Coinspeaker

Binance-Backed Bitcoin Restaking Protocol BounceBit Unveils Roadmap

BounceBit, a Bitcoin restaking protocol that is backed by leading cryptocurrency exchange Binance, has released its roadmap for this year 2024.

In a blog post, the firm lauded its self-acclaimed unique position, naming itself a pioneer in a new paradigm. BounceBit reiterated its commitment to contributing to the integration of Traditional Finance (TradFi) and Decentralized Finance (DeFi), a movement that is currently at the core of the crypto sector.

The BounceBit CeDefi Framework

According to BounceBit, which raised $6 million in February, its vision led to the adoption of a working CeDeFi framework that it has operated since it was founded a few months ago.

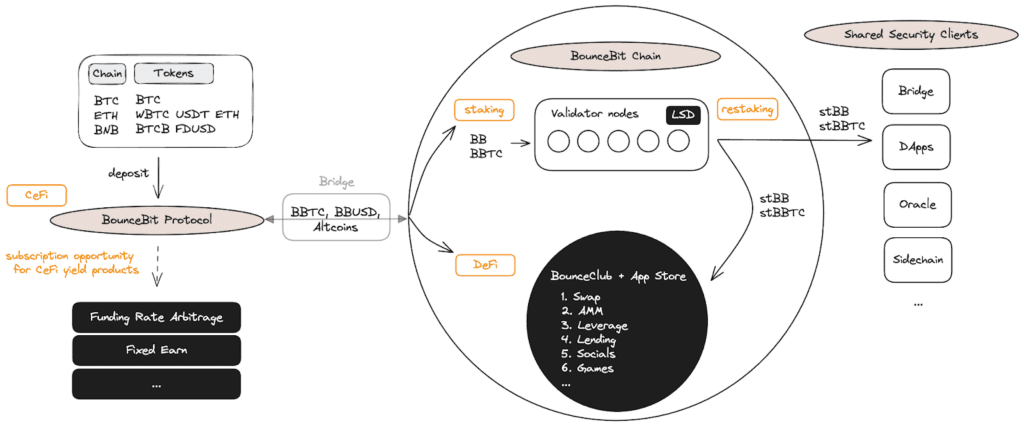

The framework encompasses the established security of Centralized Finance (CeFi) with the boundless potential of DeFi. Markedly, the BTC restaking protocol acknowledged the pivotal developments that the crypto industry has seen in recent times.

As a protocol with three pillars of development, BounceBit Portal, BounceBit Chain, and BounceClub, BounceBit announced that each pillar has its designated roadmap. Each of these main pillars has its specific role in pushing the protocol to achieve its desired outcome.

For context, BounceBit Portal serves as the operating system that permits easy interaction with products offered by the protocol.

BounceBit Chain acts as the settlement and execution layer of the project while BounceClub is the building block for CeDefi as a service and an ecosystem. However, the ultimate direction for the firm is to focus on CeDeFi, integrating more assets and more asset management venues, and launching a suite of CeDeFi products on its chain. Some of its successful products are featured on Binance Megadrop and Premium Yield.

Designated Roadmaps for BounceBit Portal, Chain, and BounceClub

For the Portal, BounceBit plans to include fixed earnings in the services offered to cater to investors who are in search of predictable and consistent yields. This category of investors will receive stable returns with little or no risk attached. There is also the option of over-collateralized lending and borrowing to allow users to leverage their Bitcoin holding for additional yield. Still under BounceBit Portal, the Binance-backed protocol intends to add other structured products and financial instruments, tailored to investor’s needs.

The underlying infrastructure of the BounceBit Chain communicates and corresponds with custody and asset management.

Hence, the plan is to upscale its usability and performance through the optimization of the Ethereum Virtual Machine (EVM) execution layer. This will specifically enhance node performance. Also, BounceBit Chain will develop a Shared Security Client (SSC) module to accommodate other projects that wish to utilize the liquidity of its broad restaking chain.

The activity of BounceClub will help those who want to launch their CeDeFi products using BounceBit’s widget. Amidst all these, BounceBit’s official role is to maintain the whitelist for contract deployment, create general components, and serve as a navigator. Therefore, the official website of BounceClub will only provide general components but have no place for Decentralized Application (DApp) business logic components.

Binance-Backed Bitcoin Restaking Protocol BounceBit Unveils Roadmap