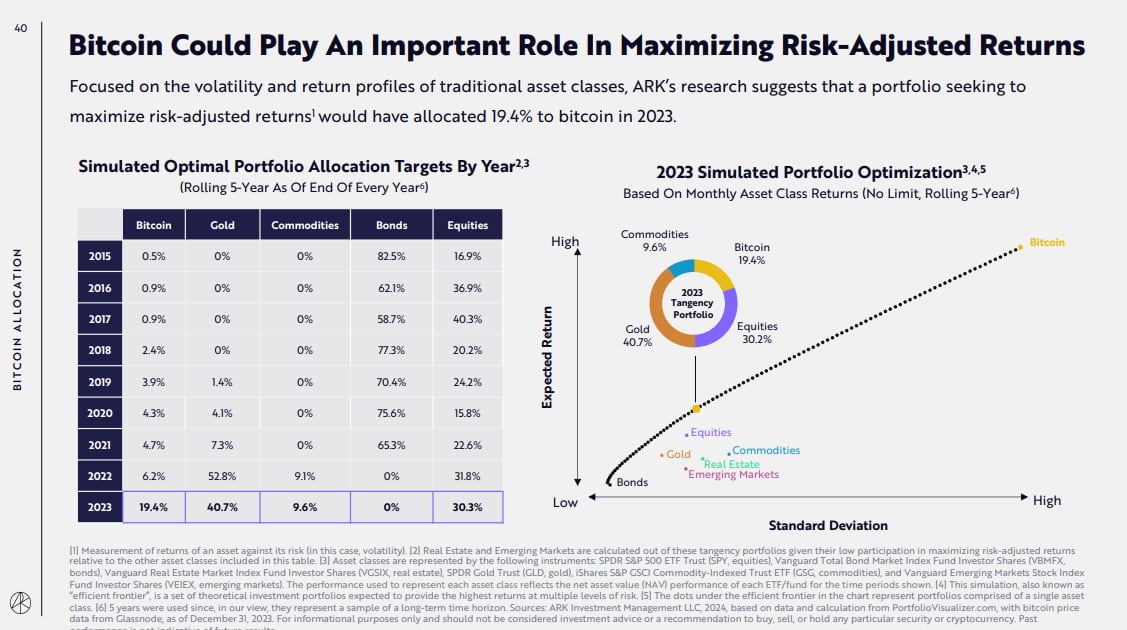

n a recent report, ARK Invest, a prominent investment management firm, has put forward a bold strategy for institutional investors, recommending a 19.4% allocation to Bitcoin to maximize risk-adjusted returns. This recommendation is based on comprehensive research analyzing the performance and volatility of Bitcoin in comparison to traditional investment assets.

Historical performance and volatility analysis

ARK Invest’s annual report, released on January 31, 2023, provides a detailed examination of Bitcoin’s performance over the past several years. The report highlights that over seven years, Bitcoin has shown an annualized return of 44%, significantly outpacing the average return of 5.7% from other major assets. This impressive performance is attributed to Bitcoin’s growing acceptance and integration into the mainstream financial market.

The report emphasizes the long-term benefits of holding Bitcoin, noting that investors with a longer investment horizon have consistently seen profits, despite the cryptocurrency’s noted volatility. This volatility, often seen as a deterrent, is recontextualized in the report as a short-term fluctuation that does not significantly impact long-term returns. The underlying message is clear: the duration of holding Bitcoin is more critical than the purchase timing.

Optimal allocation for risk-adjusted returns

Moving from historical analysis to future strategy, ARK Invest’s research suggests that a portfolio aiming for maximized risk-adjusted returns should consider a substantial allocation to Bitcoin. In 2023, this optimal allocation stands at 19.4%, a stark increase from the 0.5% suggested in 2015. This trajectory indicates a growing confidence in Bitcoin as a viable and valuable component of a diversified investment portfolio.

The report also speculates the potential impact of large-scale institutional investment in Bitcoin. If the $250 trillion global investable asset base were to follow ARK’s recommendation, the implications for Bitcoin’s market value could be profound. A 1% global asset investment could push Bitcoin’s price to $120,000 per BTC, while a 4.8% allocation could see it soar to $550,000. At the 19.4% level, Bitcoin’s value could reach an unprecedented $2.3 million per coin.

ARK invest strategy marks shift in crypto investment views

This aggressive strategy by ARK Invest contrasts with the more conservative recommendations made by other investment strategists in previous years. For instance, in January 2022, Ray Dalio and Bill Miller suggested a modest 1% to 2% portfolio allocation to Bitcoin. Similarly, JPMorgan strategists in 2021 recommended a 1% allocation to hedge against fluctuations in traditional asset classes.

The contrast in these strategies highlights the evolving perception of Bitcoin within the investment community. While once seen as a high-risk, speculative asset, Bitcoin is increasingly considered a legitimate and essential part of a balanced investment portfolio. ARK Invest’s recommendation represents a significant shift in this perception, suggesting a growing confidence in the stability and growth potential of Bitcoin.

ARK Invest’s report offers a bold and optimistic view of Bitcoin’s role in investment strategies. By recommending a significant 19.4% allocation, the firm is signaling its belief in Bitcoin’s potential to outperform traditional assets and provide substantial returns for long-term investors. As the financial world continues to evolve, the role of cryptocurrencies like Bitcoin in investment portfolios will undoubtedly be a topic of ongoing interest and debate.