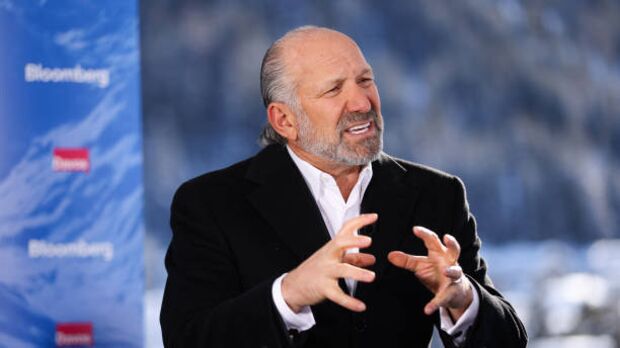

In a video release on Wednesday, Howard Lutnick, CEO of Wall Street firm Cantor Fitzgerald, delivers some striking predictions about the future relationship between traditional financial institutions and Bitcoin. The video, titled “Howard Lutnick on Bitcoin and tradfi,” is making waves within the community as Lutnick outlines a bold future where big banks will deeply engage with BTC.

Big Bank Will Embrace Bitcoin

Lutnick highlights the past five years as a period of increasing proximity between Bitcoin and the mainstream financial sector, although with significant remaining barriers. He points out, “The last five [years] Bitcoin has been an outsider in the finance business but coming closer and closer and closer right now. There’s an ETF just starting to go a little bit mainstream, maybe a toe in the water of mainstream, but banks still can’t clear it. Banks still can’t transact in it. Banks still can’t custodian it. Banks still won’t transact in it and they won’t finance it yet.”

The Cantor Fitzgerald CEO argues that the slow adoption is not due to a lack of interest from traditional financial sectors but rather regulatory bottlenecks that have yet to be addressed. “I think people misunderstand traditional financial service companies. They want to transact in Bitcoin, they want new asset classes to transact in. That’s just a good thing but they need the regulator to say it’s okay,” he elaborates.

The biggest barrier for “traditional financial service companies, the big banks, big brokerage companies” are the current regulations which require banks to hold capital equal to the full amount of BTC they manage, a restriction that significantly disincentivizes them from engaging with it. “Right now, today if a bank were to hold your Bitcoin they would have to set aside their own money equal to that amount in sort of like in the jail. I mean you’d say so well that’s crazy. The answer is that’s why they don’t hold it,” says Lutnick.

He envisions a future where regulatory changes will unlock these barriers, leading to an enthusiastic embrace of BTC by major financial institutions. “If the regulatory environment was good, you will see all the traditional financial service companies, the big Banks, big brokerage companies, they’re all going to go head first into the Bitcoin pond,” he asserts.

The predicted pivot hinges on a potential regulatory shift that would recognize Bitcoin as a bona fide financial asset, a change Lutnick believes is inevitable. “Eventually there’s going to be a CFTC chair who says, you know what, Bitcoin is a financial asset and we’re going to treat it as such and when that happens you’re going to see Bitcoin move in a very very strong positive direction,” he forecasts.

Lutnick concludes, “Bitcoin is a financial asset and we’re going to treat it as such and when that happens you’re going to see Bitcoin move in a very very strong positive direction. So that’s why I’m a fan of Bitcoin. It’s going to go much higher. It always bounces around like any other financial asset. But ultimately over the next 5 years as it gets invited into this party, up we go.”

Reactions From The BTC Community

Reactions from the community were swift and pointed. Arthur Hayes, co-founder and former CEO of crypto exchange BitMEX, noted via X, “See what happens when tradfi muppets have fees to earn? They become motivated acolytes of our Lord Satoshi.”

Crypto analyst MacroScope, known on X as @MacroScope17, pointed out the significant potential behind Cantor Fitzgerald’s involvement. “Cantor’s involvement in BTC hasn’t gotten the attention it should. That’s probably because the firm isn’t really a household name in retail-land. But it’s always been a smart, tough, aggressive shop with top desks in multiple areas. They’re always worth watching.”

Hunter Horsley, CEO of Bitwise, agreed with Lutnick’s prediction. “As odd as it may seem — banks are going to be one of the biggest catalysts for this space. Not yet, but soon,” he commented.

At press time, BTC traded at $56,406.