Avalanche price analysis for December 25, 2022, shows that the market is bearish today as the price is currently trading below $11.67. The price for the AVAX/USD pair has remained negative for the past 24 hours and is set to continue. The price of AVAXUSD has decreased by almost 1.09% from the last substantial barrier at $11.67, challenging the significant present resistance at $11.80. The 24-hour trading volume for AVAX has also decreased to $59,161,831 with a market cap of $3,627,786,192.

Avalanche price analysis 1-day price chart

The one-day Avalanche price analysis confirms that the market trend has been dropping. The market’s volatility is increasing in response to a movement, which indicates that Avalanche’s price is increasingly likely to undergo a variable shift on either extreme.

The strongest resistance is represented by the upper Bollinger band’s value of $20.9653; the strongest support is shown by the lower Bollinger band’s value of $13.2759.The relative strength index (RSI) is trading at 52.50, which indicates that the market is neither overbought nor oversold, signifying a stable cryptocurrency. The price is trading within the SMA 200 and 100 curves, which reveals that the trend direction is bearish.

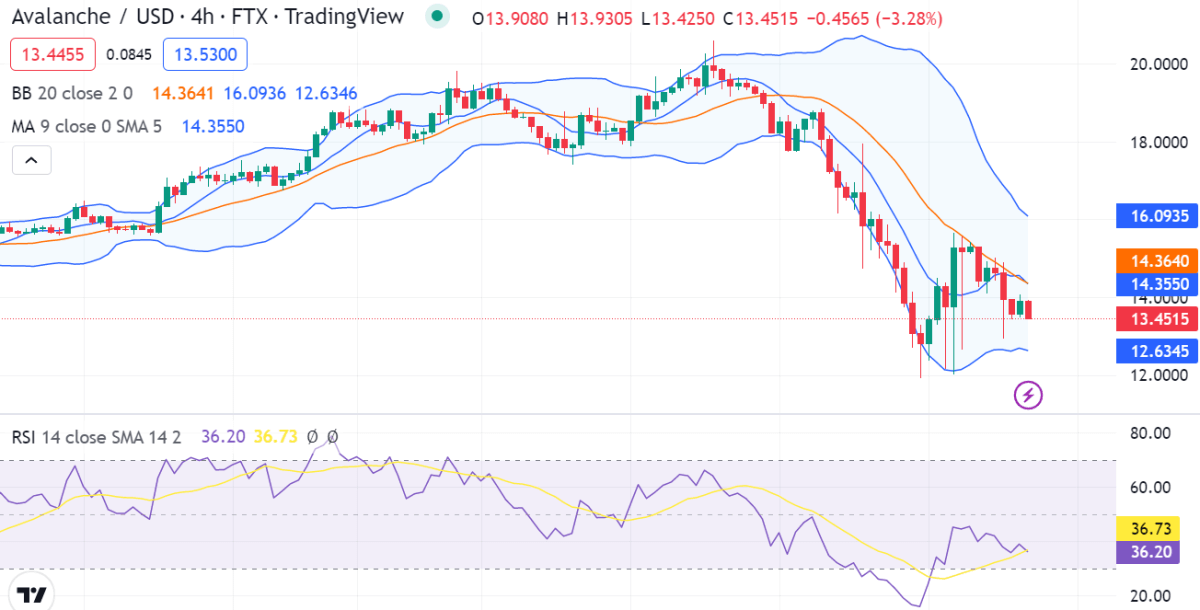

AVAX/USD 4-hour price chart: Prices continue to decline

The 4-hour Avalanche price analysis indicates a pessimistic market as the prices continue with downward momentum. Avalanche price analysis reveals that the bears have been in charge of the market for the past several hours; the price is currently trading beneath the $11.67 level and is expected to keep sliding. This suggests that the bearish era can last for a very long time.

The AVAX/USD price appears to be crossing under the curve of the moving average, signifying a bearish movement. The volatility is increasing, which means that the bearish wave is likely to expand in the upcoming days. Regarding the upper and lower Bollinger bands’ indicators’ values, the upper band shows $16.0936 figures, whereas the lower band shows a $12.6346 value. The relative strength index (RSI) curve is trading at 36.73, indicating that the bears are in control of the market.

Avalanche price analysis conclusion

The market is anticipated to experience consolidation in the near future, according to the Avalanche price analysis. Prices are anticipated to keep falling, though, as the bearish trend is still very strong. The market indicators are indicating additional near-term downside momentum as the bears take over the market. Concerned about the state of the economy, investors are still being cautious. Prices are anticipated to keep falling, though, as the bearish trend is still very strong.