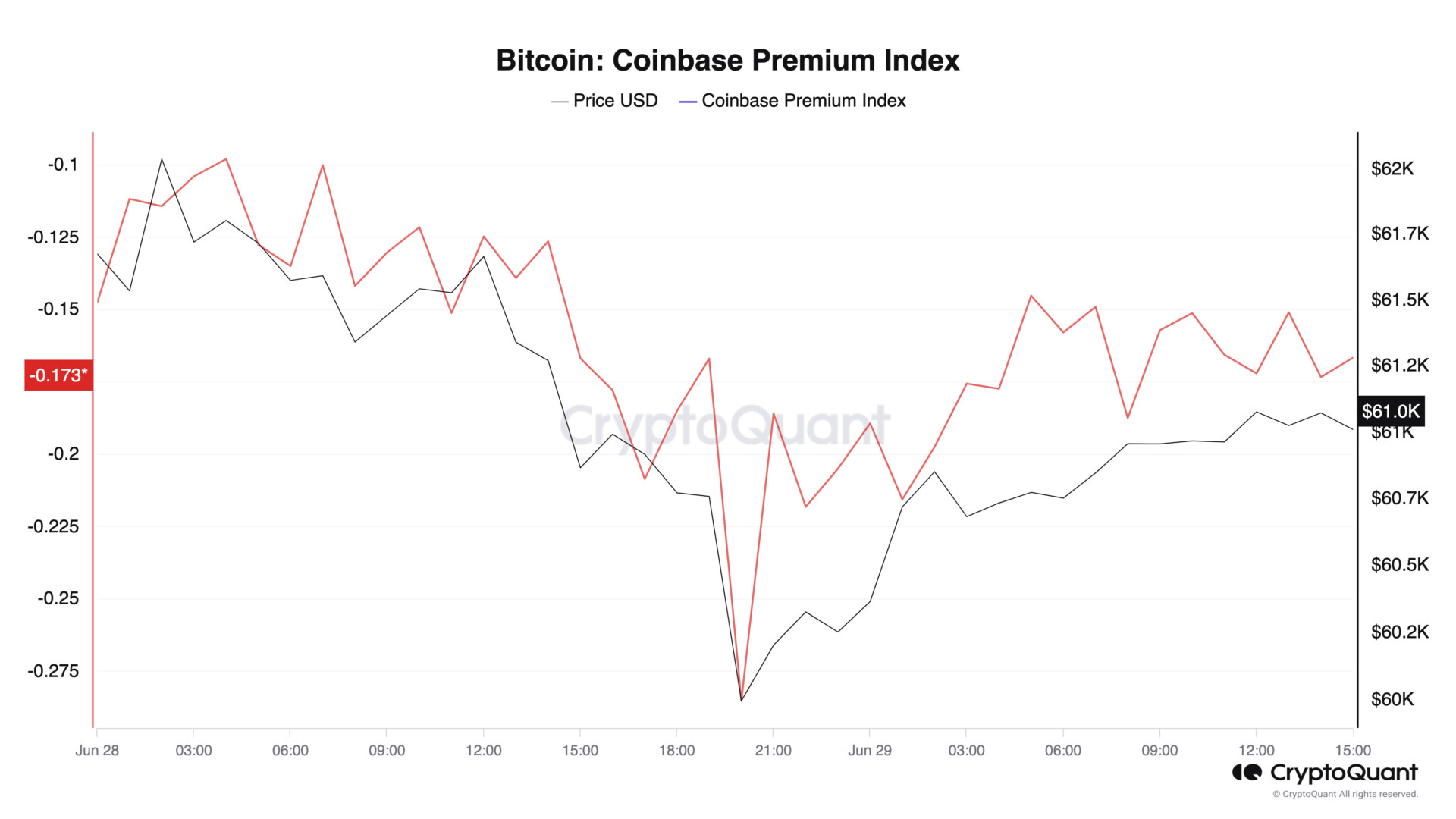

Bitcoin has taken a nosedive below $60,000. Early this morning, the price difference between Coinbase’s BTC spot and Binance’s BTC/USDt was -0.285%, as shown by data from CryptoQuant.

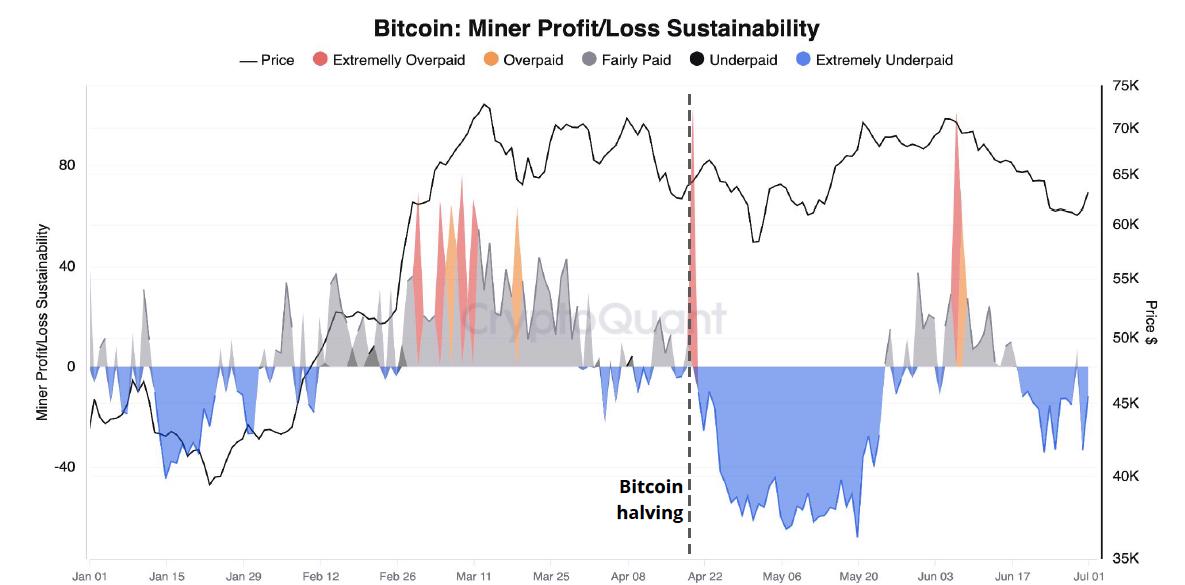

This is the lowest negative premium since May 1, hinting at more selling pressure from U.S. investors on Coinbase. The market is dealing with a huge supply from the Mt. Gox unlocks and sales by US and German governments.

These events are putting a lot of pressure on Bitcoin, pushing it to test the $60,000 support level. There’s speculation that the market could dip even further, possibly towards the $55,000 mark.

This week has been rough for Bitcoin. An onslaught of bearish headlines has dragged BTC back to the $60K support region. The $58K-$60K range has been a strong support level in the second quarter, but current conditions are challenging its resilience.

QCP Capital suggests that the supply fears might be exaggerated. They believe the market will likely grind sideways within a range, despite the current oversupply concerns. QCP noted:

“We could test lower towards 50k levels but the market will find strong support there, as interest from TradFi continues to permeate given the general regulatory easing across the world.”

Market outlook and strategies

QCP Capital recommends focusing on yield generation in a sideways market for the third quarter. Ethereum also presents some interesting opportunities.

With the upcoming launch of the ETH spot ETF in early July, there is a chance for short-term bullish trades. QCP sees this ETF as a bullish catalyst that could generate excitement in the market.

Their trade ideas include BTC CFCC (27-Sep 3 months), where traders can earn 55% per annum every Friday as long as the spot price stays above $60,000. If the spot price drops below $50,000 at expiry, the USD deployed is converted to BTC at a price of $55,000.

For Ethereum, the Zero-Cost ERKO Seagull strategy offers a potential max return of 901.2% per annum or $2,000 per ETH if the spot price is just below the $6,000 level at expiry.

This strategy involves selling a $3,000 put to buy a $4,000 call with a $6,000 knock-out. The cost of this strategy is zero, making it an attractive option for traders looking to capitalize on the expected bullish movement with the ETF launch.

Jai Hamid