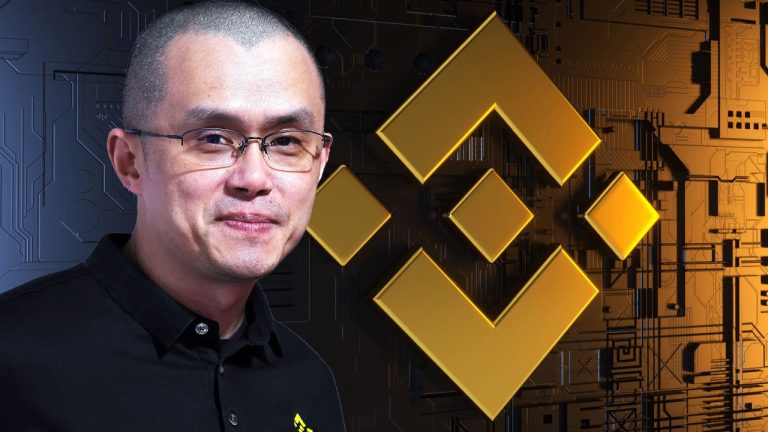

Crypto exchange Binance and its founder and CEO Changpeng Zhao (CZ) plan to seek the dismissal of a lawsuit filed by the U.S. Commodity Futures Trading Commission (CFTC). On July 27, the trading platform is due to submit its response to the CFTC complaint alleging that it broke derivatives laws in the United States.

Binance, Exchange Executives to Try to Have the CFTC’s Case Dismissed

Binance Holdings, the operator of the world’s largest crypto trading platform, Chief Executive Changpeng Zhao and former Chief Compliance Officer Samuel Lim intend to seek the dismissal of a complaint by the U.S. CFTC against the exchange, according to a court filing on Monday quoted by Reuters and Bloomberg.

In March of this year, the CFTC sued Binance for alleged violations of U.S. trading and derivatives rules. At the time, the regulator said that at least since July 2019, the exchange had offered and executed commodity derivatives transactions on behalf of U.S. persons.

The lawsuit argued that Binance should have registered with the U.S. agency and noted that the company continued to violate the CFTC’s regulations for years. The regulator accused CZ and his company of operating an “illegal” exchange and having a “sham” compliance program. The exchange is due to submit its response to the CFTC complaint on July 27.

Binance and Zhao have also been targeted in a legal action by the U.S. Securities and Exchange Commission (SEC) which claims the exchange and its management breached securities laws by selling tokens that the regulator deems unregistered securities while misleading investors and regulators.

The crypto behemoth faces a number investigations around the world, including an ongoing probe by the U.S. Justice Department over suspected money laundering violations and sanctions evasion. Authorities in Belgium ordered Binance to cease all crypto services while French prosecutors launched a money laundering investigation.

Billionaire Changpeng Zhao has sought to reassure customers following news of executives leaving the company and reports about massive layoffs. Against the backdrop of the legal battles with U.S. regulators, Binance’s American subsidiary saw its market share shrinking significantly last month.

Amid the current regulatory crackdown on the crypto industry in the U.S., blockchain firm Ripple’s partial court win in a lawsuit with the SEC over its XRP token as well as the securities regulator’s decision to formally accept financial giant Blackrock’s application for a spot bitcoin ETF have given cause for optimism.

Do you think Binance will be successful in its attempt to have the CFTC’s complaint dismissed? Share your expectations in the comments section below.