Arbitrum price analysis is indicating a decline in price today. The bears have won the leading position as the selling pressure has formed again and the price is decreasing again. The value of the token has dropped below $1.20 and is currently trading at around $1.15. The market sentiment for the Arbitrum token is bearish compared to the overall market sentiment, and it is expected to remain so in the near future. The sellers are still active and have been dominating the trading volume. This has caused a sharp decline in price as well. The 24-hour trading volume of the token has reached $175 million, and the market cap currently stands at $1.4 billion.

Arbitrum price analysis 1-day chart: ARB drops below $1.15 following a downward slide

The 1-day Arbitrum price analysis reveals that it has failed to break above the $1.17 resistance level and continues to retrace. The token found strong support at the $1.14 mark, but the price action is still bearish overall. If the bears remain in control for a prolonged period, then we can expect further downside movement ahead. On the other hand, if the bulls manage to break above the $1.17 level, then we can expect some price recovery in the near future.

The Bollinger Bands indicators on the 1-day chart for ARB/USD are currently in a bearish mode and are indicating that the market is in a downtrend. The 50-moving average line is above the 100-moving average line, which further increases the bearish pressure. The relative strength index (RSI) indicator has dropped to 51.67, which confirms that the market is neither oversold nor overbought.

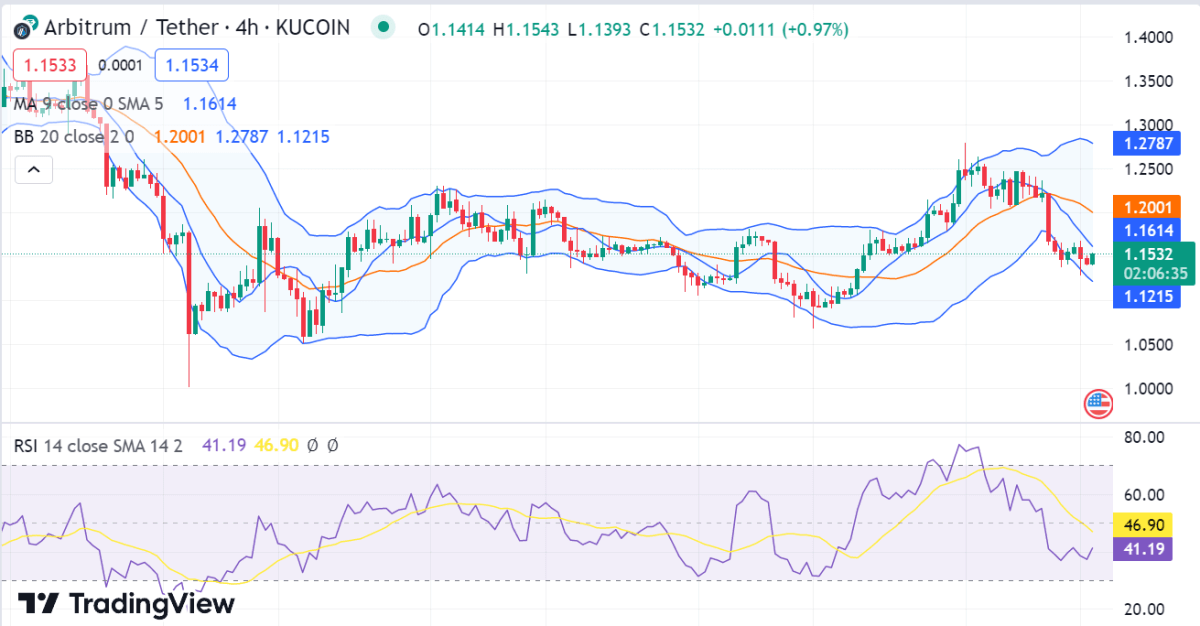

ARB/USD 4-hour price chart: Price stumbles at $1.15 as bearish signal continues

The 4-hour Arbitrum token shows that bearish sentiment has been prevailing for the past few hours. The price has been rejecting the $1.17 resistance level and is currently trading around the $1.15 level. The ARB price has declined by over 1.12% in the past 24 hours, and the bears are likely to remain in control for some time. Therefore, it can be concluded that the Arbitrum token is still in a bearish zone and could continue falling for some time.

The moving average (MA) line is trending downward, which is a bearish sign. The Relative Strength Index (RSI) indicator has dropped to 41.19, indicating that the sellers are in control of the market. The market volatility for the token is also low, indicating that the price movement in the near future might not be very volatile. The Bollinger Band indicators are in a bearish mode and are showing that the market is in a downtrend.

Arbitrum price analysis conclusion

In conclusion, this indicates that the Arbitrum token is still in a bearish zone and there could be further downside pressure ahead. The bears are dominating the market, and therefore traders should look to go short on this token. The market sentiment for the ARB token is bearish, and it can be expected to remain so in the near future. Therefore, traders should look for entry points to go short on this token and set tight stop-losses.