Coinspeaker

Bitcoin (BTC) Plummets 8% amid $685M Crypto Liquidations

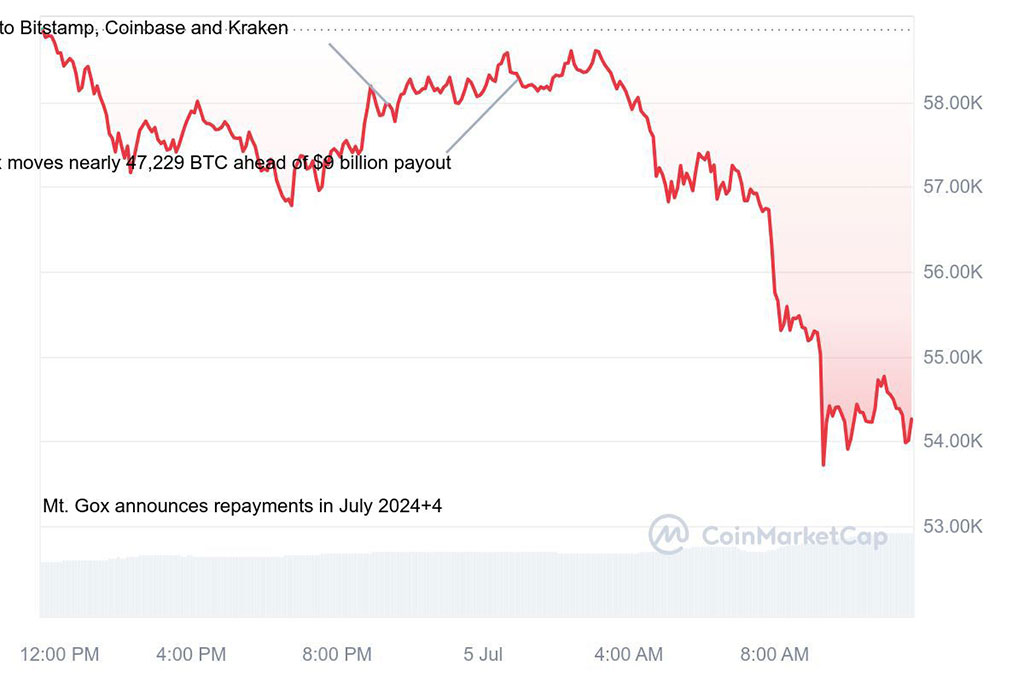

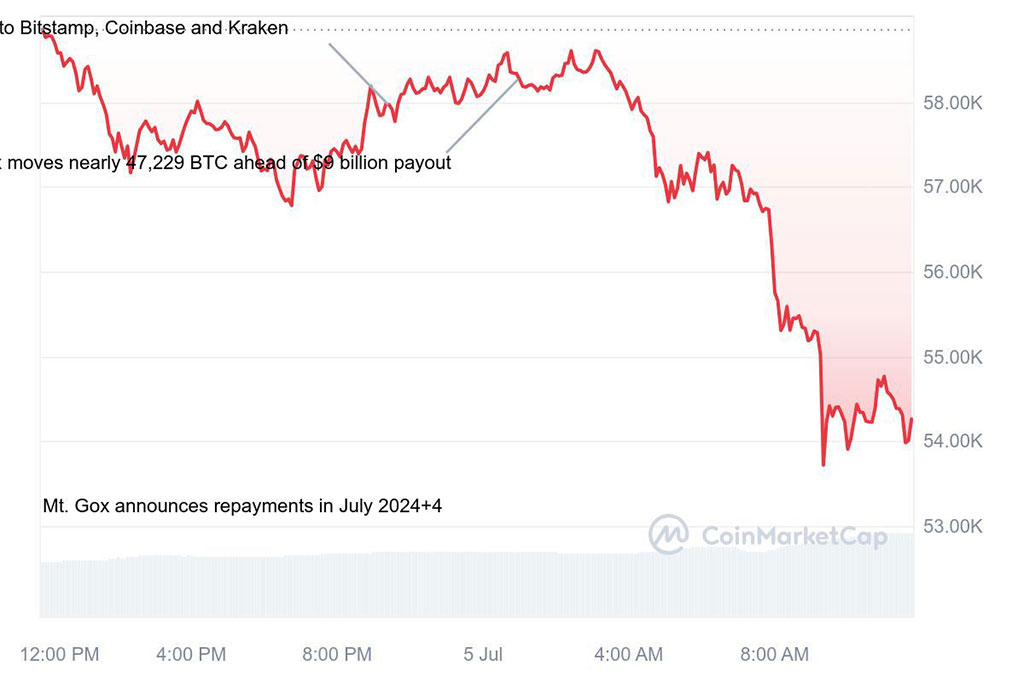

The crypto market endured a brutal 24 hours on July 5th, 2024, with over $685 million in liquidations as Bitcoin (BTC) plunged below $54,250. This sharp sell-off coincides with continued movements by defunct exchange Mt. Gox, which is preparing a payout to creditors.

Mt. Gox Shakes Confidence

Bitcoin prices tumbled by 7.89% to $54,258. This drop came amidst ongoing concerns surrounding Mt. Gox. The defunct exchange recently moved a significant amount of Bitcoin – roughly $2.7 billion worth – as it gears up for creditor payouts scheduled for early July.

Photo: CoinMarketCap

Analysts believe this movement by Mt. Gox may be a key driver of the market’s volatility. Peter Chung, head of research at Presto Research, said:

“The selling pressure may be stronger for BCH than BTC. […] Given BCH doesn’t have a strong investor base like BTC, the [Mt. Gox] creditors will probably seek to cash out immediately.”

The price drop triggered a wave of liquidations, with CoinGlass data revealing a total of 236,447 traders liquidated in the last 24 hours. These liquidations amounted to a staggering $685.39 million across centralized exchanges.

Bitcoin unsurprisingly led the liquidation pack, with over $230.39 million liquidated. Notably, $185.37 million of these liquidations were long positions, indicating forced selling by over-leveraged bulls. Ethereum (ETH) also suffered significant liquidations, with $163.4 million wiped out, of which $167 million were long positions. The ETH price followed Bitcoin’s decline, dropping a substantial 10.71% to $2,859.

Bitcoin’s Long-Term Potential

Cryptocurrency liquidations occur when a trader’s position is forcibly closed due to insufficient margin or significant losses. While the current market climate may appear bleak, some industry experts remain optimistic.

“Volatility and periods of selling do not change Bitcoin’s core thesis,” stated Ben Caselin, chief marketing officer of VALR, a Pantera-backed crypto exchange. “With any luck, we can expect prices in the lower 50,000s or even slightly lower for weeks… but nothing fundamental has changed about the market structure and current price movements are really only a concern to short-term speculators.”

While the near future may be marked by price swings, Caselin emphasizes the importance of focusing on Bitcoin’s long-term potential. The coming days and weeks will be crucial in determining how the market reacts to Mt. Gox’s upcoming payouts and whether investor confidence can be restored.