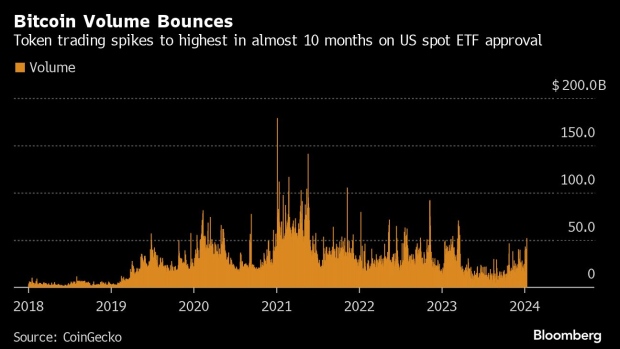

The cryptocurrency scene is currently witnessing an unexpected twist in the tale of Bitcoin ETFs, which had once enjoyed a meteoric rise in the financial markets. Following the green light from U.S. regulators for 11 new Bitcoin ETFs in January, there was a reversal of fortune this week as we saw a significant outflow of funds. Observers and investors alike are now on their toes, wondering if this $850 million departure is a mere hiccup or a forewarning of a deeper downturn in the world’s premier cryptocurrency.

After a bullish run that saw Bitcoin’s value soar to a record $73,000, the recent price dip has seemingly doused the flames of investor enthusiasm. This week, Bitcoin’s price took a dive to as low as $60,760, causing many to second-guess their investment strategies. James Butterfill from CoinShares pointed out, “People have looked at how much the price of bitcoin has fallen and they’ve decided to hold off, nobody wants to catch a falling knife.”

The Tug of War in ETF Land

While BlackRock, the global leader in asset management, boasted inflows of $576 million this week, its competitors weren’t as fortunate, witnessing minimal new investments. However, Grayscale’s Bitcoin ETF, which transitioned from a trust in January, is facing a stiff headwind due to its higher management fees, leading to sustained withdrawals. Ilan Solot of Marex chimed in, saying, “We’re approaching a dead zone for these ETF products where the initial frenzy of pent-up capital has come in already.”

Adding another layer to this complex scenario is the upcoming Bitcoin halving event in April. This quadrennial occurrence, which cuts the miners’ rewards in half, is anticipated to have a long-term bullish impact on Bitcoin’s price, despite the current climate of uncertainty.

A Battle of Titans

In the meantime, a fascinating race is unfolding between BlackRock and Grayscale. With BlackRock’s iShares Bitcoin Trust ETF now holding 238,500 Bitcoins and enjoying daily inflows of around $274 million, it’s rapidly closing the gap on Grayscale’s Bitcoin Trust ETF, which currently holds an estimated 350,252 Bitcoins. The latter, however, has been experiencing daily outflows of roughly $277 million over the last fortnight.

Should the current trend persist, BlackRock is poised to dethrone Grayscale as the world’s top institutional holder of Bitcoin by April 11. This forecasted shift has even caught the attention of crypto influencers like George Tung, who speculate that BlackRock’s ascendancy could occur within a mere two weeks.

Interestingly, the GBTC experienced its largest daily outflow on record on March 18, totaling $643 million. Despite this, senior Bloomberg ETF analyst Eric Balchunas believes that the tide of outflows, significantly influenced by the bankruptcies of crypto firms like Genesis and Digital Currency Group, could soon subside.

Moreover, BlackRock’s recent overtaking of MicroStrategy in Bitcoin holdings marks another milestone in the ETF saga. Following an additional purchase of 9,000 Bitcoins on March 19, MicroStrategy now holds 214,246 Bitcoins, yet finds itself outpaced by BlackRock’s aggressive acquisition strategy.

As we navigate through this tumultuous phase, the dynamics between inflows and outflows, along with the impending halving event, paint a picture of a sector at a crossroads. The Bitcoin ETF landscape is evolving, with each development offering a new perspective on the future of cryptocurrency investments.