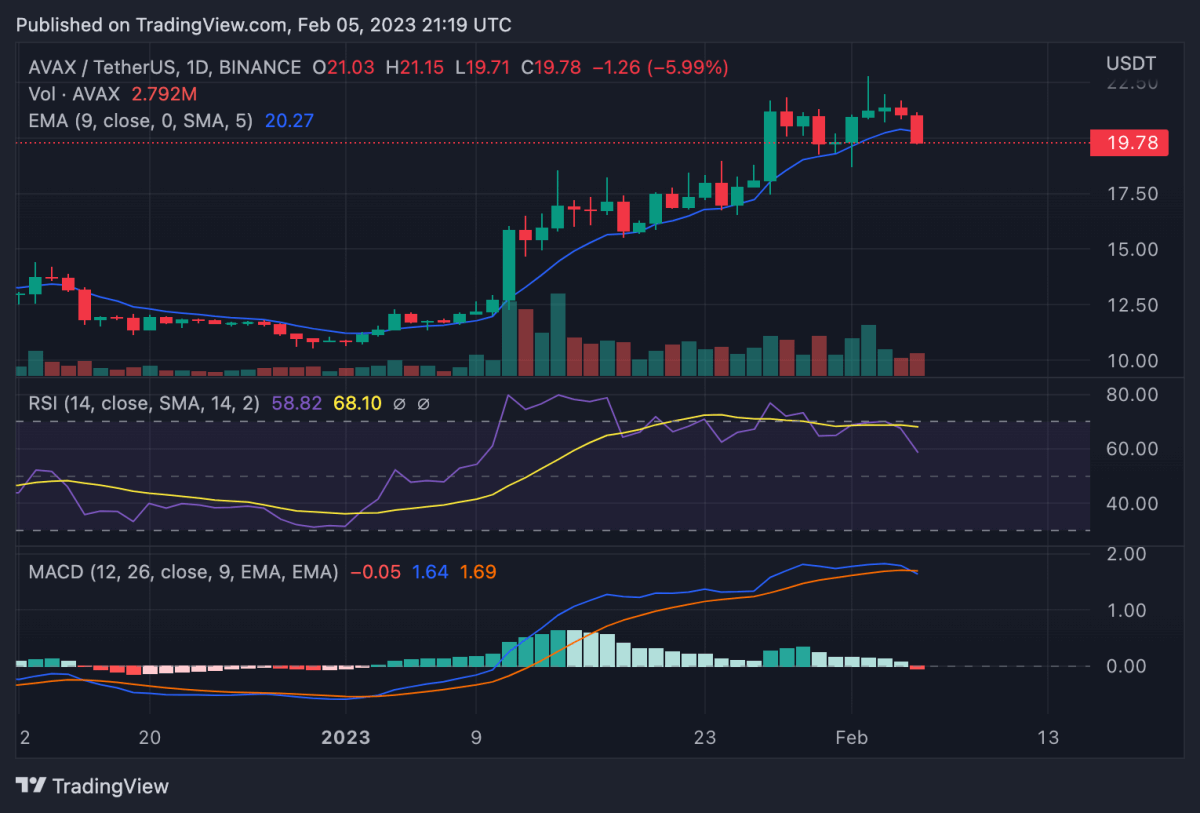

Avalanche price analysis shows a bearish trend taking over trade for the token, as price dipped for the second day running over the past 24 hours. AVAX touched a 3-month high of $22.71 on February 2, and seemed to have settled around that price point. However, over the past 48 hours, bearish action can be seen dominating the market, as price fell down to $19.70 today, incurring a 7 percent decline. AVAX price, currently at $19.97, is expected to further test support at $19 over the coming 24 hours.

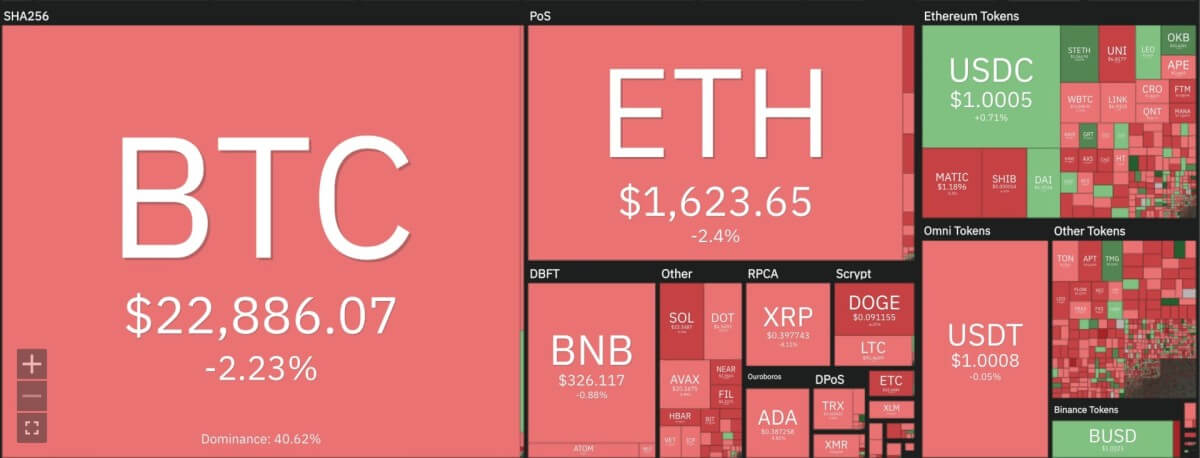

The larger cryptocurrency market showed signs of significant declines across the board, as Bitcoin dropped to $22,800 after falling from the $23,000 mark. Ethereum also declined 2 percent, moving down to $1,600. Meanwhile, leading Altcoins also mimicked a bearish trend, with Ripple falling 4 percent to $4.09, and Cardano to $0.38. Dogecoin crashed 6 percent to move as low as $0.09, while Polkadot dipped 4 percent as well, moving down to $6.54.

Avalanche price analysis: RSI slips towards the oversold zone as price drops

On the 24-hour candlestick chart for Avalanche price analysis, price can be seen shifting from an uptrend that took AVAX up to $22.78 to a downtrend over the past 24 hours. With today’s decline in place, Avalanche price is expected to test the support level at the $19 mark. Price can also be seen falling below the 9 and 21-day moving averages, and the crucial 50-day exponential moving average (EMA) at $20.34 to accompany the current decline.

The 24-hour relative strength index (RSI) can be seen complementing the price decline with a move below the 60 mark. Meanwhile, the moving average convergence divergence (MACD) curve can also be seen attempting a bearish divergence as the trend line moves below the signal line. Trading volume for AVAX over the past 24 hours rose 37 percent, mainly consisting of selling action.

Disclaimer. The information provided is not trading advice. Cryptopolitan.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.