Web3 venture capital company Animoca Brands just got slapped hard on the secondary markets. The company’s secondary shares are currently going for about $1.5 billion.

That’s a massive 75% drop from what they were valued at last July. Back then, Animoca was sitting pretty with a $5.9 billion valuation after pulling in $75 million in a funding round.

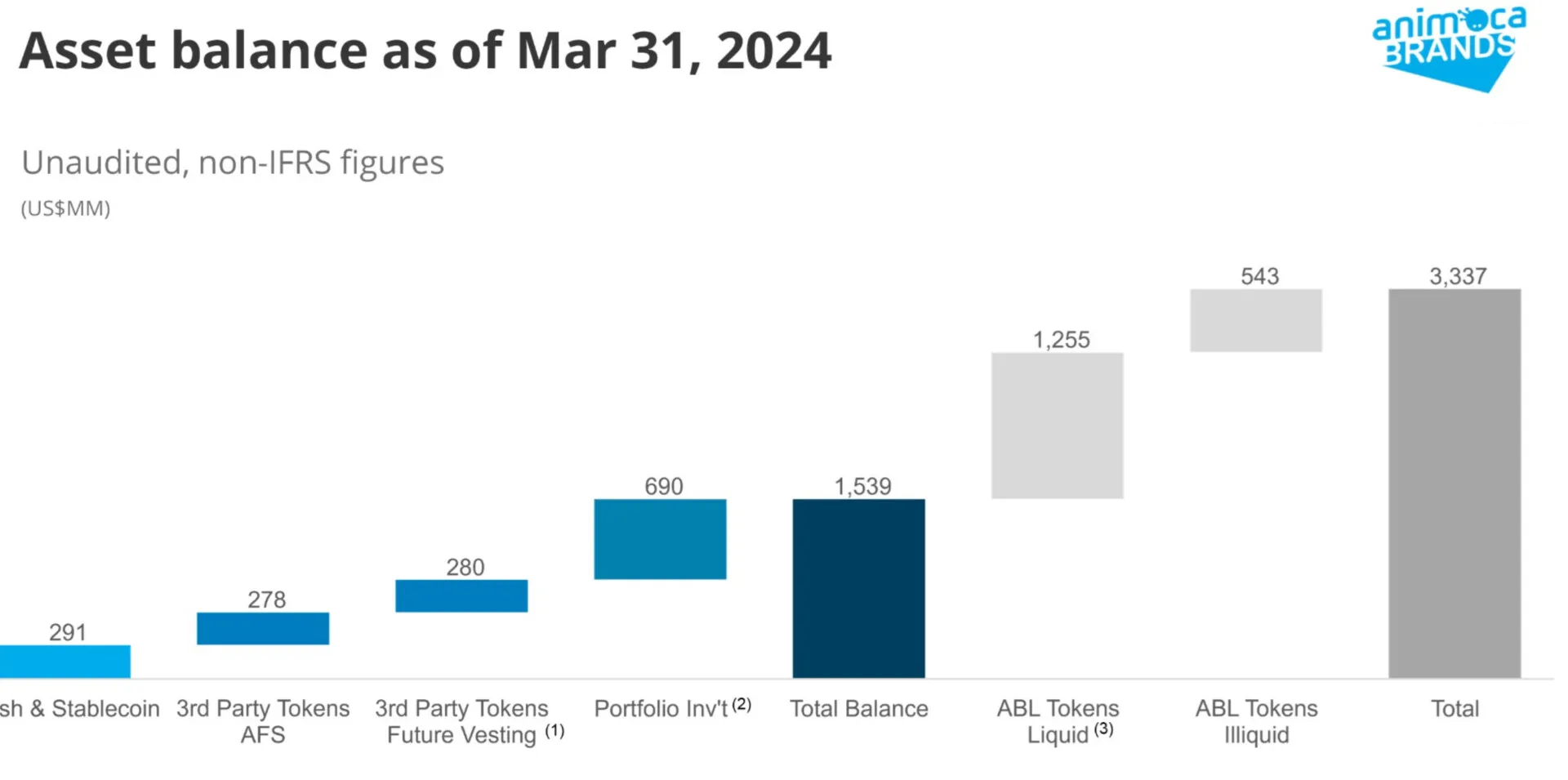

Still though. As of March ending, they were packing $3.3 billion in assets, including crypto, cash, and equities. But apparently, that doesn’t mean much to investors trading on the secondary market. They’re simply not feeling it.

Investors aren’t buying it

Yat Siu, the executive chairman and founder of Animoca, was the one who shared the numbers from secondary shares. But crypto secondary market analyst Bulletin pegs the valuation slightly lower at $1.3 billion.

So, what’s the deal? Why are investors suddenly so cold on Animoca? Well, let’s talk about the NFT market. Animoca has built its reputation on big investments in NFTs, web3 gaming, and the metaverse.

But the NFT scene isn’t exactly on fire right now. Sure, the crypto markets have bounced back a bit since the 2022 crash, but NFTs? Not so much.

Just look at the numbers—July saw only $430 million in trading volume for NFTs, a far cry from the $6 billion we saw back in January 2022.

The NFT market: A sinking ship?

The secondary market is not like the New York Stock Exchange; it’s much less liquid. There are fewer buyers and sellers, which makes big swings in valuation more common.

And right now, the market is leaning heavily bearish, especially when it comes to NFTs. Despite the doom and gloom, Animoca isn’t waving the white flag. In fact, they’re looking at the possibility of going public.

Yat thinks that if they were a publicly traded company right now, the valuation discrepancy would sort itself out. “It’s just information mismatch,” Siu reportedly said.

He’s convinced that if Animoca were listed, this whole situation would “error correct.” But that’s a big “if.” The secondary market has already spoken, and it’s not exactly singing Animoca’s praises.

Whether or not an IPO would really make that much of a difference is anyone’s guess. Right now, the company is riding out a rough patch, and it remains to be seen whether they’ll weather the storm or get dragged down by the sinking NFT ship.