Despite the drop in hash rate, Bitcoin miner selling isn’t correlated with the BTC price drop from $71,100 to $66,000.

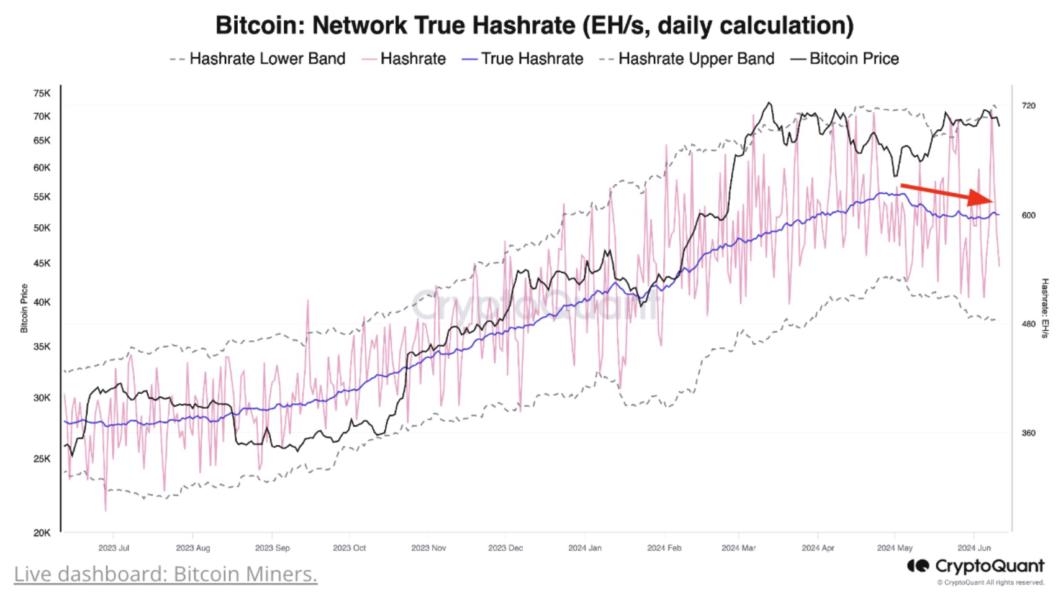

Bitcoin’s hashrate has broken down from an 18-month uptrend, suggesting the start of a potential Bitcoin miner capitulation.

Following an 18-month uptrend, Bitcoin’s true hash rate fell to around 600 exahashes per second (EH/s). The hash rate is used to measure how difficult it is for miners to mine Bitcoin (BTC).

The breakdown from the uptrend could signal that some Bitcoin mining firms are selling their BTC, according to Ki Young Ju, the founder and CEO of CryptoQuant. He wrote in a June 13 X post: