As the clock ticks towards a potentially historic shift in the cryptocurrency market, a fierce competition is emerging among asset managers vying to launch spot Bitcoin ETFs (Exchange-Traded Funds) in the United States. Despite the lingering uncertainty over the Securities and Exchange Commission’s (SEC) stance, these firms are gearing up, ready to pounce on an opportunity that could reshape the crypto investment landscape.

Eleven financial juggernauts, managing trillions in assets, have put forth their final S-1 amendments, eagerly eyeing the SEC’s green light. The market is abuzz with speculation; Bloomberg has hinted at a 95% chance of approval by week’s end. It’s more than just a regulatory hurdle; it’s a potential financial revolution, and everyone wants a piece of the pie.

The Price of Entry: A Fee Frenzy

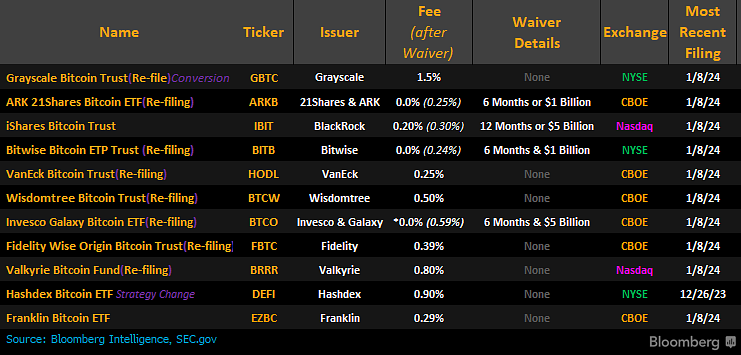

Diving into the nitty-gritty, let’s talk numbers. The proposed fees are as varied as they are competitive. BlackRock, a titan in the field, plans a 0.20% fee for the initial year or until hitting $5 billion in assets, subsequently bumping it to 0.30%. ArkInvest plays a bolder game, offering a no-fee honeymoon period for six months or until $1 billion in assets, then setting it at 0.25%.

Fidelity isn’t shying away either, with a 0.39% fee, while VanEck and Valkyrie have their sights set at 0.25% and 0.8%, respectively. WisdomTree, Invesco Galaxy, and Grayscale aren’t far behind, each with their own fee strategies. Franklin and Bitwise keep investors on their toes, hinting at competitive rates below the 0.9% threshold.

This isn’t just a fee war; it’s a strategic ballet, each firm performing its unique dance, aiming to attract a wide range of investors. Grayscale, despite its higher fee, banks on its massive asset management size to draw in clients. It’s a high-stakes game where every decimal point counts.

A Regulatory Dance: The SEC’s Crucial Role

Now, let’s pivot to the regulatory tango. The SEC isn’t just a bystander; it’s the lead dancer. Two key steps need to be mastered before these Bitcoin ETFs can waltz into the market: approval of the 19b-4 filings by the exchanges listing the ETFs, and a nod to the S-1 forms from the issuers. The SEC’s vote on these filings is imminent, and the market holds its breath, waiting for that pivotal decision.

This isn’t the SEC’s first crypto rodeo. Under Gary Gensler and his predecessor, Jay Clayton, the commission has played hard to get, citing concerns about investor protection and market manipulation. However, the winds of change are blowing. A legal setback against Grayscale Investments last August has sparked speculation that the SEC might finally relent to the growing demand for Bitcoin ETFs.

The potential impact of these ETFs cannot be understated. They’re not just financial instruments; they’re gateways for traditional finance into the world of digital assets. The approval of a Bitcoin ETF would be a stamp of legitimacy, potentially unlocking billions in capital inflow and setting a new standard in market transparency and liquidity.

As we stand at this crossroads, the implications are enormous. Approval could see Bitcoin’s value soar, drawing in both retail and institutional investors. Denial, on the other hand, would maintain the status quo, leaving the market in a state of hopeful anticipation. Either way, the outcome will resonate far beyond the confines of Wall Street, echoing across the global financial landscape.

In conclusion, as we witness this unfolding saga, it’s clear that the Bitcoin ETF saga is more than just a financial story. It’s a tale of innovation, competition, and regulatory evolution. Whether the SEC gives the green light or not, one thing is certain: the cryptocurrency market is on the brink of a transformation, and the world is watching.