A report from Bitfinex suggests that miners are either selling Bitcoin holdings or leveraging coins to raise capital.

The launch of Bitcoin exchange-traded funds (ETFs) in the United States has directly influenced miners’ BTC reserves, with more than $1 billion of BTC flowing from miner wallets to exchanges in the first 48 hours of trading.

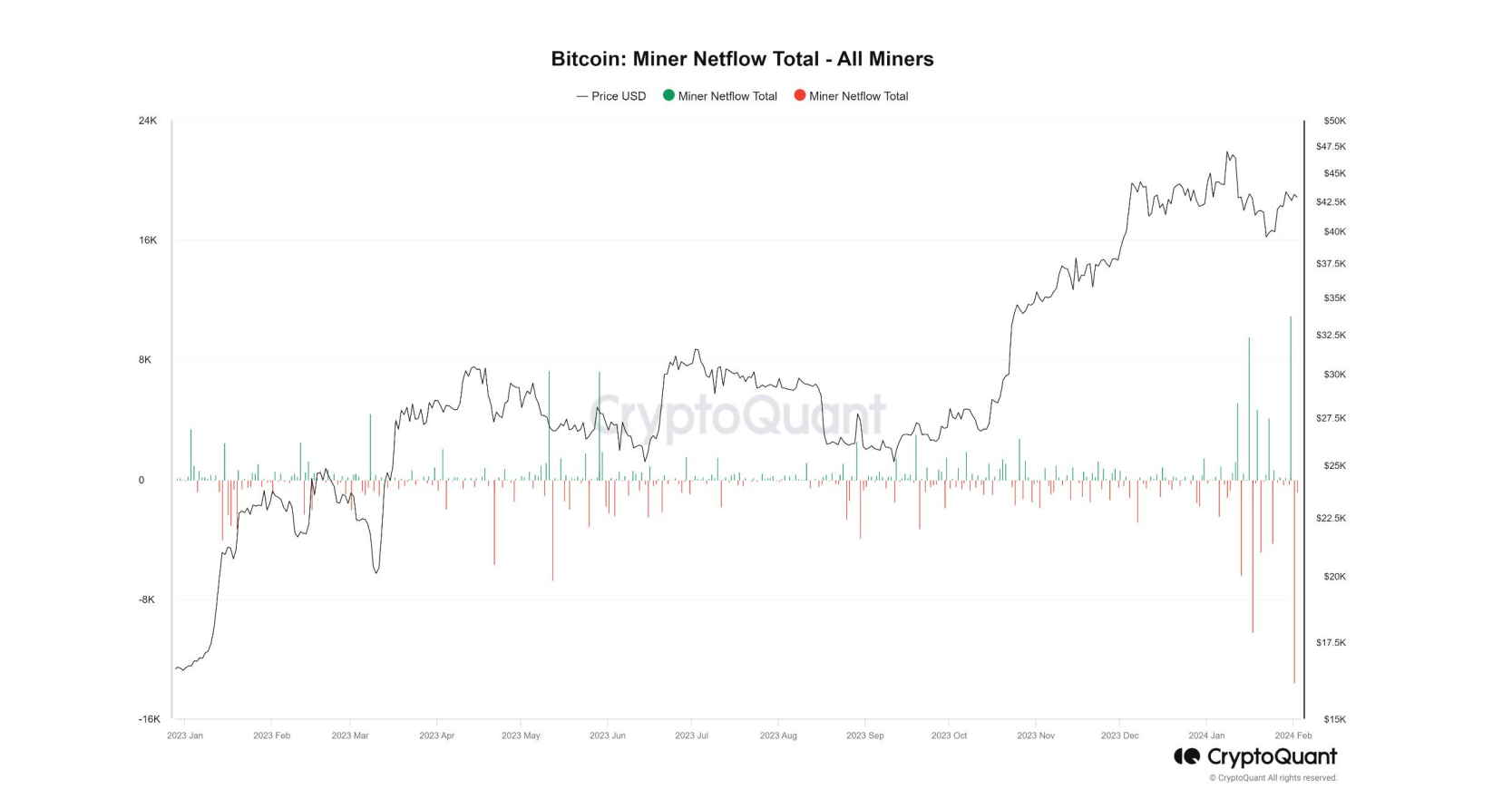

According to the latest Bitfinex Alpha market report reflecting on-chain data, the second day of trading of Bitcoin ETFs on Jan. 12 saw a significant increase in Bitcoin miners’ outflow to exchanges. Citing data from Glassnode, the report highlights over $1 billion of Bitcoin (BTC) being sent to exchanges from miner-associated wallets on the same day, marking a six-year high in miner outflow.

Feb. 1 also saw another significant amount of BTC moving out of miner wallets, with 13,500 BTC being sent to exchanges. The report also notes that around 10,000 BTC was sent back to miner wallets on Feb. 2, suggesting that activity could also be attributed to specific mining companies rebalancing wallets.