Institutional hunger for Bitcoin remains rampant, seemingly stymied by regulatory roadblocks. A specific area of interest, drawing these institutional giants like moths to a flame, is the Bitcoin ETF.

While Bitcoin’s allure has been evident for years, the gates to a massive influx of institutional funds remain largely closed. And why? The U.S. regulators’ hesitancy to bless a spot Bitcoin ETF.

A Tidal Wave Waiting for Approval

At the forefront of this conversation stands Paul Brody, EY’s global blockchain maestro. Brody has voiced concerns over the latent demand from institutions and believes that the approval of a Bitcoin ETF could be the dam-buster.

For years, the palpable demand for Bitcoin from major institutional players has been evident. Yet, their hands are tied. Many of these financial behemoths are bound by regulatory constraints, unable to dive into the Bitcoin pool without an approved ETF or similar regulatory greenlight.

But this isn’t just about meeting demand. It’s about understanding the underpinnings of these desires. Investors are flocking to Bitcoin, seeing it as a valuable asset rather than just another payment method.

In contrast, Ethereum garners interest as a foundational platform for various business transactions, especially within the booming DeFi sector.

Watching, Waiting, and Regulatory Hurdles

The U.S. Securities and Exchange Commission (SEC) has been at the center of global attention, with crypto enthusiasts and investors eyeing every move, every statement, every hint of an inclination.

Thus far, the commission’s track record with Bitcoin ETFs has been, to put it mildly, sluggish.

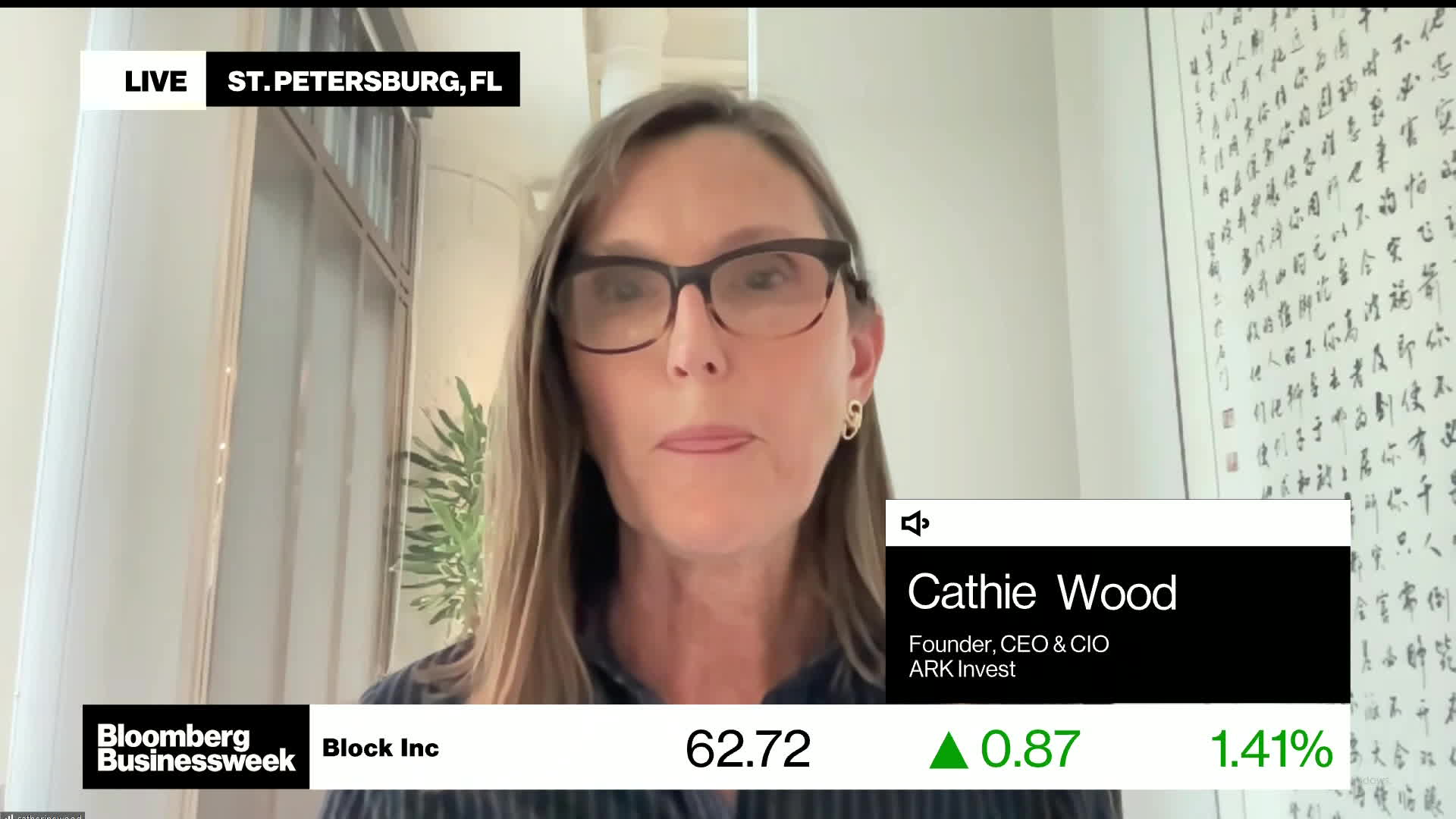

Companies that are no strangers to the world of finance, like Grayscale Investments, ARK Investment, BlackRock, and Fidelity, have all been knocking at the SEC’s door, with proposals in hand, awaiting their turn for a response.

Grayscale, having emerged victoriously from an SEC lawsuit regarding a spot Bitcoin ETF review just this past August, hasn’t wasted time.

They’ve recently set their sights on listing the Grayscale Bitcoin Trust on the New York Stock Exchange Arca. A move, no doubt, that would solidify their standing in the crypto arena.

However, it’s not all regulatory doom and gloom. There’s a glimmer of hope on the horizon. Eric Balchunas, Bloomberg’s renowned ETF analyst, hints at some positive undercurrents.

He points out a recent modification to the spot Bitcoin ETF by both ARK Invest and 21Shares as potential evidence of forward motion. According to Balchunas, these mid-October amendments might be the result of addressing specific concerns raised by the SEC.

The tale of the Bitcoin ETF has been long, winding, and fraught with anticipation. As institutions circle, waiting for the go-ahead, it’s clear the demand is there, and it is colossal.

But the proverbial ball is in the SEC’s court, and the financial world watches with bated breath.