Binance Coin price analysis reveals the exchange coin is following the overall market sentiment and trading lower. The BNB/USD pair faced a lot of selling pressure below $280.0, resulting in trading at $276.74 at the time of writing.

At the moment, the price is approaching the $270.0 support level and it seems like there could be more losses in the near term. On the upside, an initial resistance is around the $280.0 level, above which the price could recover towards the $290.0 resistance zone.

Looking ahead, traders should keep an eye on any potential break below the $270.0 support level and the 100 SMA (4-hour). A daily close below this level may perhaps trigger more declines in the near term toward the $235.0 support area in the near term.

On the flip side, if BNB/USD pair recovers above $280.0, it could face resistance at $290.0 and $295.00 before bulls attempt a break above the last swing high at $300.00.

BNB/USD 4-hour chart price analysis: Bears are likely to keep pressing the price lower in the near term

Binance Coin price analysis on a 4-hour chart indicates a falling wedge pattern and the price may decline below the $270.0 support level. In the short term, BNB/USD pair is likely to continue to face a lot of selling pressure toward the $235.0 support area. Conversely, gains above $280.0 might encourage bulls to break above the last swing high at $300.00 and target resistance at $310.0 in the near term.

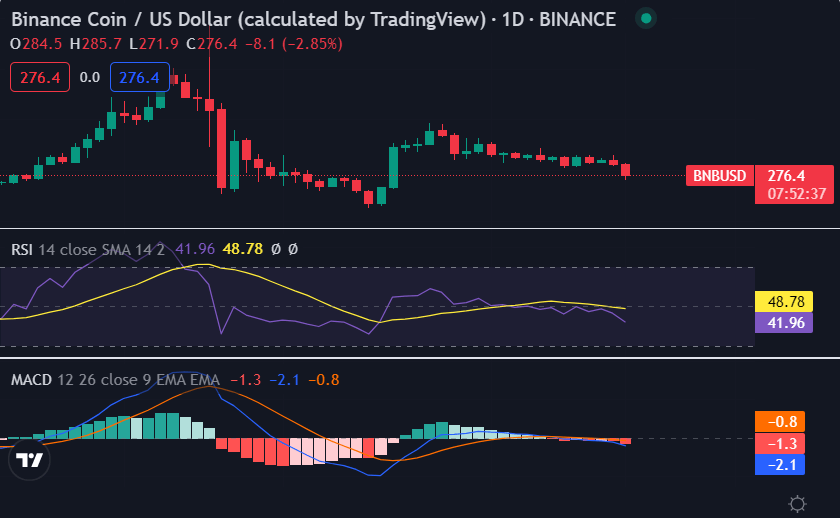

The technical indicators point to more losses in the short term. The RSI is below 50, supporting a bearish bias, while the MACD points to a steady decline. Meanwhile, there is no clear sign of major bullish catalysts as long as BNB/USD pair remains below the $300.0 resistance level.

Binance Coin price analysis on a daily chart: The price is approaching the $270.0 support level

Binance Coin analysis on a daily chart reveals that the exchange is trading along the 100-day SMA, which could act as a major support area in the near term. The RSI is below 50 and consolidating, suggesting that buyers are still in control of the BNB/USD pair.

The ATR indicator shows that BNB/USD pair is quite volatile and it could trade in a wide range between $270.0 to $300.00 as long as the fundamental drivers are supportive. In case of a break below $270.0, the price might find support at $250.0, which is close to the 61.8% Fibonacci retracement level.

On the upside, gains above $290.0 might encourage buyers to test resistance at $300.00, which is close to a major triangle formation (daily chart). If bulls manage to push BNB/USD pair above this key barrier, it could accelerate gains toward the last swing high at $310.0. However, the key hurdle in the near term could be $300.00, above which BNB/USD pair is likely to test $310.0 and $320.0 in the medium term.

Binance coin price analysis conclusion

Binance Coin price analysis concludes that BNB/USD pair is trading lower and it may decline toward the $270.0 support level in the near term. If there are more bearish moves, buyers might defend the 100-day SMA below $250.0 as long as bulls do not break higher above the $300.00 resistance level