Coinspeaker

Bitcoin (BTC) and Broader Crypto Market Come Crashing Down Following SEC Lawsuit on Binance

The filing of the lawsuit by the US SEC against crypto giant Binance sent shockwaves across the entire cryptocurrency market on Monday, June 5. Over the last 24 hours, Bitcoin (BTC) and the broader cryptocurrency market have corrected by over 4%.

As of press time, the Bitcoin (BTC) price is down by 4% and is currently trading at $25,778 with its market cap dropping under $500 billion. With the recent move, Bitcoin has lost its most important support of $26,300, and this could further drag the BTC price all the way to $23,000.

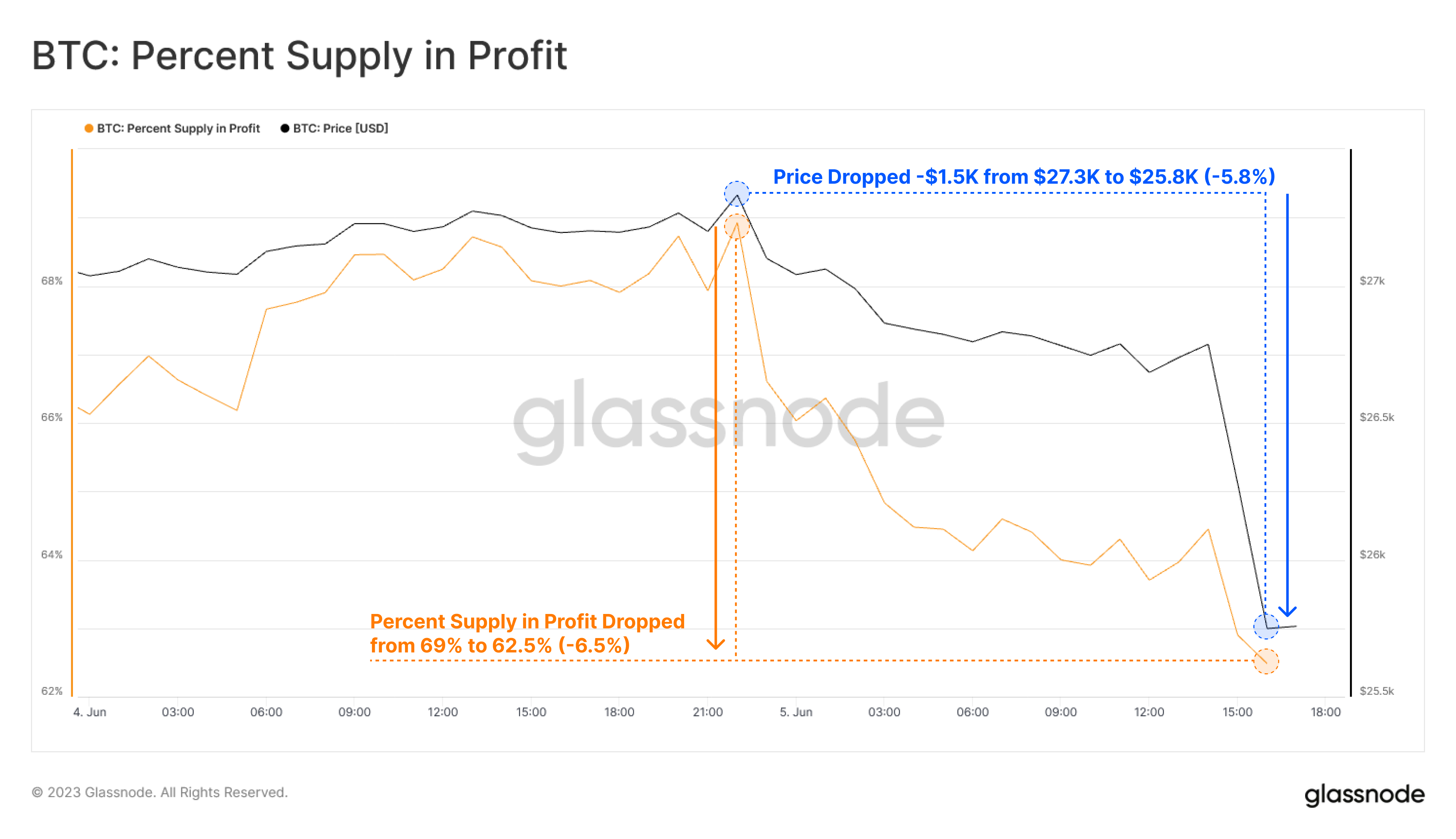

On-chain data provider Glassnode further wrote:

“The recent Bitcoin move downwards from $27.3K to $25.8K (-5.8%) has caused the percent supply in profit to decline from 69% to 62.5% (-6.5%), plunging a further 1.26M coins into loss.”

- After a strong start to the year 2023, the world’s largest crypto cryptocurrency has come under selling pressure over the last few weeks. It has already corrected by more than 15% from its 2023 high of over $30,000.

Also, the US boosting its debt ceiling hasn’t helped Bitcoin investors much as they wait on the sidelines for the next FOMC meeting next week on June 14. In its recent report, on-chain data provider Glassnode wrote:

“As an increasingly hostile regulatory environment is established in the US, capital appears to be flowing out, and eastward in the digital asset sector. Much of this hints to a generally risk-off environment, with the remaining capital concentrating in the more liquid majors, and a growing preference for Stablecoin capital.”

Altcoins Face Greater Correction

Along with Bitcoin, the altcoins have entered a deeper correction. In its lawsuit, the SEC has named altcoins like Binance BNB, Cardano’s ADA, Solana’s SOL, Polygon’s MATIC, Filecoin’s FIL and Algorand’s ALGO, for violating the securities laws by trading on the Binance crypto exchange.

The Binance BNB coin has faced the most correction and is down by 9% in the last 24 hours. All the above-mentioned altcoins have also corrected in the range between 5-9% each.

On-chain data from Dune analytics shows that crypto exchange Binance witnessed net outflows of a massive $635 million following the SEC’s lawsuit. It will be interesting to see how strong can Binance continues to stay against the regulatory headwinds.

Binance and its chief CZ have received massive support from industry leaders. Cardano chief Charles Hoskinson has asked industry players to unite against the authoritarianism of the SEC and other regulatory bodies.

The total market capitalization for #Crypto is still sustaining on the 200-Week MA and 200-Week EMA.

As long as that holds, and given that the final party, #Binance, is receiving an attack, we could also be reaching the low of this correction. pic.twitter.com/gAY7fig2ns

— Michaël van de Poppe (@CryptoMichNL) June 6, 2023

However, investors need not panic immediately. Popular crypto trader and analyst Michael Van de Poppe noted that the crypto market is still sustaining above the 200-week moving average (WMA).

Bitcoin (BTC) and Broader Crypto Market Come Crashing Down Following SEC Lawsuit on Binance