Coinspeaker

Bitcoin DeFi TVL Can Overtake Ethereum’s in Just Two Years, Says DAO Contributor

Bitcoin DeFi developer Branden Sedo has recently made a bold prediction that the total value locked (TVL) in the Bitcoin-based decentralized finance (DeFi) protocols could probably overtake Ethereum’s DeFi TVL within a span of just two years.

Branden Sedo is an initial contributor to the Bitcoin sidechain Core DAO. Speaking at the Korea Blockchain Week, Sedo said that the trillion-dollar capital currently held in the Bitcoin ecosystem will soon move on-chain while eventually flipping the capital on the Ethereum network. “If you look at Bitcoin, there’s over a trillion dollars sitting there,” he said.

Sedo further added that as Bitcoin continues to grow in value, it will attract further institutional capital, especially via the Bitcoin ETF products. Thus, the Core DAO contributor strongly believes that a lot of this institutional capital would be put to use in Bitcoin sidechains and other Bitcoin-based DeFi applications. He added:

“You could feasibly see a lot of that capital coming on chain — especially with the solutions like trustless bridges and roll-ups that are coming out. It’s a no-brainer to bring some of that liquidity on-chain and bring about more opportunities for Bitcoin”.

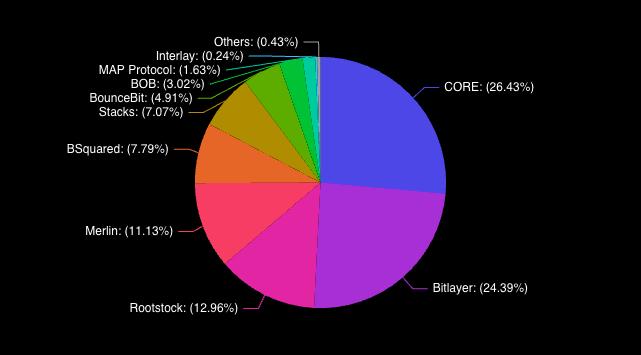

The approval of the spot Bitcoin ETFs earlier this year brought some spotlight on Bitcoin scalability, thereby igniting a surge in development and market enthusiasm for Bitcoin sidechains including Bitlayer, Core, and Stacks.

Here’s How Bitcoiners Can Contribute to the Flippening

Sedo said that if the Bitcoin DeFi TVL shall flippen Ethereum’s, a large number of Bitcoiners also need to contribute and get comfortable with the idea of putting their Bitcoin to work on-chain.

However, following the collapse of crypto lenders like BlockFi and Celsius during the crypto winter of 2022, investors have rather moved their BTC to cold storage. Following the loss of Bitcoin during the collapse, many Bitcoin enthusiasts became strongly opposed to any yield-bearing opportunities for Bitcoin. They chose instead to strictly HODL their Bitcoin in cold storage wallets.

“A lot of people have lost Bitcoin. I’ve lost Bitcoin. It’s not fun to lose Bitcoin. It fucking sucks. So there’s lots of understandable skepticism with these new things that come out,” he said.

However, Sedo pointed out a positive development stating that Bitcoiners are slowly getting comfortable with using their BTC for non-custodial DeFi applications. Upon returning from the Bitcoin 2024 conference in Nashville, Sedo found that the prevailing sentiment was the “explosion of possibilities” emerging on the Bitcoin network.

He further expressed confidence in Core’s staking approach which is completely non-custodial. Sedo added that Core’s bridge, which allows users to bridge stablecoins and native CORE tokens, is powered by LayerZero. This is the only bridging protocol in the crypto space that hasn’t fallen prey to DeFi bridge attacks.

Using Core Chain, Bitcoin users can timelock their BTC and don’t have to worry about custody or handing over private keys. Besides, they receive a 3% yield payout in CORE tokens which they can later use for gas and governance on the network.

Bitcoin DeFi TVL Can Overtake Ethereum’s in Just Two Years, Says DAO Contributor