Binance Coin price analysis indicates a prevailing bullish trend, suggesting a sustained and potentially increased positive momentum in the market. The current conditions favor the bulls, who are expected to maintain their dominance and potentially exert even greater control over the market in the near future. Additionally, Binance Coin has witnessed a notable surge in value, rising from $301 to $308.1 and maintaining stability around this level. This price development suggests the potential for further upward movement in the foreseeable future.

The present value of Binance Coin (BNB) stands at $308.15, accompanied by a 24-hour trading volume of $1.30 billion. Its market capitalization is estimated to be $48.03 billion, and it holds a market dominance of 4.24%. Over the past 24 hours, the BNB price has experienced a modest increase of 0.81%. Currently, market sentiment for Binance Coin’s price prediction is bearish, while the Fear & Greed Index stands at 49, indicating a neutral outlook.

The circulating supply of Binance Coin presently amounts to 155.86 million BNB out of a maximum supply of 200.00 million BNB. The yearly supply inflation rate is currently -6.56%, which implies that approximately -10.94 million BNB tokens were generated in the past year. In terms of market capitalization, Binance Coin holds the top position in the Exchange Tokens sector, as well as the Binance Smart Chain sector, and ranks third in the Layer 1 sector.

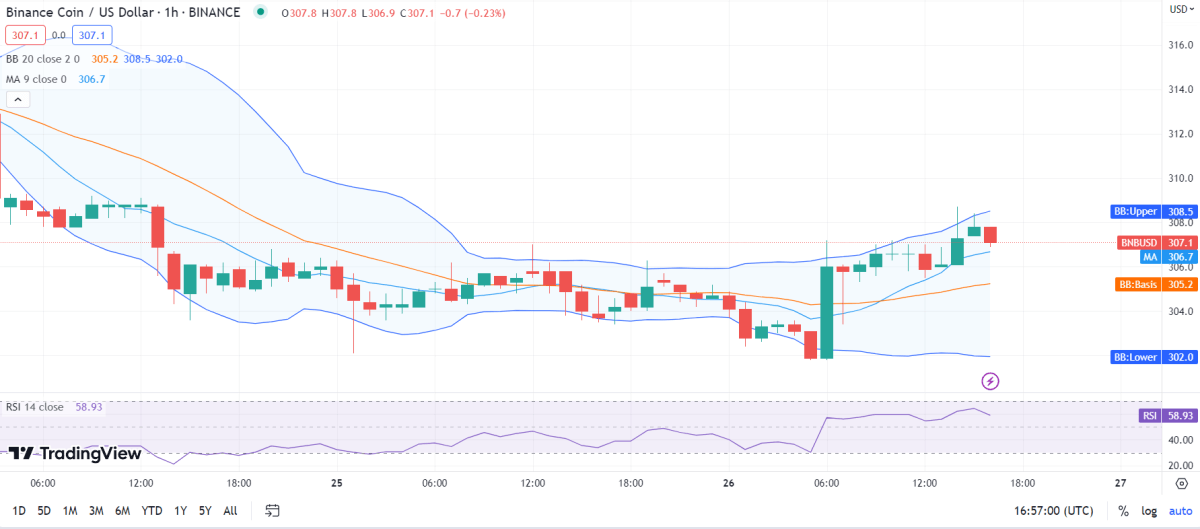

BNB/USD 1-hour price analysis: Latest developments

Binance Coin price analysis suggests a favorable outlook with an upward price trend and decreased volatility. The upper boundary at $308.5 acts as a strong resistance level, while the lower boundary at $302 serves as a critical support level. Surpassing the resistance could indicate a bullish momentum, while the support level is crucial for monitoring potential reversals or further upward movement.

The BNB/USD price currently resides above the Moving Average curve, indicating a bullish trend in the market. However, there is a notable upswing in market volatility today. Additionally, the BNB/USD price is approaching a resistance level, implying the likelihood of a potential market reversal. This reversal has the potential to yield favorable outcomes for Binance Coin, offering a promising outlook amid the existing market conditions.

Binance Coin price analysis reveals that the Relative Strength Index (RSI) score is currently at 58. The score indicates that the cryptocurrency is currently in a state of stability, positioned within the upper range of the neutral region. Furthermore, the RSI score reflects a downward movement, suggesting a dominance of selling activities. This equilibrium suggests a potential shift towards a period of bearish regime or decreasing market dynamics.

Binance Coin price analysis for 7-days

Binance Coin price analysis has entered a bullish movement in the last few days. Moreover, as the volatility remains dormant, the value of the cryptocurrency moves with a volatile change; the price is becoming resistant to variable change in this instance. Consequently, the upper limit of the Bollinger Bands is currently observed at $319.1, serving as a significant resistance level for Binance Coin (BNB). Conversely, the lower limit of the Bollinger Bands is situated at $303, acting as a strong support level for BNB.

The BNB/USD price is currently displaying a crossover below the Moving Average curve, suggesting a bearish momentum in the market. However, there is a notable shift indicating an upward movement, as the price consistently demonstrates dynamics that favor upward price trends.

The Relative Strength Index (RSI) score of 42 indicates the cryptocurrency’s value is relatively stable, falling within the central neutral region. However, the upward movement of the RSI score suggests a growing market. Moreover, the stable RSI score suggests that buying activity is dominant in the market.

Binance Coin Price Analysis Conclusion

Binance Coin price analysis shows bearish momentum with solid possibilities of an overall reversal movement in the coming days. The current market conditions are favoring the bears, indicating their dominance. If the bulls do not initiate a counter-attack in the near future, the bears may gain control over the market in the long term. However, considering the significant potential demonstrated by the bears, there is a possibility that they could completely take over the market, especially if the price breaks below the support level. In such a scenario, the market dynamics would likely shift in favor of the bulls.