Argentina’s economy is between a hard place and a rock. According to reports, Argentina introduced its largest-denomination banknote on Monday. According to the available data, inflation is running at more than 100 percent per year, forcing the populace to carry ever-increasing amounts of cash to pay for daily expenses.

Argentina registers the worst inflation case in history

Currently, the inflation rate in the South American nation is 109 percent. This is one of the world’s highest points. A survey conducted by a central bank predicts that by the end of this year, inflation will reach nearly 130%. The interest rates have been dramatically increased to 97%.

In April, consumer prices increased at the fastest rate since 1991, when Argentina emerged from hyperinflation. The economy is anticipated to enter a recession before the presidential election later this year due to accelerating price increases and a record drought.

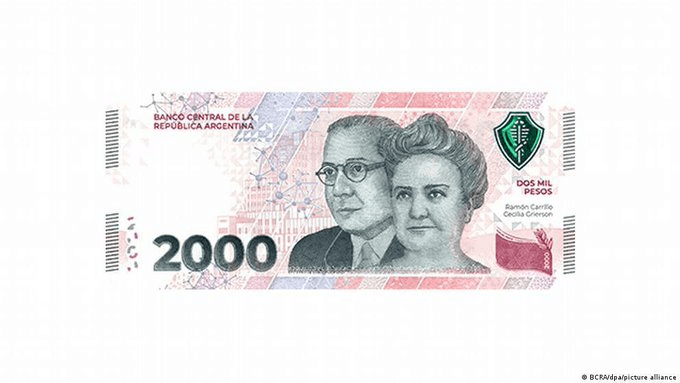

Meet Argentina’s 2,000 Peso banknote

The largest denomination banknote in Argentina, the 2,000 peso bill, went into circulation on Monday (May 22). However, due to the swift depreciation of the national currency, two thousand pesos are now only worth $8.50 at the official exchange rate. In parallel markets, the price is slightly more than $4.

In comparison to the US dollar, the peso has lost roughly a quarter of its value this year alone. This occurred despite the capital controls designed to halt its decline. The majority of Argentinians purchase dollars on the black market. In these markets, the exchange rate for the dollar is 480 pesos, compared to the official rate of 235.

While the new denomination is an improvement over the 1,000 peso note, which was previously the most valuable currency in circulation, private economists and citizens who demanded banknotes of up to 10,000 pesos were disappointed. The currency’s rapid depreciation has caused logistical difficulties for customers, businesses, and banks, which have had to open new vault space to accommodate more banknotes for ATMs.

Approximately half of all commercial transactions in Argentina are still carried out in cash. The new 2000 peso note is anticipated to alleviate some of the problems that have led to banks running out of vault space and locals and tourists carrying large amounts of cash to pay for goods.

The central bank said in a Monday statement that the higher denomination bill would improve the operation of ATMs and optimize the circulation of cash. According to the central bank, the new 2,000 peso banknote features a design commemorating the development of science and medicine in Argentina.

Can crypto help Argentina fight inflation?

Here is an interesting yet sad tale of two countries in Latin America; El Salvador and Argentina. Two years back – 2021- El Salvador chose Bitcoin while Argentina pled its economic status to the IMF. In March 2022, The Argentine Senate approved a $45 billion bailout deal with the IMF to avert an imminent default on the country’s debts.

However, the agreement contained a peculiar provision. Argentina had to adopt a firm stance against cryptocurrencies. The agreement outlined Argentina’s efforts to discourage the use of crypto to prevent money laundering, informality, and disintermediation in order to further protect financial stability.

Two years later, today, El Salvador’s inflation stands at 7.2%, with a presidential approval of 90%. On the other hand, Argentina’s inflation sits at 109%, with presidential disapproval of 75%.

Despite the introduction of the 2000-peso note by the central bank, conditions for ordinary Argentinians remain difficult. Many of them are exchanging their pesos for US dollars because they view the US dollar as their only protection against inflation.

However, Argentina has imposed restrictions on foreign currency purchases. This has stimulated the informal foreign exchange market. In addition, the drought has exacerbated economic issues. It has had a negative impact on the agricultural sector. The sector is indispensable to the nation’s ability to obtain foreign currency.

According to the central bank, Argentina has lost more than $5.5 billion in international reserves since the beginning of the year, bringing the total to $33.5 billion. Can crypto help Argentine citizens out of their financial hurdles? Probably yes. But the government stands against it.