Although the Avalanche price analysis leans slightly on the bullish side, the currency has been suffering since the beginning of the month around the $13 range. The recent price caps, which cover a constrained range from the higher side of $12 to $13.9, are indicative of the moderate pace of price movement. Although there were occasional high and low swings over this period, the volatility for the AVAX/USD pair remained low. Bulls are once again in charge of price movement today, but as was previously stated, the price level is still within the previously established range of $13.23.

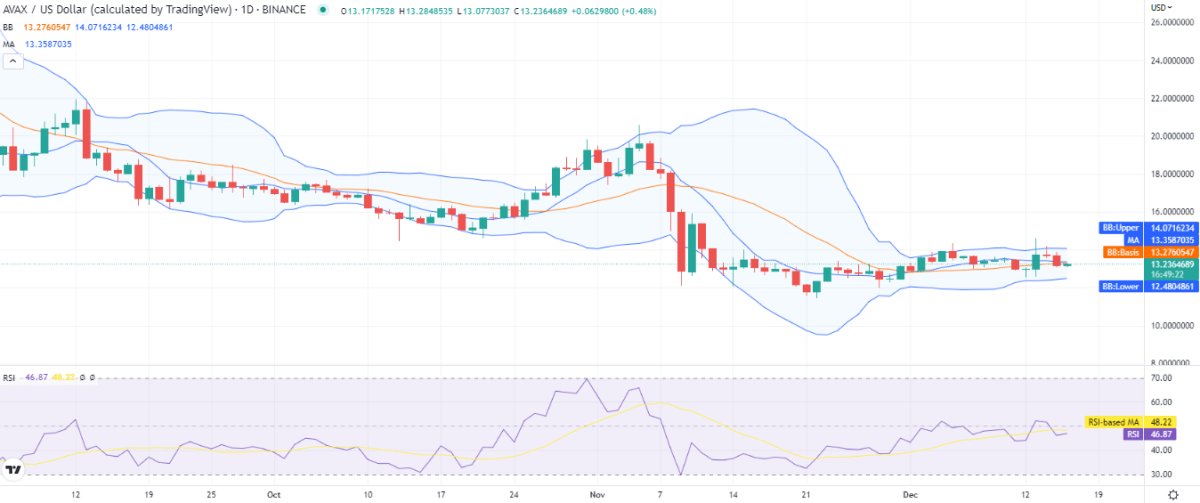

AVAX/USD 1-day price chart: Bulls try to take the lead

The green candlestick in the 1-day Avalanche price analysis and the current trading price of $13.23 for the coin indicate that the price function is now moving upward. Up until today, there hasn’t been much upward movement, but bulls are starting to recover, so maybe the price will rise more over the day. Since the price function stayed downward yesterday, the coin is still down 2.52 percent over the last 24 hours and 1.80 percent over the last week. This is because the price levels are relatively low as a result of the recent adverse price action.

AVAX has minimal volatility since the Bollinger bands have a smaller region of coverage. Resistance is represented by the upper band at the $14.07 level, and support is by the lower band at the $12.48 level. The Bollinger bands’ average is located at $13.27 above the current price. Above the SMA 50 curve, the moving average (MA) is located at the $13.35 level. At an index of 46, the relative strength index (RSI) is now trading in the lower half of the neutral zone. The RSI’s curve has a very tiny upward slope, suggesting market purchasing activity.

Avalanche price analysis: Recent developments and further technical indications

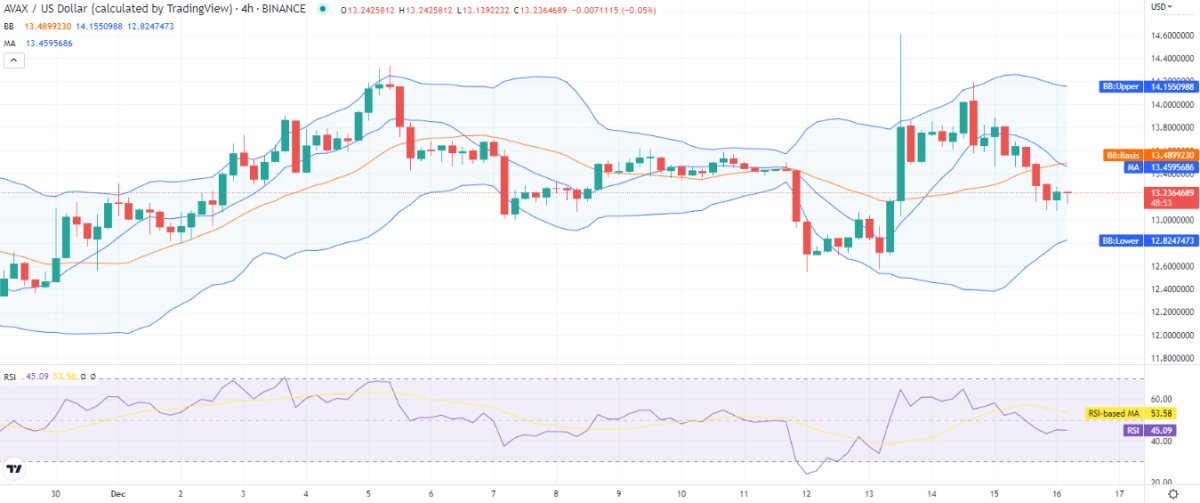

The price recovered significantly during the first four hours of the trading session, according to the 4-hour Avalanche price analysis, but later on, as selling pressure increased, the price began to swing lower. The price breakout was upwards. The loss has almost fully recovered as of late, with prices moving once more in an upward trajectory. In the ensuing hours, it is expected that the price would increase much more.

On the 4-hour chart, AVAX’s volatility is noticeably high due to the widened Bollinger bands. The average of the Bollinger bands is at $13.48; the upper band is at $14.15; the lower band is at $12.82. Over the price level, the moving average (MA) is located at the $13.45 level. The relative strength index (RSI), which is currently trading at 45, is in the bottom half of the neutral region, and its horizontal curve suggests that the declining price levels may be about to recover.

Avalanche price analysis: Conclusion

The currency is currently recovering, according to the Avalanche price analysis, but the price function has been trapped in a constrained range since the 1st December 2022, making it difficult for bulls to burst through this level. In the event that the bullish support holds, we anticipate AVAX to recover further in the ensuing hours.