Avalanche price analysis indicates the emergence of a bearish trend that is progressively gaining strength, with substantial potential for further downward movement. The AVAX/USD trading pair is presently valued at $14.1, denoting a 1.23% reduction within the past 24 hours. The market experienced a notable downturn in the preceding day, characterized by a rapid descent. Nevertheless, the market has demonstrated indications of unfavorable bearish behavior at the onset of the current day subsequent to descending below the $13.8 threshold. Furthermore, market volatility has diminished, fostering a conducive atmosphere for potential recuperation by bullish investors.

As of today, the price of Avalanche (AVAX) stands at $14.17, accompanied by a 24-hour trading volume of $245.68 million. The market capitalization of Avalanche is $4.74 billion, and it holds a market dominance of 0.43%. Over the past 24 hours, the AVAX price has experienced a decline of -1.30%. The current sentiment for Avalanche price prediction is bearish, while the Fear & Greed Index is indicating a neutral value of 51.

The circulating supply of Avalanche at present is 334.60 million AVAX out of a maximum supply of 720.00 million AVAX. The yearly supply inflation rate is currently 23.56%, resulting in the creation of 63.80 million AVAX in the past year. In terms of market cap ranking, Avalanche holds the #7 position in the Proof-of-Stake Coins sector, #1 in the Avalanche Network sector, and #11 in the Layer 1 sector.

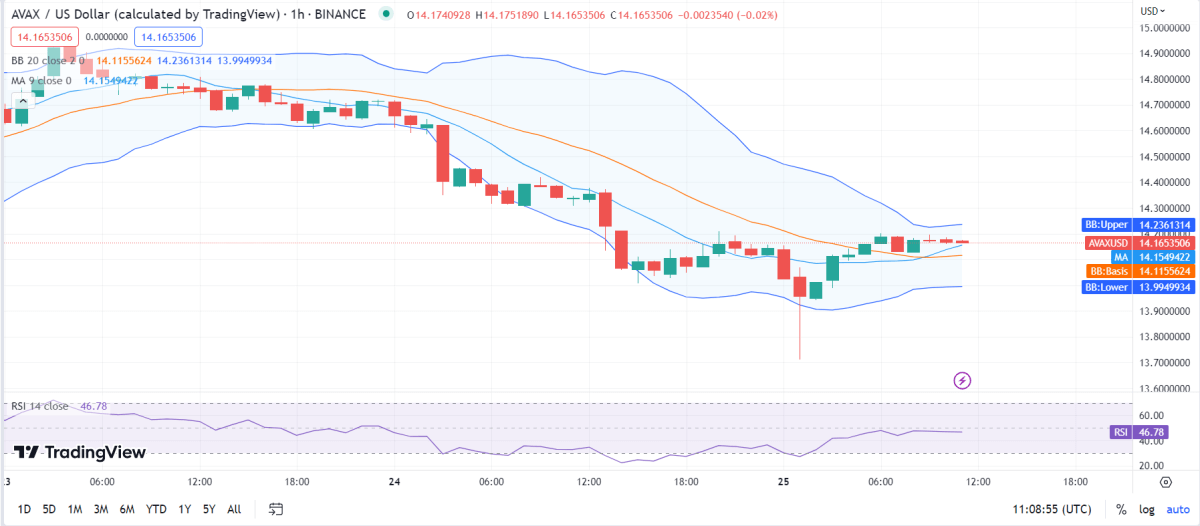

AVAX/USD 1-hour analysis: Latest developments

Avalanche price analysis suggests a decreasing trend in market volatility, implying that the AVAX/USD prices are becoming less susceptible to significant fluctuations. AVAX is currently encountering a significant resistance level at $14.2, as evidenced by the upper limit of the Bollinger Bands. Additionally, the lower limit of the Bollinger Bands at $13.9 is establishing an additional support level for AVAX.

The AVAX/USD price has recently crossed over the Moving Average curve, signaling a bullish trend in the market. The presence of bearish activity has been noticeable in the preceding hours, and it is anticipated to continue as the price approaches the support level. This implies the possibility of a market breakout, underscoring the prevailing bearish sentiment.

Avalanche price analysis reveals the Relative Strength Index (RSI) currently sits at 46, indicating that the cryptocurrency is stable. Moreover, the RSI has been trending linearly within the undervalued range, implying the equivalence of selling and buying activities in the market. If the RSI continues its stable movement and moves further into a dormant state, it may suggest a potential continuation of the bearish sentiment.

Avalanche price analysis for 1-day

Avalanche price analysis indicates a decreasing trend in market volatility, suggesting a lower probability of AVAX/USD experiencing fluctuations as volatility rises. The upper limit, currently at $16.3, acts as a noteworthy resistance level, indicating a significant hurdle for AVAX’s upward movement. Conversely, the lower limit, positioned at $13.7, serves as a robust support level, providing a foundation for AVAX’s price during declines. These levels serve as crucial reference points for market participants, aiding them in assessing and analyzing the price dynamics of AVAX.

The current movement of the AVAX/USD price shows a bearish trend as it crosses below the Moving Average curve. Although the market has displayed relative stability in recent days, bears have taken control, undermining the position of the bulls. Moreover, the AVAX/USD price dropping below the support band indicates the possibility of a market breakout. The price is currently following a linear path, which suggests stable movement at the time of writing.

According to the Avalanche price analysis, the current Relative Strength Index (RSI) of 33 indicates that the cryptocurrency is undervalued. With the price showing a linear trajectory within the undervalued range, accompanied by equal selling and buying activity, there is potential for a significant market reversal and a shift toward a bullish trend.

Avalanche Price Analysis Conclusion

In conclusion, the analysis of Avalanche’s price indicates a prominent bearish trend for the cryptocurrency, but there is considerable potential for a reversal if the support level is surpassed. Bears have held control over the market recently and show the ability to sustain their dominance. However, their influence has already been significant, posing challenges for the bulls. Nonetheless, should the bulls seize an opportunity for a breakout, there exists the possibility of a noteworthy resurgence in the days ahead.