Is it more expensive to attack a Proof-of-Stake (PoS) network compared to a Proof-of-Work (PoW) one? BitMEX’s latest report digs into this debate, challenging the idea that PoS systems are harder to compromise.

The key here is comparing the cost of renting versus buying the necessary resources for an attack.

Renting vs. buying: The cost dynamics

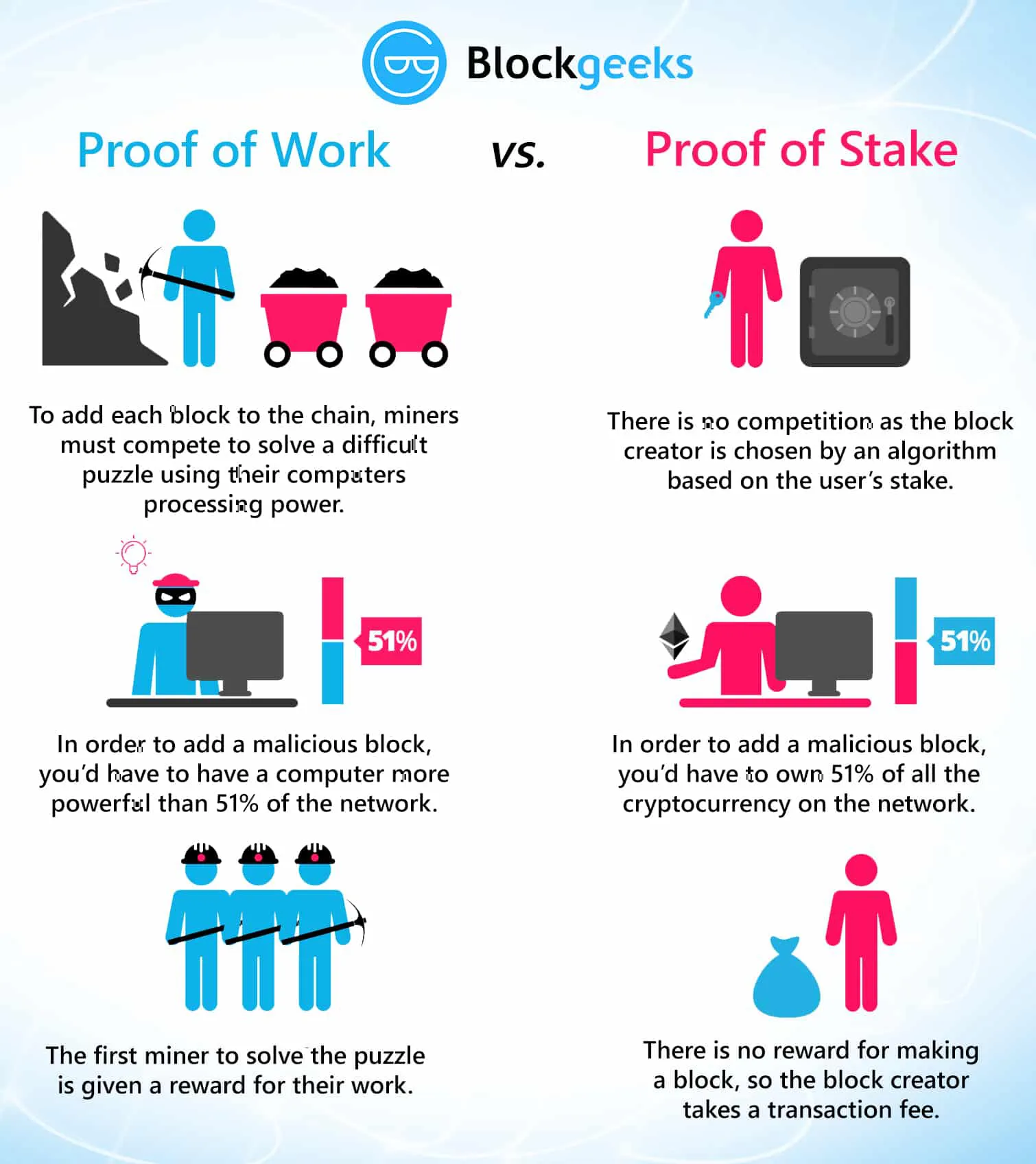

Let’s start with the basics. To attack a PoW network like Bitcoin, you’d need to control 51% of its mining power.

Miners make about $10 billion a year, so renting enough hash power to attack the network would be a huge expense. But what if you only need to offer a little more to entice miners?

A 20% premium on their annual income means you’d need around $12 billion. After subtracting potential earnings from mining, BitMEX said the net cost could be about $2 billion per year.

On the other hand, PoS networks like Ethereum require attackers to control a large portion of the staked coins. Stakers earn around $3 billion annually.

Applying the same 20% premium, the cost to rent enough staked Ethereum would be roughly $3.6 billion per year.

However, only a third of the total stake is needed to disrupt the network, bringing the annual cost down to about $1.2 billion.

According to BitMEX, this comparison isn’t perfect but highlights that PoS might not be as expensive to attack as some think. They argue that

“When normalizing for market capitalizations, the cost to attack is about the same, with Bitcoin around three times larger.”

A more permanent threat

If an attacker wanted to go all in, they’d need to buy and build—acquiring mining hardware for PoW or purchasing staked assets for PoS.

For PoW networks, this means buying up to 51% of the mining hardware, which could be a long and costly process, possibly taking years and billions of dollars.

For PoS, if someone like Elizabeth Warren’s fictional anti-crypto department tried to buy up a third of the staked Ethereum, it could cost up to $100 billion. This could trigger a surge in markets.

BitMEX points out that this attack could be counterproductive:

“The impact of such an attack on the ecosystem would be tremendous, and a huge rally would occur in the price of alternative coins.”

Attacking PoW networks requires ongoing expenses to maintain control over the network, while PoS systems might only need a one-time investment. BitMEX notes:

“One critical factor of PoW systems here is that the attacker may need to continue spending funds in the long term to maintain and sustain the attack, while for PoS systems, it’s mostly a one-off cost.”

Confiscation risk and real-world anchors

Another consideration is the risk of confiscation. Mining hardware is physical and can be seized, whereas cryptocurrency stakes can be moved across borders with relative ease.

This makes staking potentially more secure against physical attacks. BitMEX says that:

“Transporting the stake is as easy as moving a private key, and it’s very easy to move it across borders undetected.”

However, both PoW and PoS systems have their vulnerabilities. In PoS, if an attacker controls a huge portion of the stake, they could theoretically destroy the network.

In PoW, the network might recover over time as mining hardware degrades and is replaced. BitMEX said:

“You at least have the chance to wait it out and return, hopefully unburdened by what has been.”

The lack of a real-world anchor in PoS systems could be a weakness, making them potentially more susceptible to certain types of attacks.