BTC futures open interest approaches a record high and today’s sharp sell-off triggered alarm from traders.

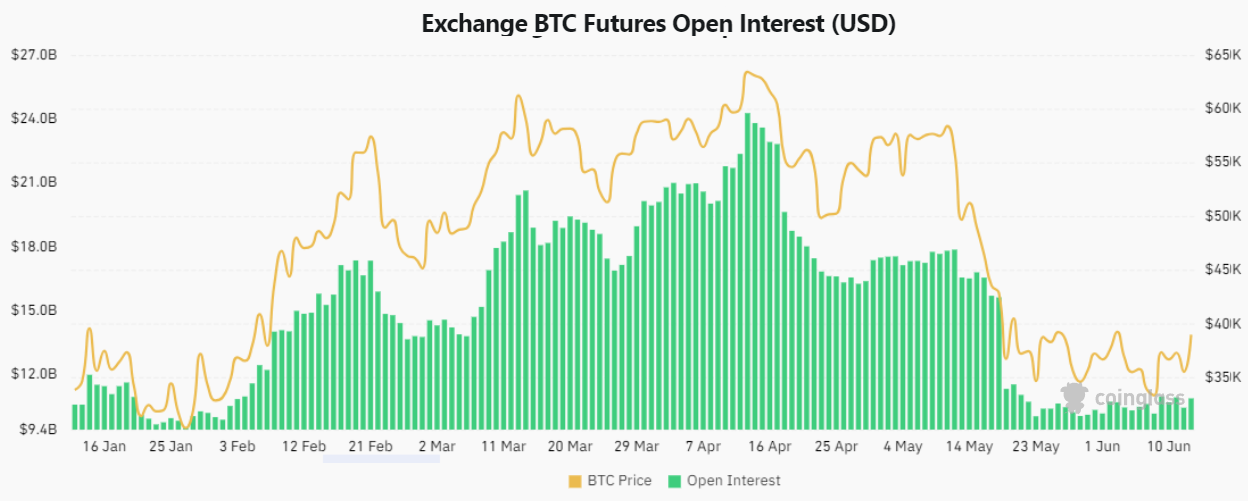

Bitcoin (BTC) took a shot at $53,000 on Feb. 20, briefly surpassing $52,900 before correcting as the result of $50 million in leveraged long liquidations. Nevertheless, even with a drop to $50,750, Bitcoin futures open interest remains at $23.7 billion, which is just 2.5% below its all-time high in April 2021.

In April 2021, the open interest figure peaked at $24.3 billion but failed to break the $64,900 resistance, leading to a 27% correction in 11 days. With the current strong demand for BTC futures contracts, investors are contemplating the possibility of a similar outcome.

Some traders argue that the rise in Bitcoin futures open interest indicates excessive borrowing, but this is not universally accurate. Every derivatives trade requires a buyer and a seller of the same size and an investor may be fully hedged even when utilizing leverage, such as buying monthly BTC futures and simultaneously selling an equivalent amount of perpetual contracts if a favorable price difference exists.