Coinspeaker

Binance and CZ Face New Lawsuit Over Alleged Role in Crypto Theft

The shadows of past crimes are still hanging over crypto exchange Binance. Three disgruntled investors have filed a class-action lawsuit against the platform, saying that it helped launder money which eventually caused them to lose their crypto assets. This new lawsuit is just one more piece of the puzzle that is already making Binance’s year even harder.

The lawsuit, which was filed on August 16, 2024, in the US District Court for the Western District of Washington, details how the plaintiffs’ crypto holdings were stolen and subsequently transferred to Binance by the perpetrators. This movement, the complaint alleges, was to disrupt the digital trail and make the stolen funds impossible to trace.

The crux of the plaintiffs’ argument hinges on the native transparency of blockchain technology. They contend that crypto transactions leave an “immutable record” on the blockchain, facilitating easy tracing.

“Without a place to launder crypto, such as Binance.com, if a bad actor steals someone else’s crypto, there is a risk the authorities would eventually track them down by retracing their steps on the blockchain,” the lawsuit asserted.

Binance Faces RICO Lawsuit Scrutiny

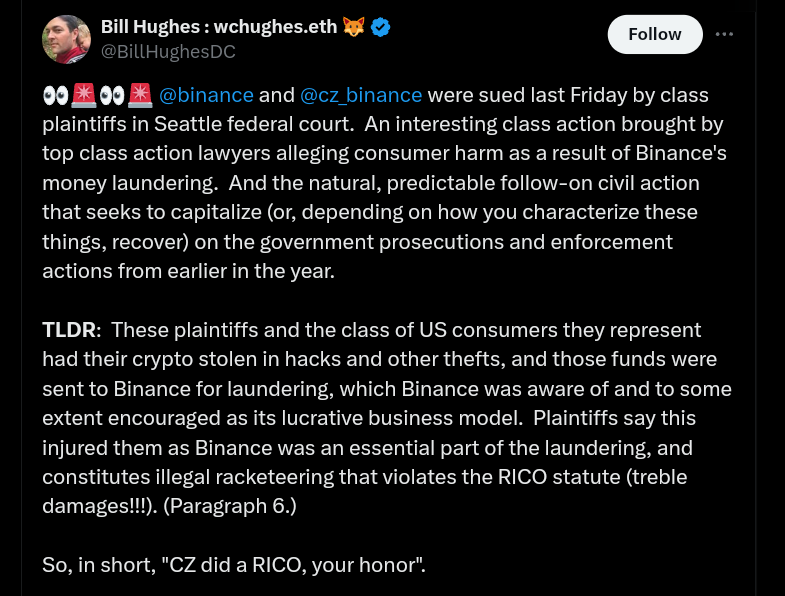

The lawsuit accuses Binance of playing a pivotal role in the money laundering scheme, thereby violating the Racketeer Influenced and Corrupt Organizations Act (RICO). This legislation targets criminal organizations engaged in various illegal activities, including money laundering.

Legal experts remain cautious about the lawsuit’s success. Bill Hughes, a senior regulatory advisor at Consensys, a blockchain software company, expressed doubt regarding the plaintiffs’ ability to substantiate their claims. However, in a recent online post, Hughes acknowledged the lawsuit’s potential to significantly impact the crypto industry.

He further highlighted the potential implications for blockchain analytics and on-chain asset recovery should the case progress. The transparency of blockchain transactions, a core strength of the technology, could be put under scrutiny, forcing the industry to re-evaluate its tracing and recovery methods.

Binance’s Troubled Past

Notably, this case is not the only one for Binance. In November 2023, chief executive officer Changpeng Zhao (CZ) pleaded guilty to money laundering and was forced to leave as part of a settlement with the US authorities. Binance also paid a hefty $4.3 billion in fines for regulatory violations.

Additionally, the SEC submitted a separate complaint against Binance in June 2023, alleging it has misled investors about its market surveillance practices and artificially inflated trading volumes. A significant portion of this lawsuit was allowed to proceed by the court in June 2024.

Binance and CZ Face New Lawsuit Over Alleged Role in Crypto Theft