Fidelity Investments’ global macro director Jurrien Timmer says that a recession could spark a big rally for Bitcoin (BTC).

Timmer tells his 167,000 followers on the social media platform X that current high-interest rates need to decline for Bitcoin to put up big gains.

“What will keep driving it?

First, the macro narrative needs to change from restrictive to accommodative.

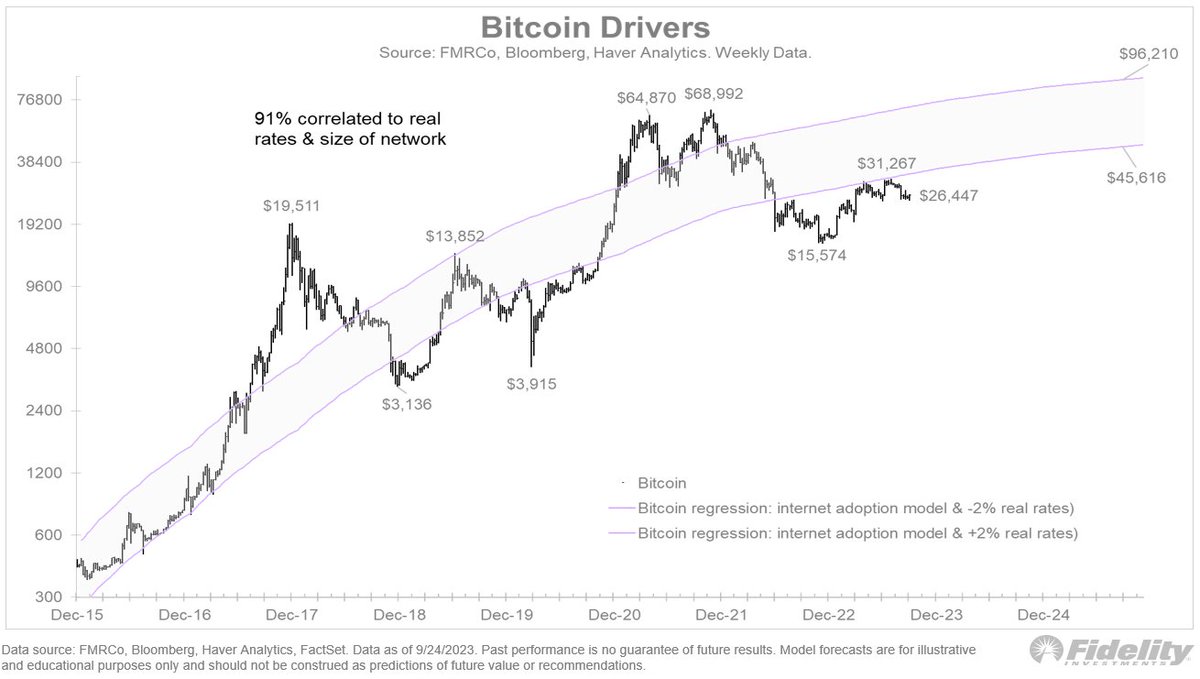

Below is a regression model that lays out a price band based on a typical adoption curve and a range of real rates (from -2% to +2%).”

The macro expert’s chart uses a price range derived from the Bitcoin adoption rate based on the past adoption rate of the internet and a real interest rate range between 2% and -2%, which is nominal interest minus inflation.

Looking at his chart, Timmer believes that Bitcoin’s move to the upside may only be to the $45,616 level towards the end of 2025. However, if interest rates come down, his chart suggests Bitcoin could see a high of $96,210 before 2025 comes to a close.

The macro expert believes that a recession would cause the Federal Reserve to pivot and then investors would likely view gold and Bitcoin as safe haven investments, driving the assets’ prices higher.

“If and when that long-elusive recession finally hits, and the Fed pivots for real, Bitcoin and gold could be viewed as high-powered hedges.”

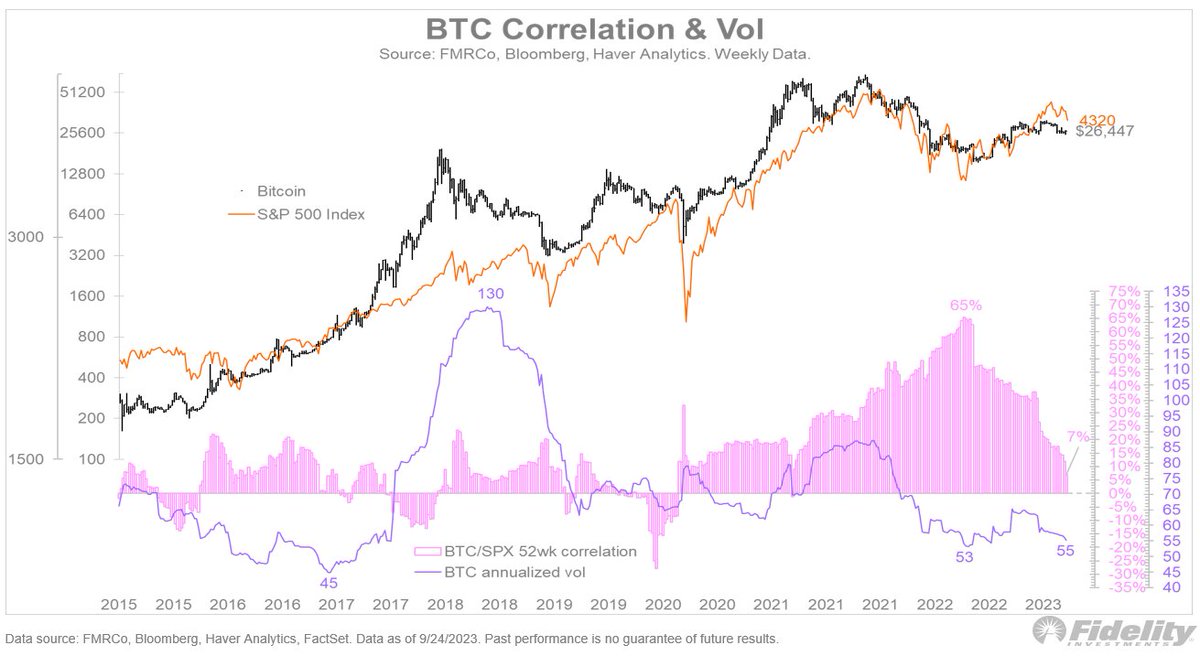

According to Timmer, Bitcoin could print gains in the next market cycle regardless of how the stock market performs.

“Bitcoin has become less correlated to equities, and less volatile. Its annual volatility has declined from 85 in 2021 to 55 (which is still high), and its 12-month correlation has fallen from 65% to only 7%. So Bitcoin might provide uncorrelated returns in the next market cycle.”

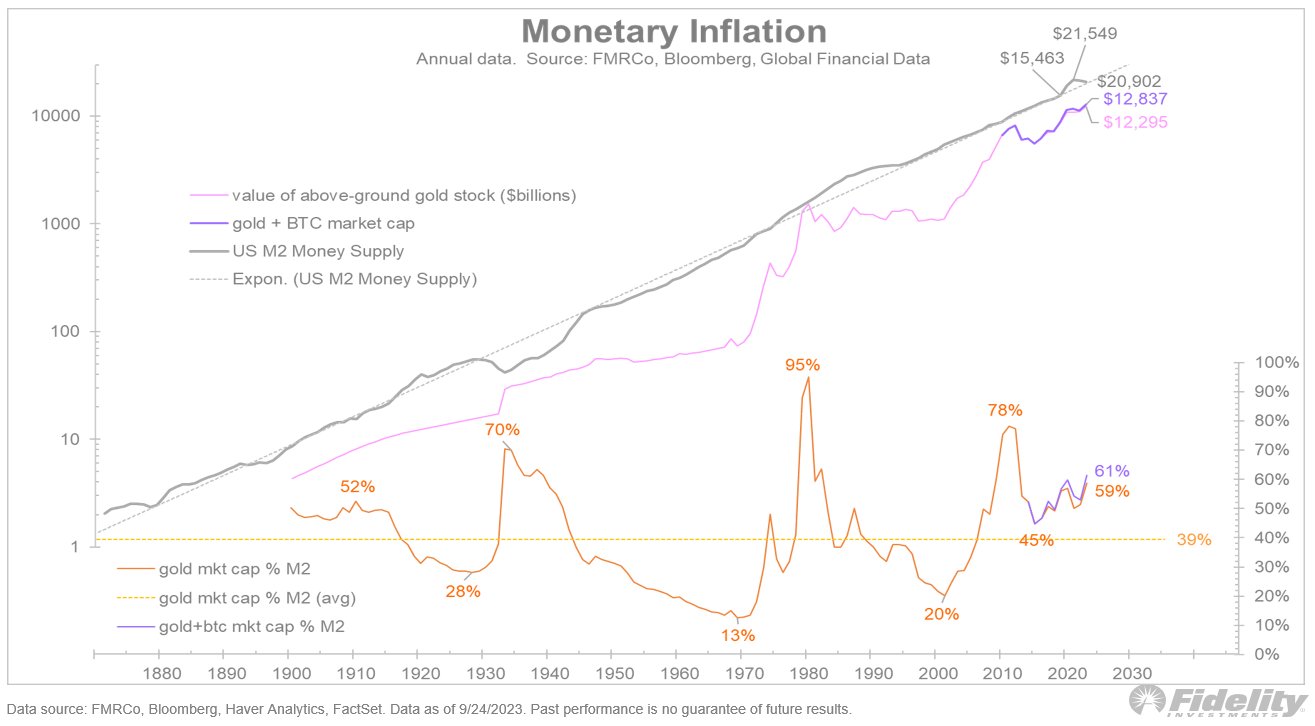

The macro expert also says that for Bitcoin to reach new all-time highs, the Federal Reserve will need to inject more liquidity into the markets, which it did during the Covid-19 pandemic to prop up the economy through quantitative easing, also known as printing money.

“Bitcoin bulls need the money printers to go to work again. The money supply exploded in 2020-21, a scenario in which gold bugs and Bitcoin bulls thrived. When the money supply grows faster than its long-term growth rate, gold’s market share has gone up.”

Bitcoin is trading for $26,931 at time of writing, down 0.5% in the last 24 hours.

Don't Miss a Beat – Subscribe to get email alerts delivered directly to your inboxCheck Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

The post Bitcoin Could Benefit if an Economic Recession Hits, Says Fidelity Investments Macro Analyst – Here’s Why appeared first on The Daily Hodl.