The third-largest inflow day for spot Bitcoin ETFs came on the same day the BTC price crossed $46,000 to record a new multiweek high.

On Feb. 8, spot Bitcoin exchange-traded funds (ETFs) experienced their third-largest influx, totaling $403 million. The large inflows came despite over $100 million exiting the Grayscale Bitcoin Trust (GBTC).

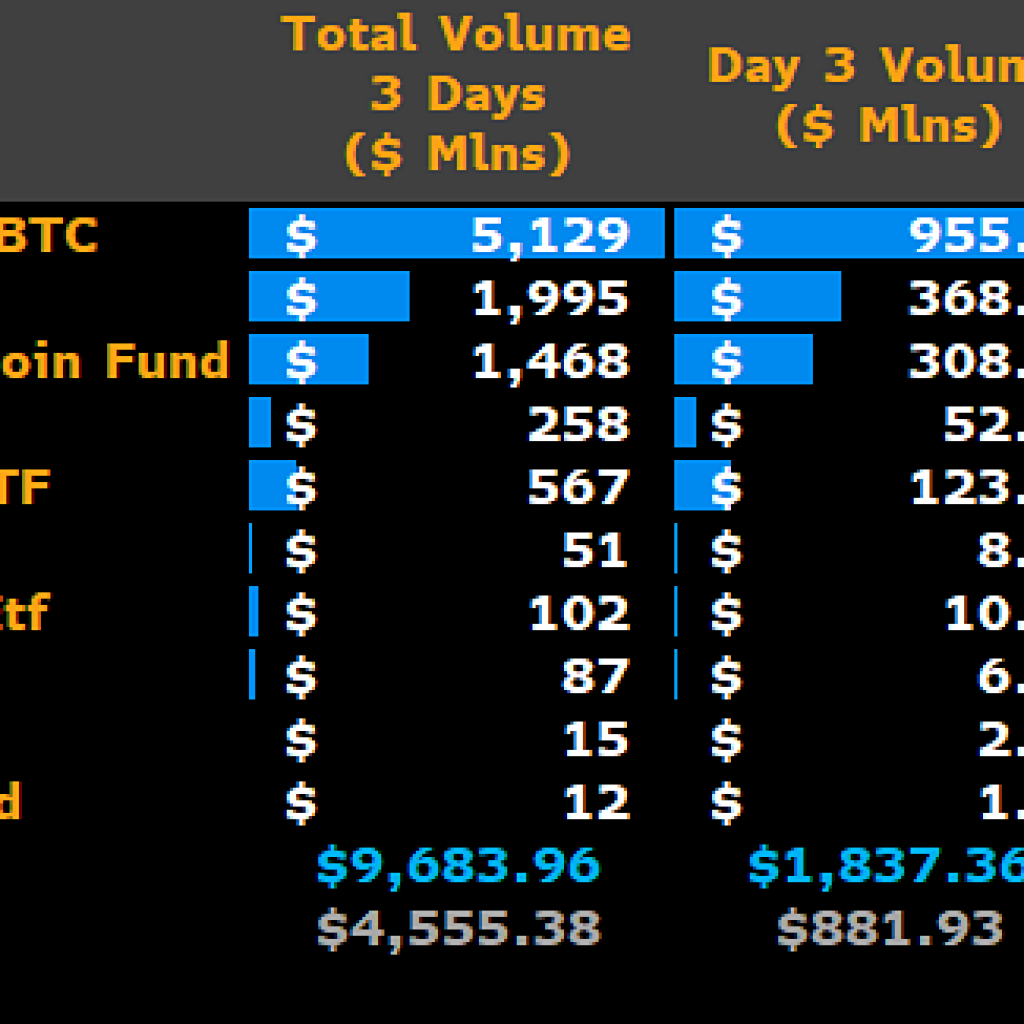

The total inflow into spot Bitcoin (BTC) ETFs has already exceeded $2.1 billion since their launch on Jan. 11, indicating a strong demand for BTC in the market. The third-largest inflow day for spot BTC ETFs came as BTC price crossed $46,000 to record a new multiweek high just $2,000 short of new yearly highs.

BlackRock iShares Bitcoin Trust (IBIT) leads the ETF flow chart with an inflow of $204 million, Fidelity had $128 million, ARK 21Shares had $86 million and Bitwise had $60 million. The other seven ETFs combined saw $27 million in inflows, with GBTC recording another $102 million in outflows.