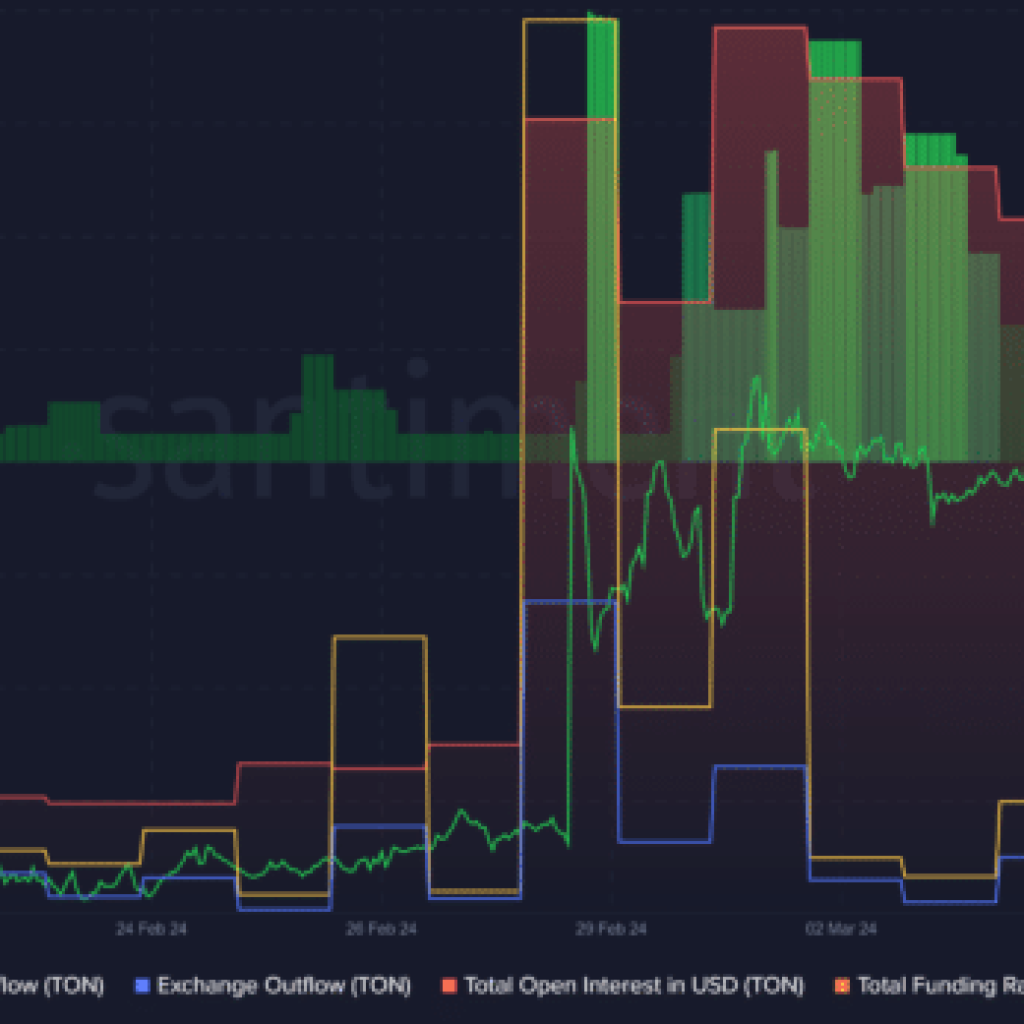

Record-long positive Bitcoin futures funding rates signal “strong bullish sentiment” which can often precede price corrections, says on-chain analytics firm CryptoQuant.

Bitcoin futures funding rates — periodic payments made between short and long traders — may be signaling a potential price correction for Bitcoin in the future, which could present “prime buying opportunities," according to market analysts.

In a post shared on X on April 3, an analyst from on-chain analytics firm CryptoQuant reported that record-long positive Bitcoin futures funding rates are signalling “strong bullish sentiment.”

Futures funding rates are the periodic payments that traders pay each other based on the difference between the price of the perpetual futures contract and the spot price of BTC.