Arbitrum price analysis is showing bearishness as the ARB market is suffering a major downturn. The price of ARB has dropped by 4.46 percent in the past 24 hours, and it is currently trading at around $1.17. The bears seem to be in control, as the token is struggling to find support at this level and could potentially fall further. This bearish pressure may cause the price to break through the support level of $1.16, increasing its downside potential even further in the coming days ahead, and if the bearish momentum persists, the ARB price could test even lower levels shortly. The bulls need to act fast to push the ARB price above the resistance level of $1.23 in order to restore the bullish sentiment in the market and prevent further downside price action.

Arbitrum price analysis 1-day chart: ARB price level shows a bearish momentum after the market crash

The 24-hour Arbitrum price analysis shows that the token has a bearish outlook. The ARB price shows that it has been in a sideways pattern for the past few days as the bears have been controlling the market. The market capitalization of ARB is currently at $1.49 billion, which is low compared to the previous figures. The 24-trading volume for ARB is also on the decline and currently stands at around $203 million in the last 24 hours.

The relative strength index (RSI) indicator is in the neutral zone at the 47.05 level and may move further into the bearish zone if the ARB price continues to drop. The ARB/USD is currently trading below both its 50-day and 200-day moving averages, which indicates that the bearish sentiment is still strong and may lead to further downside. The MACD has also turned negative, with histogram bars in the bearish zone.

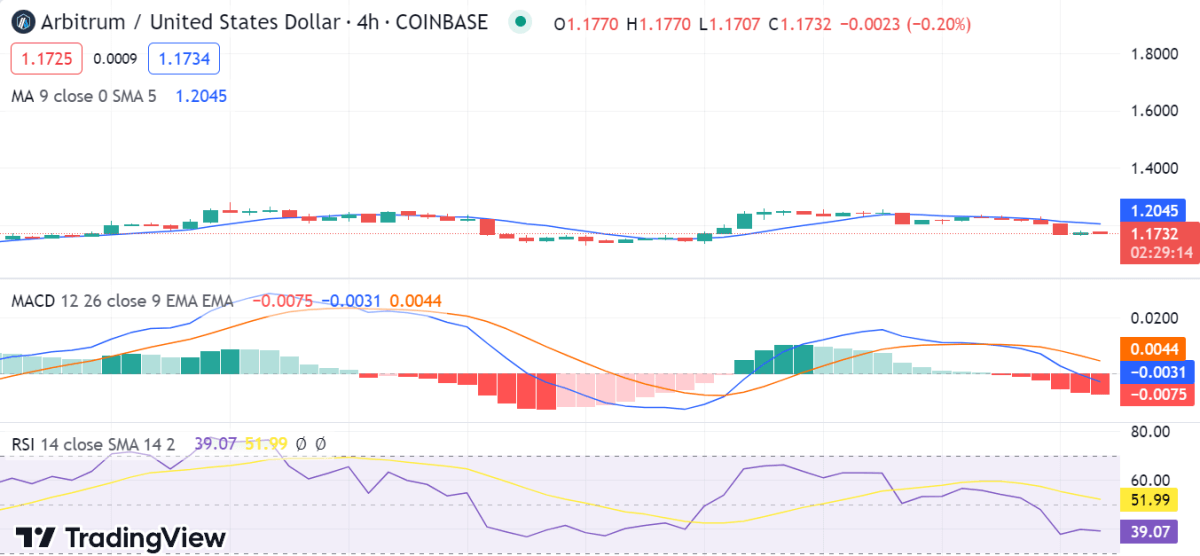

ARB/USD 4-hour price chart: Latest developments

The 4-hour Arbitrum price analysis also shows that the token is in a downward trend, and it looks like the bears are in control. The token has also failed to break out of its current range, and it looks like it may soon head lower. The price is expected to continue falling in the near term as bearish momentum increases. The market sentiment for ARB is bearish, as the long-term and short-term moving averages are both trending downward.

The moving averages are also trending lower, suggesting that the bearish momentum is likely to remain in control over the short term. The SMA 20 has crossed below the SMA 50, further confirming that bears are in control of the sentiment. The MACD has also crossed into bearish territory, indicating that selling pressure could be increasing. Furthermore, the relative strength index (RSI) is also trending down, indicating that the bearish momentum could continue in the near future.

Arbitrum price analysis conclusion

Arbitrum price analysis is bearish with bears being in control of the market for the past 24 hours. If the bears break below $1.16, then ARB/USD will likely fall to the $1.11 support level. However, bulls could cause a pullback above the $1.23 resistance if they regain control of the price. In any case, traders should remain patient and wait for a clear trend reversal before entering the market.