Coinspeaker

Bitcoin (BTC) Rebounds after Tipping $1B Market-Wide Liquidation

The crypto market is prone to wild price volatility. March 5 was a stark reminder of this as Bitcoin (BTC) briefly retested an all-time high of $69K before dropping to $59K. The largest cryptocurrency by market capitalization shed $10K (over 10% drop) within hours, causing a wide bloodbath across the sector.

Since BTC is the barometer of the market, its drop triggered a significant portion of assets to record massive declines. Memecoins that dominated the charts, like Dogecoin (DOGE), hit massive discounts of about 30%. Additionally, Shiba Inu (SHIB) spot prices dipped by over 40% on the Binance exchange before stabilizing.

The flash crash saw leveraged traders bear the worst grant. A total of $1 billion in liquidation was reported in the past 24 hours, as per Coinglass data. Over $800M of the $1B in Bitcoin liquidation was accounted for by long positions, meaning leveraged bulls recorded massive losses.

BTC Slump Linked to Profit-Taking and Miners’ Moves

Market watchers cited profit-taking after BTC retested ATH of $69K and miners offloading their holdings as reasons for the massive sell-off.

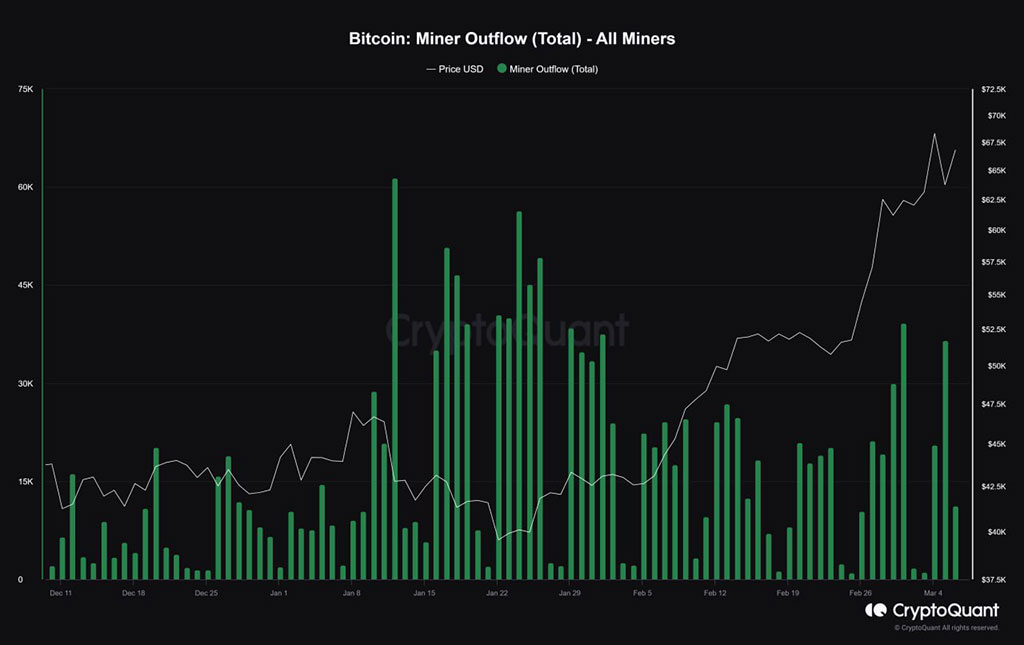

A quick spot check on Miners’ Outflow (Total) lends credence to miners offloading their stash. According to CryptoQuant data, Miners’ Outflow spiked to 39K BTC and 36K BTC on March 1 and 5, respectively. It meant miners moved more BTC to exchanges for selling – a bearish signal.

Photo: CryptoQuant

However, the market rebounded swiftly on March 6. At the time of writing, BTC reclaimed $67K during the afternoon Asian trading session. The second largest cryptocurrency by market cap, Ethereum (ETH), was also up +7% as it crossed $3.8K.

On the memecoin sub-sector, Dogwifhat (WIF) rebound outperformed its peers on the daily front. It was up +35% and traded above $2 following a successful listing on Binance Exchange. PEPE followed closely as its recovery hit +25% at the time of writing. However, on the daily charts, SHIB and DOGE were up 5% and 10% respectively.

Some market watchers opined that BTC’s price would increase, given the current supply shock and the upcoming Halving event in April.

Adex Adelman, CEO of Lolli (a bitcoin rewards application), held a similar stance in a recent comment on a CoinDesk report. He asserted that ETF’s daily average demand of $500M inflow outstrips miners’ BTC output. Additionally, after the Halving event, the BTC supply reduction in April will drive scarcity and price appreciation to $150K by next year.

Bitcoin (BTC) Rebounds after Tipping $1B Market-Wide Liquidation