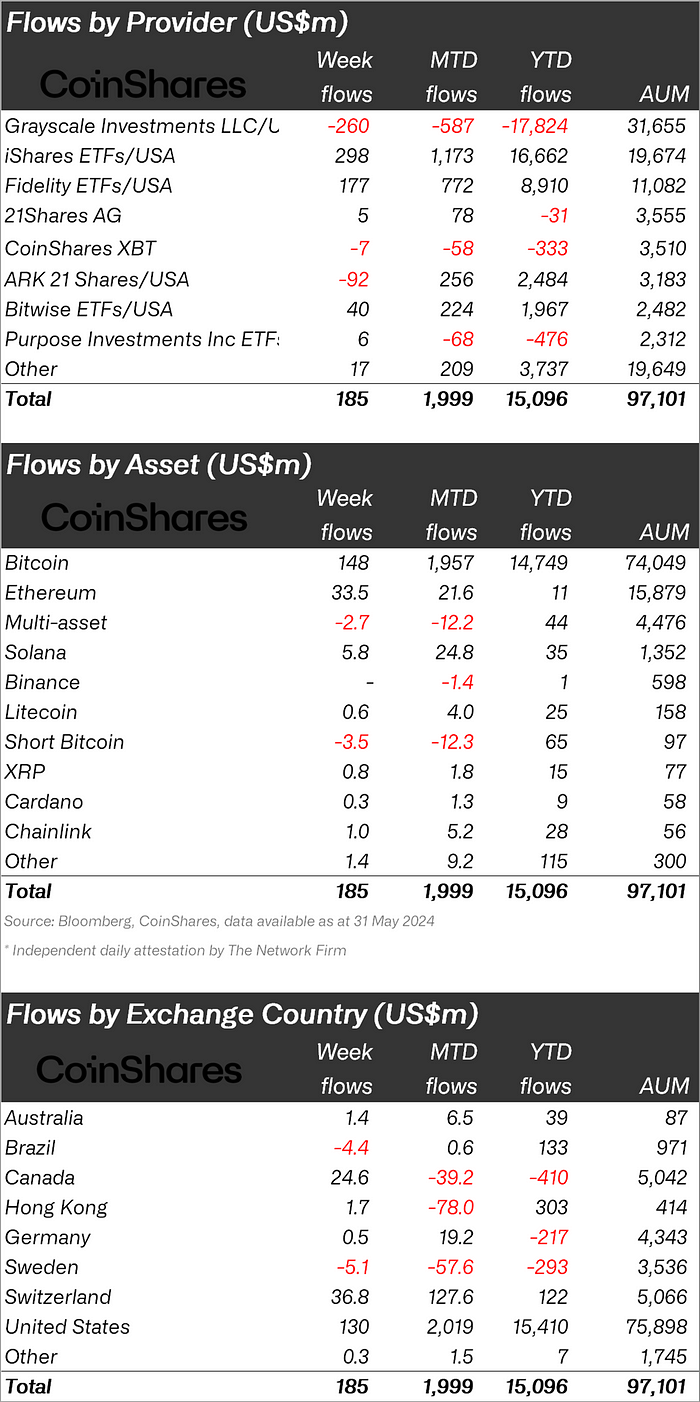

Binance, the world’s largest cryptocurrency exchange, has moved over $5 billion worth of Bitcoin since yesterday. This represents nearly 30% of the exchange’s net BTC reserve balance, causing some experts to comment on the “unusual” movements and spooking others. However, Binance has assured users that the transfers are nothing to worry about.

Crypto industry at alert after the transactions

Data from Coinglass shows that over 183,080 BTC flowed out of the exchange in 24 hours, leading some to speculate that the exchange was withdrawing large amounts of crypto. The movements came just after Binance temporarily paused BTC withdrawals on its platform.

Binance took to Twitter to clarify the situation, stating that the outflows were movements between its hot and cold wallets due to BTC address adjustments. The exchange assured users that the movements were not a cause for concern.

A Binance spokesperson later pointed to a tweet from CryptoQuant’s Head of Research, Julio Moreno, who stated that the movements were due to “newly created change addresses” owned by the exchange.

Binance clarifies the source and destination of the funds

As the world’s biggest digital asset exchange, the exchange’s large transactions are closely watched by users. Such movements can often be interpreted as signals of investor confidence in the company or the lack thereof.

In December of last year, billions of dollars in crypto flowed out of Binance in 24 hours, leading some to speculate on whether its reserves were secure. CEO Changpeng “CZ” Zhao dismissed the concerns, stating that the withdrawals were “business as usual.”

Last month, the exchange faced withdrawals again after the Commodity Futures Trading Commission (CFTC) hit it with a lawsuit for allegedly violating trading and derivatives rules. CZ dismissed the withdrawals on Twitter as “small.”

Binance’s recent movements of billions of dollars in Bitcoin have raised eyebrows in the crypto community, but the exchange has assured users that the transactions are routine and not cause for concern. Nonetheless, the movements serve as a reminder of the scrutiny that digital asset exchanges face in the fast-paced and often volatile world of cryptocurrency trading.