Coinspeaker

Bitcoin ETFs See $168M Outflow, Ether ETFs Buck Trend with $48M Inflow

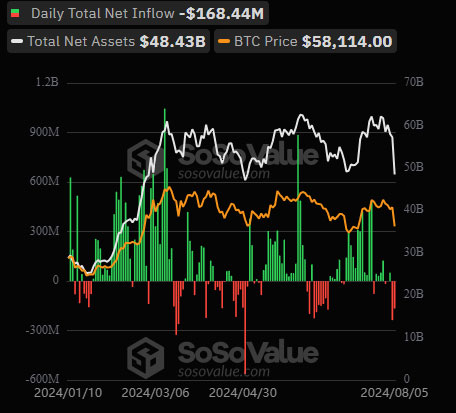

The crypto market went through a rollercoaster ride, marked by significant turbulence on Monday. As a result, spot Bitcoin exchange-traded funds (ETFs) in the US saw a net outflow of $168.4 million. This occurred alongside broader market unease, with both global equities and cryptocurrencies facing downward pressure.

Photo: SoSoValue

GBTC Leads Record Daily Outflows

Grayscale‘s industry-leading GBTC fund witnessed the highest daily net outflow of $69.12 million, according to data from SoSoValue. Ark Invest and 21Shares’ ARKB followed closely with $69 million in outflows, while Fidelity’s Bitcoin ETF saw $58 million leave the fund. The outflow trend highlights investor jitters in the face of recent market volatility.

However, it’s important to note that this pullback wasn’t uniform. Grayscale’s latest Bitcoin trust, launched last week, actually experienced a positive inflow of $21.81 million. Additionally, ETFs from VanEck and Bitwise managed to attract modest inflows of around $3 million on Monday.

BlackRock’s IBIT, the largest spot Bitcoin ETF by net asset value, along with several other funds, remained stagnant with zero net flows yesterday, suggesting that some investors are choosing to hold onto their positions despite the market turbulence.

Despite the net outflows, a significant amount of capital moved through spot Bitcoin ETFs on Monday. A total of $5.24 billion worth of funds were traded, marking the highest daily volume since March 25. This surge in activity likely reflects investor uncertainty and potential opportunistic buying in the wake of the price dip.

Crypto Dips Yet Ether ETFs Shine

The global market selloff on Monday stemmed from a confluence of factors. On the macro side, escalating tensions in the Middle East and weak US economic data weighed heavily on global equities. In the crypto realm, concerns surrounding Jump Crypto’s asset movements and the upcoming US election further fueled the selloff.

Bitcoin’s price briefly dipped below the psychologically important $50,000 mark before recovering to trade around $54,804 at the time of writing. Similarly, Ether price plummeted to lows of $2,200 before bouncing back to $2,450.

Interestingly, spot Ether ETFs, which only began trading last month, defied the broader trend and actually reported a net inflow of $48.73 million on Monday. BlackRock’s ETHA led the pack with $47 million in inflows, followed by VanEck and Fidelity’s offerings with inflows of around $16 million each.

Bitcoin ETFs See $168M Outflow, Ether ETFs Buck Trend with $48M Inflow