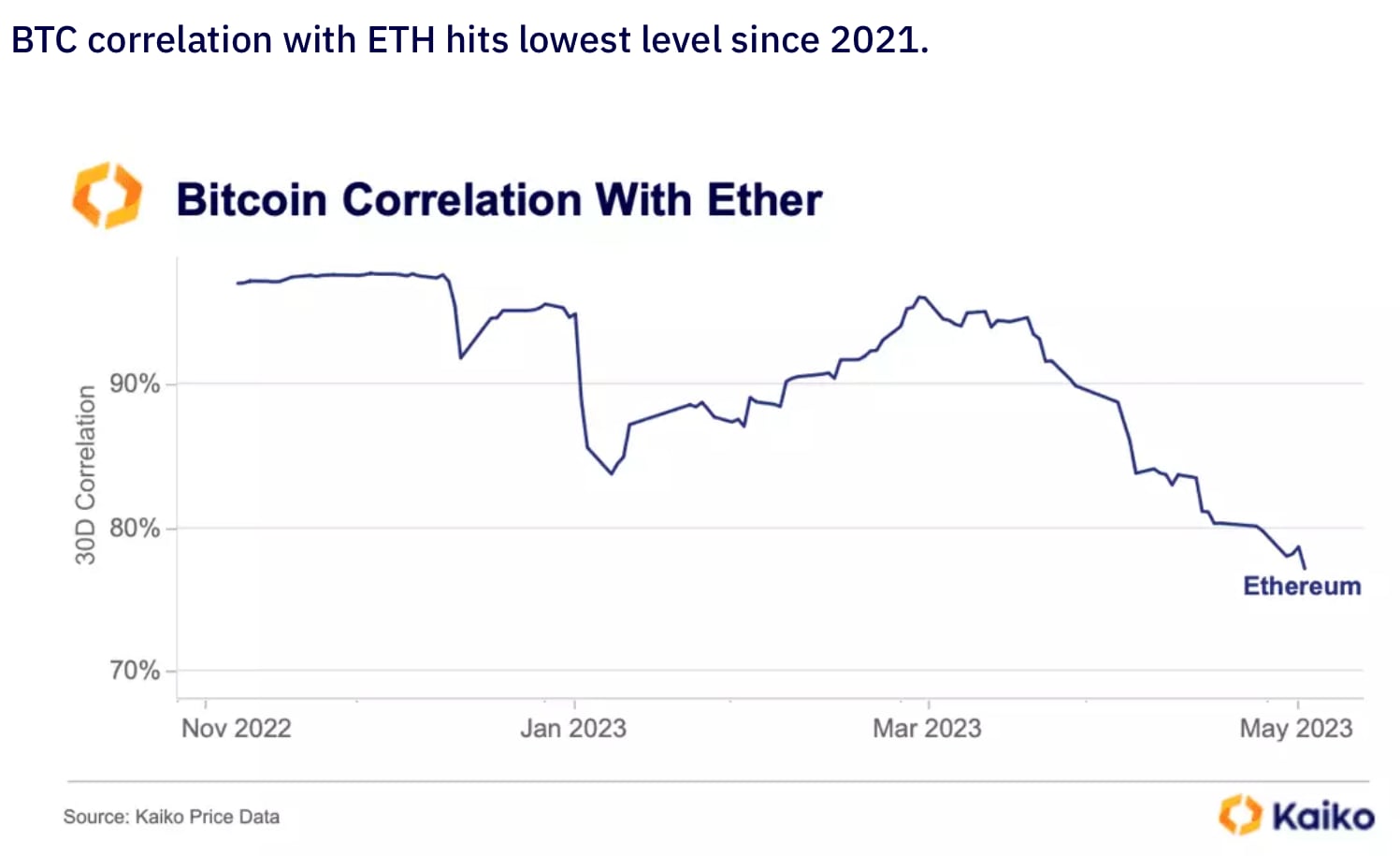

Witnessing a historic divergence in the crypto sphere, Bitcoin (BTC) and Ethereum (ETH) have taken distinct paths, pushing their correlation to the lowest point since 2021. This shift, a clear deviation from the usual sync seen between these two digital currency giants, mirrors a broader evolution within the crypto market. As BTC basked in the glow of ETF expectations and speculation, ETH chugged along a different track, driven by a diverse set of narratives and market dynamics.

The Diverging Paths of BTC and ETH

The disconnection between Bitcoin and Ethereum is not just a number game; it reflects a deeper story of two leading cryptocurrencies carving out their unique identities. While Bitcoin enjoyed a surge in interest and value with the introduction of spot ETFs, Ethereum, despite its technological advancements and promising developments like the Merge, has not mirrored BTC’s rally in terms of market excitement. This divergence is more than just a fleeting market trend; it signals a maturation of the crypto market where assets are increasingly judged on their individual merits and utility rather than moving in tandem.

Ethereum, in particular, has been a hotbed of innovation and competition. With developments in deflationary mechanisms, Layer 2 solutions, and potential ETFs, Ethereum is charting its course, sometimes in contrast to Bitcoin’s trajectory. The variety and intensity of these developments, including competitive pressures from networks like Solana, have shaped ETH’s market behavior distinctly from BTC’s.

Will ETFs Fuel Ethereum’s Rally?

The big question hovering over Ethereum now is whether the potential approval of its own spot ETFs will ignite a rally similar to what was observed with Bitcoin. Historical data suggests a nuanced picture. While ETH has seen substantial growth, it has lagged behind BTC’s explosive returns, especially around the time of Bitcoin’s ETF approval. However, post-ETF approval for Bitcoin, Ethereum began showing signs of decoupling, hinting that its own ETF journey might chart a different path.

Ethereum’s recent spike in trade volume, especially on centralized exchanges, underscores the growing interest in the asset. However, unlike Bitcoin, this increase in ETH’s spot volume has not been paralleled by a similar enthusiasm in the derivatives market. This suggests a cautious approach by traders, perhaps waiting for more clarity on the regulatory front before committing to aggressive positions.

The contrast in market reactions between BTC and ETH ETFs can also be attributed to their distinct characteristics. Ethereum’s complex ecosystem, which includes elements like staking yields and Layer 2 scaling solutions, presents a different investment proposition compared to Bitcoin. While Bitcoin’s journey with ETFs has been momentous, Ethereum’s path is fraught with more uncertainties and regulatory ambiguities.

The diverging paths of Bitcoin and Ethereum reflect the evolving narrative of the cryptocurrency market, where assets are increasingly evaluated on their unique propositions. While Bitcoin has established a strong narrative around ETFs, Ethereum’s journey is multifaceted, with factors like technological advancements and competition shaping its market dynamics.

The correlation between these two giants at a historic low point is not just a statistical anomaly but a testament to the maturing and diversification of the crypto market. Whether Ethereum will replicate Bitcoin’s ETF-induced rally remains an open question, but one thing is certain: the crypto market is evolving beyond monolithic trends, embracing a more nuanced and asset-specific approach.