Bitcoin is under immense selling pressure at spot rates, tracking lower from the all-important resistance level of $66,000. Although BTC may even crash below the psychological line at $60,000 towards $56,500 or May 2024 lows, some analysts are upbeat.

Bitcoin Drop Is Normal Post-Halving: Analyst

Taking to X, one analyst explained that the current correction is a normal part of its cyclic market cycle. If anything, savvy traders should continue accumulating on dips, targeting Q1 2024 all-time highs, and expect prices to chart fresh territories.

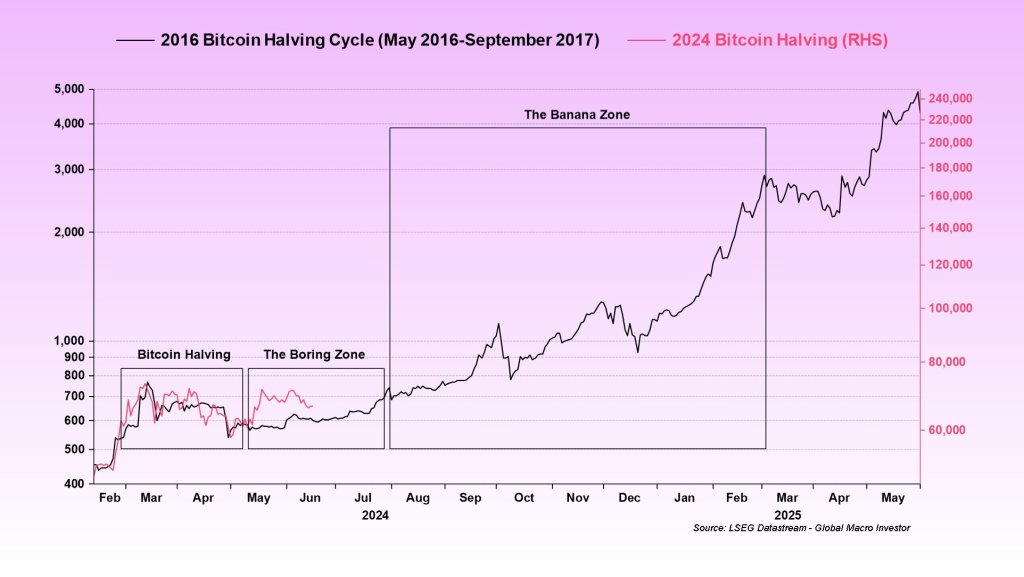

Looking at the formation in the daily chart, the analyst insisted that the current Bitcoin price action aligns with historical trends, especially the weeks after the network halves miner rewards.

Bitcoin is now in the fifth epoch after Halving on April 20, slashing miner rewards from 6.25 BTC to 3.125 BTC, significantly impacting miner revenue streams.

As things are, BTC finds itself in a familiar pattern, even with the 12% correction from the all-time high at $73,800. According to the analyst, BTC prices tend to rally before Halving.

From October 2023 to March 2024, prices soared, rising from as low as $25,000 to record all-time highs. However, the spike in demand was also accelerated by expectations of the United States Securities and Exchange Commission (SEC) to approve a spot BTC exchange-traded fund (ETF). The product began trading in January 2024.

BTC In The “Boring Zone” As Whales Dump

The pre-halving rally was followed by a sharp correction after the event, which saw BTC dump by 25% to as low as $56,500 in May.

Once this phase is done, prices tend to move sideways with minimal volatility before a final push lower to shake out traders.

Before prices push higher in the “Banana Zone,” prices enter another extended consolidation phase marked by stagnant prices. It remains to be seen whether BTC is in the “Boring Zone” due to the current drop within the $56,500 and $73,800 zone.

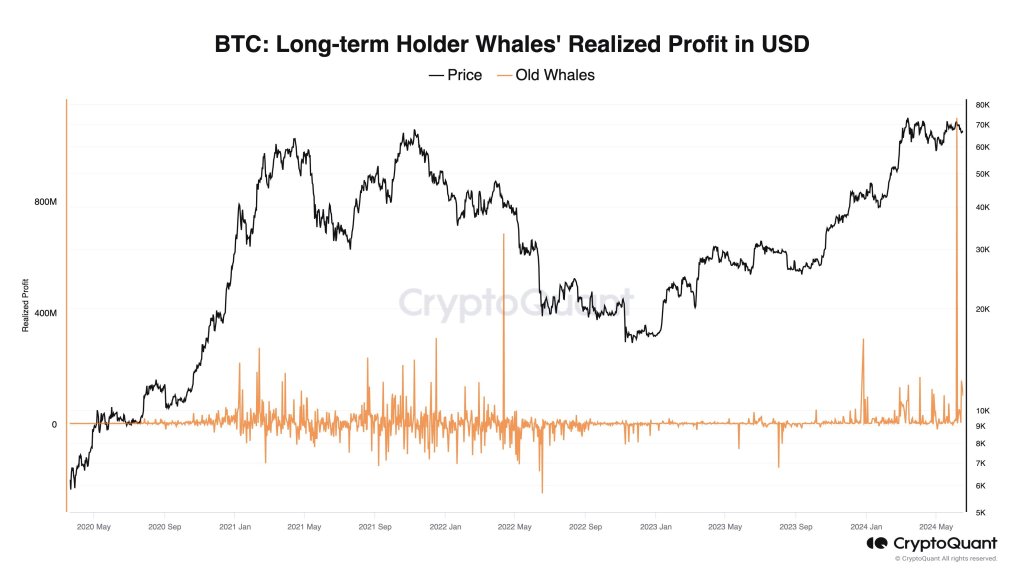

Ki Young Ju, the founder of CryptoQuant, a blockchain analytics platform, said whales have been dumping their BTC over the last two weeks.

According to on-chain data, these long-term holders have sold roughly $1.2 billion worth of the coin, likely through brokers, suppressing prices. The increasing outflows from spot Bitcoin ETFs have also slowed down the uptrend.