Coinspeaker

Bitcoin ETFs Surge with $250M Inflows After Rate Cut Hints at Jackson Hole

The combined daily inflow of spot Bitcoin exchange-traded funds (ETFs) in the United States surpassed $252 million on Friday. This was the highest net inflow recorded by the funds in a single day since July 23.

While the inflow was remarkable, other metrics associated with the funds appear to reflect that encouraging comments from the Jackson Hole symposium may have lent a boost to risk assets, including Bitcoin (BTC).

Bitcoin ETFs See Record Daily Inflow

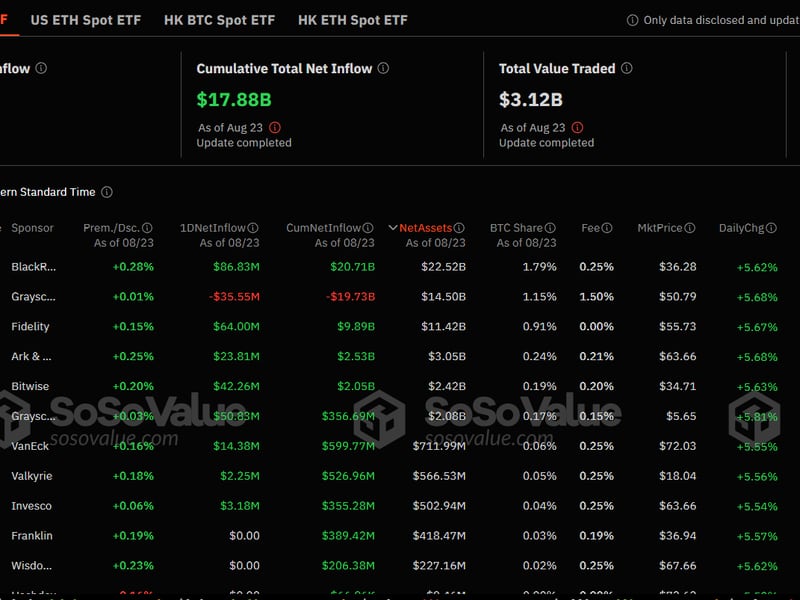

Not only was there an influx of capital into the funds. Trading volumes for all eleven ETFs also went above $3.12 billion, according to SoSo Value data. This means that the trading volumes for US-listed Bitcoin ETFs have now hit the highest level since July 19.

Of all the funds, BlackRock’s IBIT saw the most activity as well as the most inflow. Its trading activity topped $1.2 billion, while it saw a positive flow of $83 million at the end of the day.

Fidelity followed with its FBTC seeing $64 million in inflows, while Bitwise’s BITB also had an interesting day after receiving $42 million. Notably, Friday’s inflow was enough to help Bitwise cross the $2 billion asset under management (AUM) mark for the first time. Although not shocking, Grayscale’s GBTC continued its unimpressive run of form. It was the only product that saw negative flows after $35 million left it. That is, despite its mini Bitcoin fund BTC, seeing massive inflows of over $50 million the same day.

The Fed Effect

As earlier noted, Friday’s inflow is, without doubt, related to the signals coming from the Federal Reserve. That is, as it relates to potential monetary policy changes.

Fed chair Jerome Powell, while at the Jackson Hole symposium on Friday, noted that it is time for the agency to adjust its policies. This has been translated by many as meaning that the Fed is getting ready to loosen monetary policy. He said partly:

“The direction of travel is clear, and the timing and pace of rate cuts will depend on incoming data, the evolving outlook, and the balance of risks.”

As would be expected, Powell’s comments almost immediately sparked an industry-wide rally that saw BTC climb above $64,000. Therefore, it might be safe to say that this was what ultimately translated into the inflows recorded by the ETFs.

Looking ahead, though, the Fed’s next policy meeting is scheduled for September 17. So, crypto traders are fully optimistic that the Federal Reserve will deliver its first rate cut at that time.

The concept remains that tighter monetary policies typically weigh on risk appetite in financial markets. This means that it becomes extremely difficult for investors to access capital pools, making it less likely that they put their money into risky assets. On the other hand, lower rates tend to attract investors to these asset classes because they now have cheaper access to capital pools.

Bitcoin ETFs Surge with $250M Inflows After Rate Cut Hints at Jackson Hole