The Aptos price analysis is showing bullish results for the day as the price kept rising steadily. The buying pressure is seen to be strong, pushing the price up by 2.89% from its opening value of $9.01 rallied to $9.30. The market was in the bearish trend earlier today, threatening to drop below its intraday low of $8.87. But it quickly shifted back to the bullish sentiment and has maintained its momentum throughout the day.

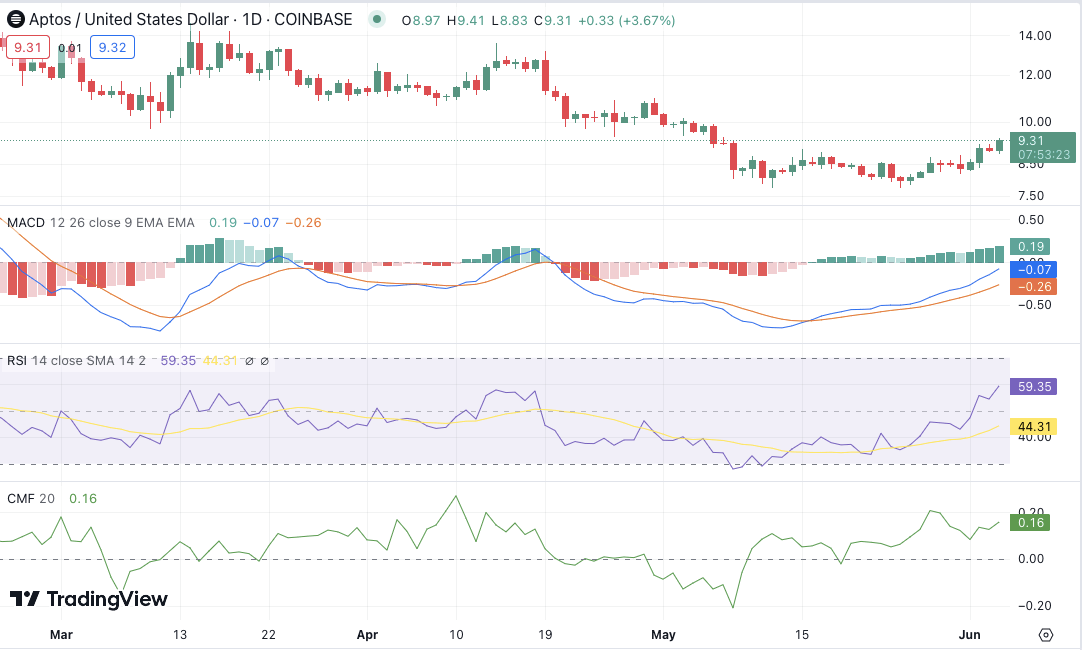

APT/USD 1-day price chart: Aptos price gains bullish momentum as it reaches $9.30

The 1-day Aptos price analysis chart shows the candlesticks are moving in a bullish direction after a prolonged period of loss. The APT/USD price has recovered above the $9.30 level as more buying is seen in the market. The trading volume has slightly increased by 19.17 percent, and it is currently at $103 million, while the market cap has increased by 2.97 percent over the past 24 hours resulting in the market dominance of 0.16 percent.

The Relative Strength Index (RSI) score is going up as well because of the increase in price, and the indicator is giving a reading of index 59.35 in the lower half of the neutral zone. The moving average convergence divergence (MACD) also shows a bullish sign as the MACD line crosses above the signal line to form a crossover. The Chaikin money flow (CMF) is also indicating a positive trend as the indicator goes above the zero line. The Aptos price is likely to continue its bullish momentum in the near future.

Aptos price analysis: Bulls are in the driver’s seat

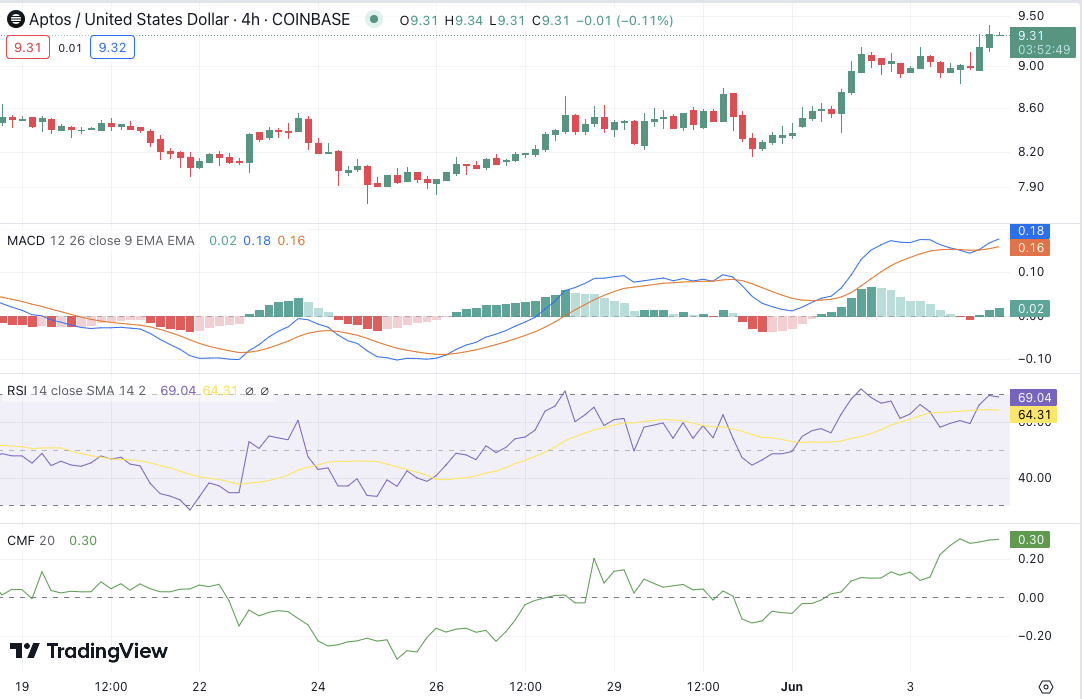

The 4-hour Aptos price analysis is also showing bullish signs as the price has gone up to reach the $9.30 level, despite the fact that the price breakout was downwards at the start of the trading session. There has been a continuous increase in the price during the previous eight hours, and yet the price is covering the upward movement at present.

The moving average converge divergence (MACD) is showing signs of a bullish trend as the histogram is above the zero line and moving towards the positive region. The Chaikin money flow (CMF) indicator is also in the green zone at 0.30, indicating more buying pressure in the market. The relative strength index (RSI) is currently standing at a moderate level of 69.04, which means that it is neither overbought nor oversold. The 20-day simple moving average (SMA) is also in the bullish region, and the price is trading above it at the moment.

Aptos price analysis conclusion

Overall, the Aptos price analysis indicates that the bulls are in control of the market as there is a clear upward trend in APT/USD prices. The buying pressure looks strong, and if this continues, the price may reach higher levels. The support present at $8.87 is likely to hold if the prices decrease in the short term. However, if the price breaks out below this level, it may find further support at $8.50. On the other hand, if the prices continue to rise, then we can expect Aptos to reach new heights in the coming days.