calculating fraudster—remains, for some, unresolved.

Yet, for those who once believed in the gospel of crypto he championed, the betrayal is palpable and the verdict irrefutable. So, here’s to you, Samuel Bankman-Fried.

Your reputation, once golden, now tarnished, concludes not with a standing ovation, but with the echo of a gavel’s fall and the somber realization that in the pursuit of greatness, one must never lose sight of the ledger’s bottom line.

The toast is solemn, the lessons stark; may the future of finance heed the cautionary tale written in the ledger of your fall. And kudos to the American government, for finding you guilty of all the crimes you definitely committed.

Have fun in jail!