Coinspeaker

Bitcoin ETF Outflows Intensify as Fed Refuses to Budge on Rate Cuts

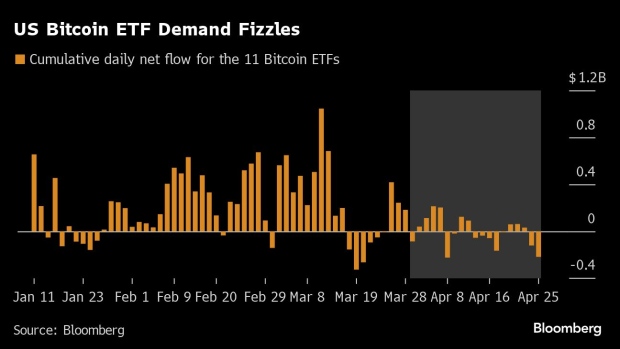

After a strong start to the month in June, the spot Bitcoin ETFs have witnessed significant outflows during the last month as the Fed stuck to its plans for holding the interest rates for longer than expected.

On Monday, June 17, the US spot Bitcoin ETF recorded a total of $145 million in net outflows, led by Fidelity’s FBTC which saw over $92 million worth of outflows. During the last week, Fidelity’s FBTC has recorded net outflows of over $140 million.

On Monday, the Ark Invest and 21Shares’ ARKB experienced net outflows of $50 million, while Grayscale’s GBTC and VanEck’s HODL saw negative flows of approximately $4 million each. On the other hand, the net inflows were relatively very weak with Bitwise’s BITB, totaling $3 million while BlackRock’s IBIT seeing zero inflows on Monday.

The massive outflows recorded by the US spot Bitcoin ETFs bring the total assets under management (AUM) to under $15 billion once again. As said, the major outflows have centered around the FOMC meeting last Wednesday, wherein Fed Chair Jerome Powell announced that the country’s current interest rate should be maintained at 5.25% to 5.50%.

Although market experts had predicted several rate cuts earlier this year, the strong jobs market and sticky inflation forced the Fed to hold at higher interest rates. As a result, market analysts are now expecting only one interest rate cut by the end of 2024.

Bitcoin Products See $620M in Outflows

During the last week, Bitcoin investment products saw total outflows to the tune of $620 million along with the short Bitcoin funds seeing $1.8 million worth of inflows, as per the report from CoinShares. The report noted that the majority of the outflows were led by spot Bitcoin ETFs.

According to Butterfill, the net outflows and a 5% decline in Bitcoin’s price amid last week’s broader crypto market sell-off led to a decrease in global assets under management, falling from $100 billion to $94 billion.

According to CoinShares, global digital asset investment product trading volumes were lower last week at $11 billion, compared to the yearly weekly average of $22 billion. US spot Bitcoin ETFs accounted for $8.73 billion of the weekly trading volume, significantly down from a peak of $32.69 billion during the week of March 4-8.

Well, it seems that the initial enthusiasm surrounding the spot Bitcoin ETFs is waning among the institutional players. Thus, these players are awaiting another macro catalyst in the form of rate cuts for the capital inflows to flood the Bitcoin ETFs once again.

Bitcoin ETF Outflows Intensify as Fed Refuses to Budge on Rate Cuts