Institutional investors seem to be regaining confidence in cryptocurrencies as for the second week in a row, crypto investment funds saw net inflows from investors. According to a report from digital asset manager CoinShares, investments in digital asset funds increased by $125 million during the last week, making this the second consecutive week of inflows.

Investor Sentiment for Crypto Funds Improving

Bitcoin and major altcoins have stabilized and even started rebounding from their mid-year price drops, and this development has been reflected in crypto funds. As a result, institutional investors are more confident about getting into the market.

The report shows that the increase in crypto funds investments has brought the last two weeks of inflows to $334 million, representing almost 1% of total assets under management. This has led to the total digital assets under management growing to $37 billion during the week, with the majority of those in the United States and Canada.

Germany, however, came out top in terms of inflows recording $64.8 million and over $137 million over the past week and month, respectively. Blockchain equities also saw inflows of $6.8 million following a 9-week run of outflows, signaling a renewed interest in the sector.

Bitcoin Leads the Pack

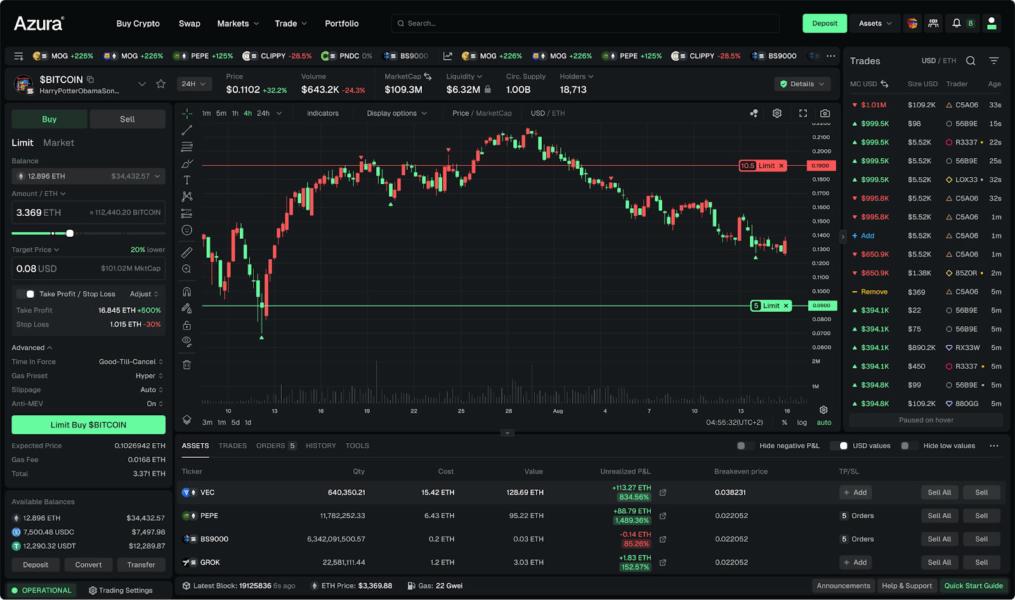

Bitcoin is, once again, leading the charge again for digital assets. According to the latest report, 98% of all crypto fund inflows over the past two weeks have gone straight into Bitcoin. Last week alone, the cryptocurrency had inflows of $123 million. This should not come as a surprise, given that Bitcoin is widely acknowledged to be the leading and most reliable digital asset.

Other altcoins also recorded inflows, however, as Ethereum saw inflows of $2.7 million, Cardano inflows amounted to $0.9 million, while Litecoin and XRP had inflows of $0.3 million and $0.4 million, respectively. Solana, however, did see a minor outflow of $0.8 million during the week.

Following the recent increase in BTC’s price, short-bitcoin investment products continued to see outflows totaling $0.9 million. The price of bitcoin continues to stay in bullish sentiment, although market action has been ranging around the $30,000 region for the past week. According to CoinGlass, a cryptocurrency market data and analysis platform, more than $4.92 million in bitcoin shorts have been liquidated in the past 24 hours.

Will the Positive Trend in Inflows Continue?

The recent trend of inflows into digital asset investment products is encouraging for the market and investors. But it’s still too early to tell if this positive momentum will continue long-term.

However, considering the entire market has been growing steadily for the past few weeks, interest in crypto funds like popular ETPs, mutual funds, and OTC trusts will likely increase.