Avalanche price analysis shows price on the up once again with price movement over the past 24 hours providing a 4 percent increment. AVAX moved up to $18.22 after today’s price action, after having moved down to $16.42 yesterday. The token has been showing a rather volatile movement pattern over the past week, with price continuously oscillating between $16 and $18.5. After facing rejection at the $19 resistance mark yesterday, AVAX bulls will be targeting the same resistance point over the next 24 hours.

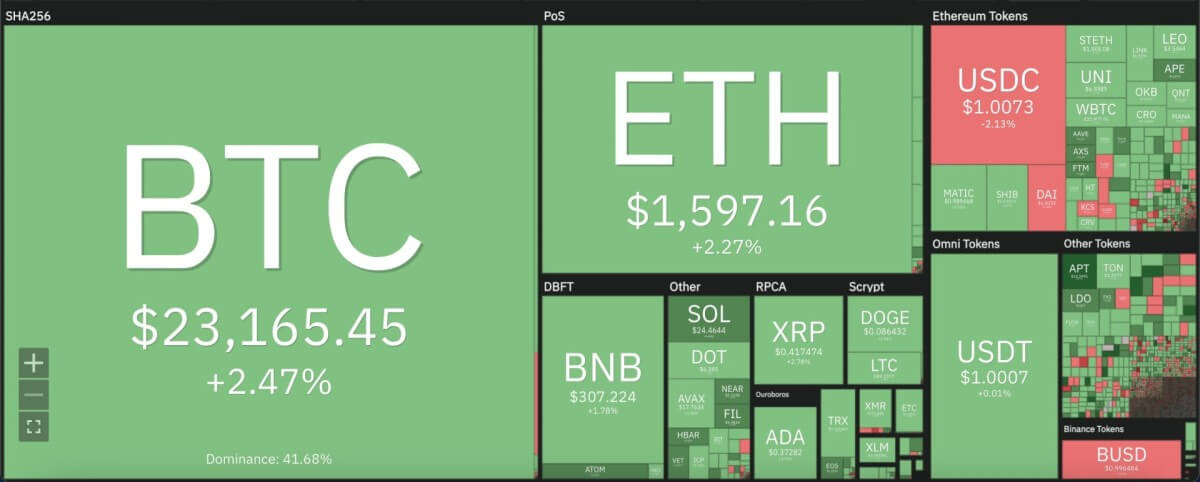

The larger cryptocurrency market also showed similar increments across the board over the past 24 hours, with Bitcoin leading the way with a 2 percent increment to move up to $23,000. Ethereum followed suit with a 2 percent increase to move as high as $1,600. Among leading Altcoins, Ripple also rose 2 percent to move up to $0.41, while Dogecoin rose 3 percent but stayed at $0.08. Meanwhile, Cardano upped 4 percent to move as high as $0.37, and Polkadot rose 3 percent to move up to $6.38.

Avalanche price analysis: AVAX could be nearing price correction on daily chart

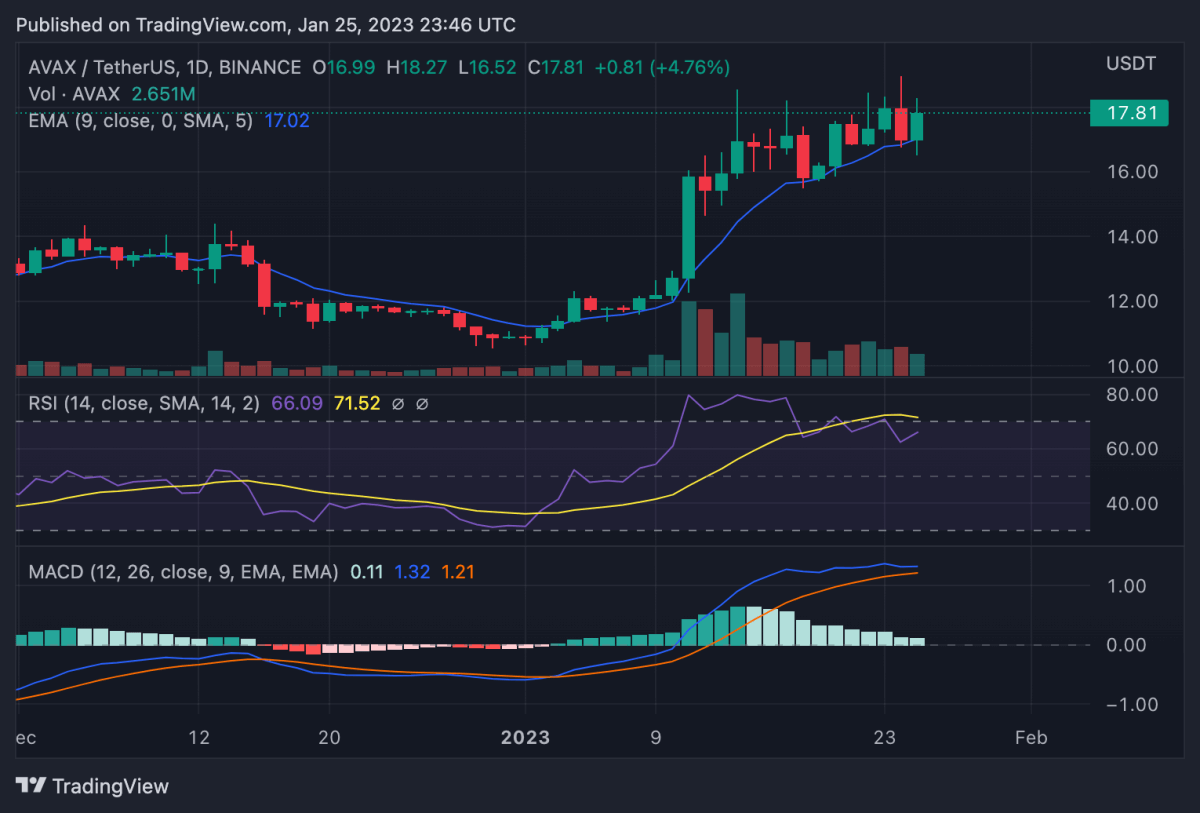

On the 24-hour candlestick chart for Avalanche price analysis, price can be seen showing high volatility over this week’s movements. Bulls have generally had the upper hand, and price remains above the 9 and 21-day moving averages, along with the crucial 50-day exponential moving average. However, the high volatility will keep sellers interested and short-term cash outs may take place if price switches downwards again.

The 24-hour relative strength index (RSI) can be observed in visible fluctuation on the daily chart, having reached deep into the overbought zone before settling into the current level at 66.09. The RSI could lower further if price corrects, and will have to restart from a lower point before another bull run. Meanwhile, the moving average convergence divergence curve also hints towards a potential incoming downtrend after moving closer to the signal line.

Disclaimer. The information provided is not trading advice. Cryptopolitan.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.