The Bitcoin and crypto space is poised for a potentially transformative week, with several key events that could have far-reaching implications for the market. Let’s delve into the specifics of each event:

#1 Spot Bitcoin ETF Approval – Friday

As Bitcoinist reported earlier today, a critical window is currently open for the SEC to potentially approve all 12 spot Bitcoin ETFs. The deadline ends on November 17, after which newer filings will enter a public comment period. This is especially interesting because it is assumed that the SEC aims to avoid favoritism in a highly competitive market, as highlighted by industry experts. Remarkably, the SEC needs to make a decision on two spot Bitcoin ETFs by Franklin Templeton and Hashdex by November 17!

#2 US CPI Report – Tuesday

The Consumer Price Index (CPI) report is set to be released on November 14, 8:30 am ET. The leading inflation metric in the US is anticipated to show a decrease on a year-over-year (YoY) basis to 3.3% in October from September’s 3.7%, influenced mainly by lower gasoline costs. Month-over-month (MoM) inflation is expected to come in at 0.1%, lower than the previous 0.4%.

However, core inflation rates, which exclude volatile food and energy prices, are likely to remain relatively stable. Similar to September, the forecast for the core inflation rate (CPI MoM) in October is 0.3%. The year-on-year US core inflation rate is expected to fall slightly from 4.1% to 4.0%.

The Federal Reserve’s reaction to these figures will be critical, as chair Jerome Powell has indicated a willingness to continue interest rate hikes if inflation pressures do not ease. This data is crucial for investors and could have immediate implications for the Bitcoin and crypto market.

#3 US PPI Report – Wednesday

The Producer Price Index (PPI) for October, scheduled for release on November 15, 8:30 am ET, offers insights into the inflation at the producer level. The forecast indicates a marginal increase in the YoY PPI from 2.2% to 2.3%. The PPI could provide a complementary perspective to the CPI and is essential for understanding inflationary trends from the production side of the economy.

#4 Potential US Government Shutdown – Friday

The risk of a US government shutdown looms (again), with November 17 as a critical date. This comes in the wake of Moody’s downgrade of the US credit rating outlook to ‘negative,’ citing concerns over large fiscal deficits and debt affordability.

Proposals for temporary measures have been put forward once again in an effort to prevent a government shutdown. However, various US government agencies are already initiating preparations to brace their staff for a possible partial shutdown, following their established protocols.

This could have several implications for Bitcoin and crypto. On the one hand, Bitcoin and crypto have historically reacted positively to the US government shutdown, and the market rally could be further strengthened. On the other hand, as was the case last time, a decision by the SEC on the Spot Bitcoin ETFs could come as early as Friday.

#5 Polygon’s Major Announcement – Tuesday

Polygon has been generating considerable excitement in recent days, in line with its progression towards the 2.0 roadmap. A heightened sense of anticipation has been stirred by Sandeep Nailwal, Polygon Labs Executive Chairman. On November 7, he hinted at significant announcements slated for November 14.

Are you ready?

9th November

14th November

Stay tuned!

— Sandeep Nailwal | sandeep. polygon

(@sandeepnailwal) November 7, 2023

Speculation within the community is rife, with dominant theories suggesting the possibility of an airdrop and the revelation of a significant partnership. This conjecture is partly fueled by Nailwal’s previous remarks about a potential airdrop to users of Polygon’s Ethereum Layer 2 solution, Polygon zkEVM. Additionally, the ongoing transition of the network’s native token from MATIC to POL has sparked further discussions and theories.

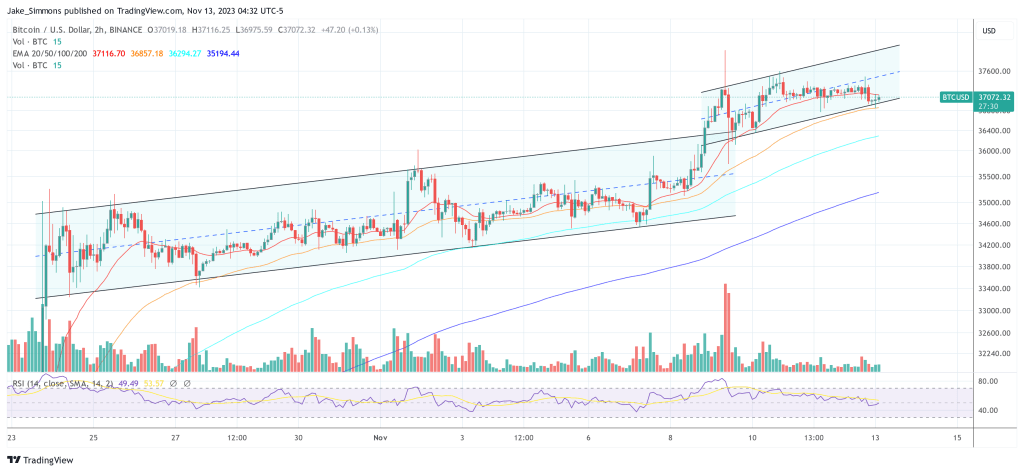

At press time, Bitcoin traded at $37,072.