New York Community Bancorp, Inc. (NYSE: NYCB) shares plummeted by 45% today after a dividend cut and an unexpected loss on earnings. And as history has proven, when banks are bleeding, Bitcoin often is a beneficiary. This time is no different, with BTCUSD making new record highs against the NYCB stock price.

New York Community Bancorp Shares Suffer 45% One-Day Collapse

In March of 2023, Bitcoin made a huge move from its bottom range on the heels of a collapse in the banking system. Back then, Signature, Silicon Valley, and Silvergate each saw extensive bank failures. The shares of each bank sank ahead of the failures, tipping off the market that something was awry. Silvergate, in particular, was later acquired by New York Community Bancorp in the aftermath.

Now it is New York Community Bancorp that saw its share tank by 45% in a powerful pre-market selloff. The selling pressure was driven by a 71% reduction in quarterly dividend payouts to shareholders, from $0.17 to $0.05. Two bad loans also added to a surprising earnings loss. The shares of other regional banks suffered as well.

Bitcoin Sets New ATH Record Against Regional Bank

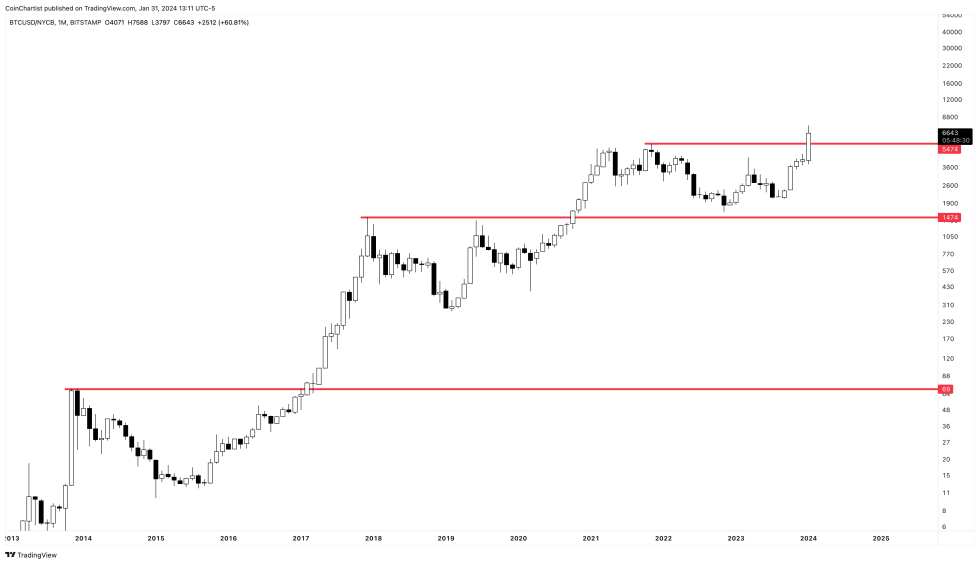

With more trouble hitting regional banks today, BTCUSD has made a new all-time high when priced in shares of NYCB. Considering the carnage in the traditional bank, this isn’t all that shocking. However, it is possibly a notable development. In the past, each time a new all-time high was made, Bitcoin kept making new highs month after month for roughly a full year.

If Bitcoin remains bullish for around a year, 2024 could prove to be one of the most interesting years for the cryptocurrency market ever.

Another Victory For Satoshi Nakamoto

BTC was designed by Satoshi Nakamoto to allow individuals to opt out of the traditional banking system, which has been in trouble since the 2008 Great Financial Crisis. Hidden within the Genesis Block of the Bitcoin blockchain is a headline from The Times that reads “Chancellor on brink of second bailout for banks” in reference to a series of bailouts following the crisis.

15 years later, Bitcoin was just approved for a spot ETF, enabling widespread mainstream access into the digital asset. If the banking system shows further weakness, wealth may continue to flow into the BTC market cap by the way of these new ETF wrappers.