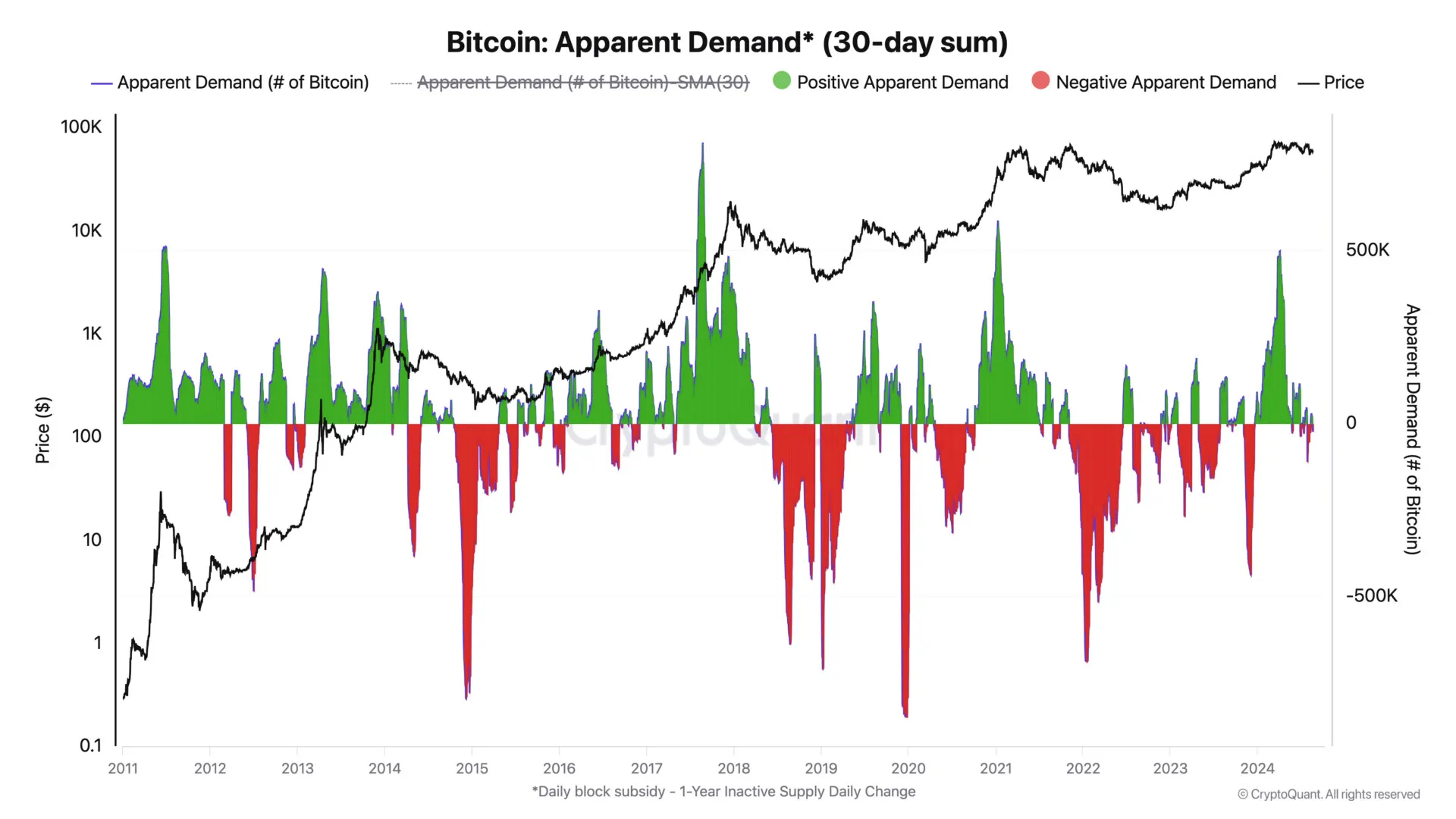

Demand for Bitcoin has been tanking since April, and it’s getting close to dipping into negative territory.

According to CryptoQuant’s data, Bitcoin’s demand has gone from a strong 30-day growth of 496,000 BTC in April to a weak negative growth of 25,000 BTC in just a few months.

So, what’s apparent demand? It’s basically the difference between the total daily Bitcoin block subsidy and the daily change in the number of Bitcoins that have stayed untouched for a year or longer. It’s a key indicator, and right now, it’s pointing down.

With demand dropping, Bitcoin’s price has taken a beating. Back in April, Bitcoin was riding high around $70,000. Fast forward to early August, and it’s dropped to about $51,000.

Even with this correction, the cryptocurrency still shows a 33% return year to date. But let’s be real, that’s not the headline anyone’s been hoping for.

The decrease in demand seems to be driven by a slowdown in purchases by spot exchange-traded funds (ETFs) in the United States. In March, these ETFs were grabbing 12,000 BTC.

Now, between August 11 and 17, they’ve only picked up an average of 1,300 BTC. That’s a massive drop-off. Coinbase isn’t doing any better. The price premium for Bitcoin trading on Coinbase was at 0.25% in early 2024, right after the ETFs launched.

Now, that premium has shrunk to a measly 0.01%. This is another clear sign that demand in the U.S. is cooling down fast.

CryptoQuant’s data highlights that a bounce back in spot ETF purchases is needed to get Bitcoin demand back on track. Without it, any hopes of a price rally might just be wishful thinking.

While institutions are losing interest, hardcore Bitcoin holders are still buying the dip. Permanent holders—those who have never sold their Bitcoin—are stacking up their balances like there’s no tomorrow.

Their total balance is climbing at a record-high rate of 391,000 BTC per month. CryptoQuant highlights that demand from these permanent holders is growing even faster than it did in the first quarter of 2024, when Bitcoin’s price shot past $70,000.

They’re clearly seeing value in the lower prices and are taking advantage of the situation. But not everyone is holding onto their Bitcoin. The so-called “whales,” those with wallets holding between 1,000 to 10,000 coins, are lightening their load.

The data claims that the 30-day percentage change in whale holdings has dropped from 6% in February—the fastest pace since 2019—to just 1% now. Usually, when whale holdings grow at more than 3% per month, Bitcoin prices rise.

But that’s not the case right now.