Coinspeaker

Bitcoin ETFs Record 14% Increase in Institutional Investors’ Adoption

Despite the recent market downturn, institutional investors’ interest in spot Bitcoin ETF products has increased 14% quarter-over-quarter. According to Matt Hougan, the Chief Investment Officer of investment asset manager Bitwise, this growth came around Q2 2024, when the price of Bitcoin (BTC) dropped by about 12%.

Institutional Investors Defies Crypto Market Crash Odds

In his note to investors, the Bitwise executive confirmed that the price decline did not spook institutions out of the market. Rather, the numbers grew from 965 to 1,100. Hougan, who remains bullish about spot Bitcoin ETFs, emphasized how institutional adoption of this crypto product that gained SEC approval in January is happening at a meteoric rate.

At the current percentage, institutional investors own up to 21.15% share of the total Assets Under Management (AUM) in Bitcoin ETFs. This is a significant rise from 18.74% in the previous quarter. As of June 30, institutional investors’ Bitcoin ETF holdings amounted to $11 billion. Quite a number of institutions exited their positions during this period. However, many more joined the train as well.

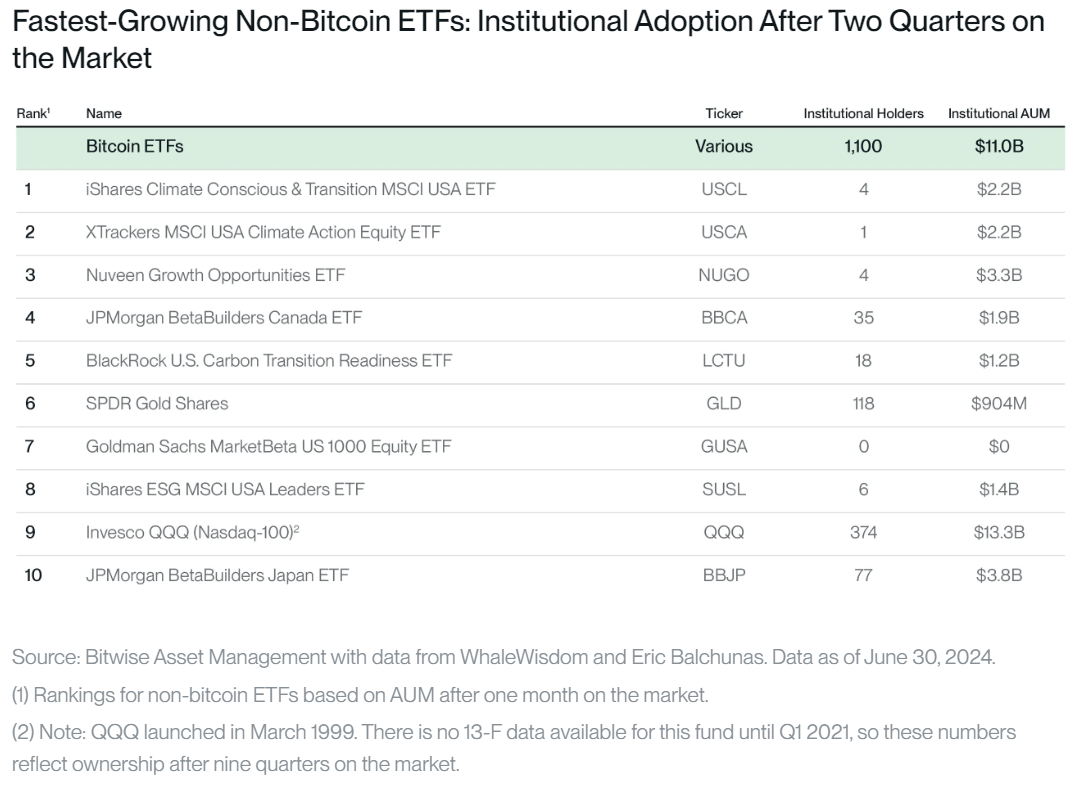

Precisely, 112 investors emptied their Bitcoin ETF holdings in Q2, and 247 new firms entered the market, resulting in a net of 135 new institutional investors. Generally, United States spot Bitcoin ETFs have attracted around three times more institutional buyers in barely six months of launch. Hougan likened this level of Bitcoin ETF adoption to the early growth of Invesco’s QQQ ETF.

Wall Street Investors Take a Slice of Individual Bitcoin ETF

Furthermore, he talked about comparing BTC ETFs as a group to individual ETFs, and in his opinion, individual ETFs still dominate. For context, he highlighted his company’s ETF, which ranked fourth in terms of AUM in June. Hougan noted that BITB gained more institutional investors than SPDR’s GLD ETF did at the same stage of development.

Hence, “We shouldn’t let the historic adoption of Bitcoin ETFs by retail investors obscure the fact that they are also gaining institutional traction faster than any other ETF in history,” the Bitwise CIO explained.

Hougan is quite positive that institutional adoption of Bitcoin ETFs will increase further as the years go by. Wall Street firms are some of the institutional holders of spot Bitcoin ETFs. Goldman Sachs Group Inc (NYSE: GS) recently revealed in its 13F filing to the SEC that it holds positions in about seven out of the eleven BTC ETFs. Its most significant holding is in BlackRock’s IBIT, with 6.99 million shares valued at $238 million.

The bank holds 1.51 million shares of Fidelity’s Bitcoin ETF (FBTC), valued at approximately $80 million. It holds $56 million in Invesco Galaxy’s BTCO, $35 million in Grayscale’s GBTC, and $8.3 million in Bitwise’s BITB.

Goldman Sachs has also invested over $1 million in WisdomTree’s BTCW and Ark Invest’s ARKB. Besides Goldman Sachs, other top firms like Wells Fargo & Co (NYSE: WFC) and Susquehanna International Group (SIG) also have BTC ETF exposures.

Bitcoin ETFs Record 14% Increase in Institutional Investors’ Adoption