HodlX Guest Post Submit Your Post

Bitcoin halving 2024 perhaps the most eagerly awaited event in the crypto world this year is now less than a month away.

While the abundance of countdown timers scattered across various platforms highlights its significance, its true implications for the crypto market remain somewhat ambiguous.

Officially, the Bitcoin halving signifies a halving of Bitcoin’s mining reward. However, its impact extends beyond mining dynamics alone.

Occurring roughly every four years, these events have historically served as pivotal moments in Bitcoin’s journey, shaping its price trajectory and influencing market sentiment.

As we approach the fourth Bitcoin halving event scheduled for a block height of 740,000 examining the current state of the crypto market in light of past performance provides valuable insights into interpreting market dynamics.

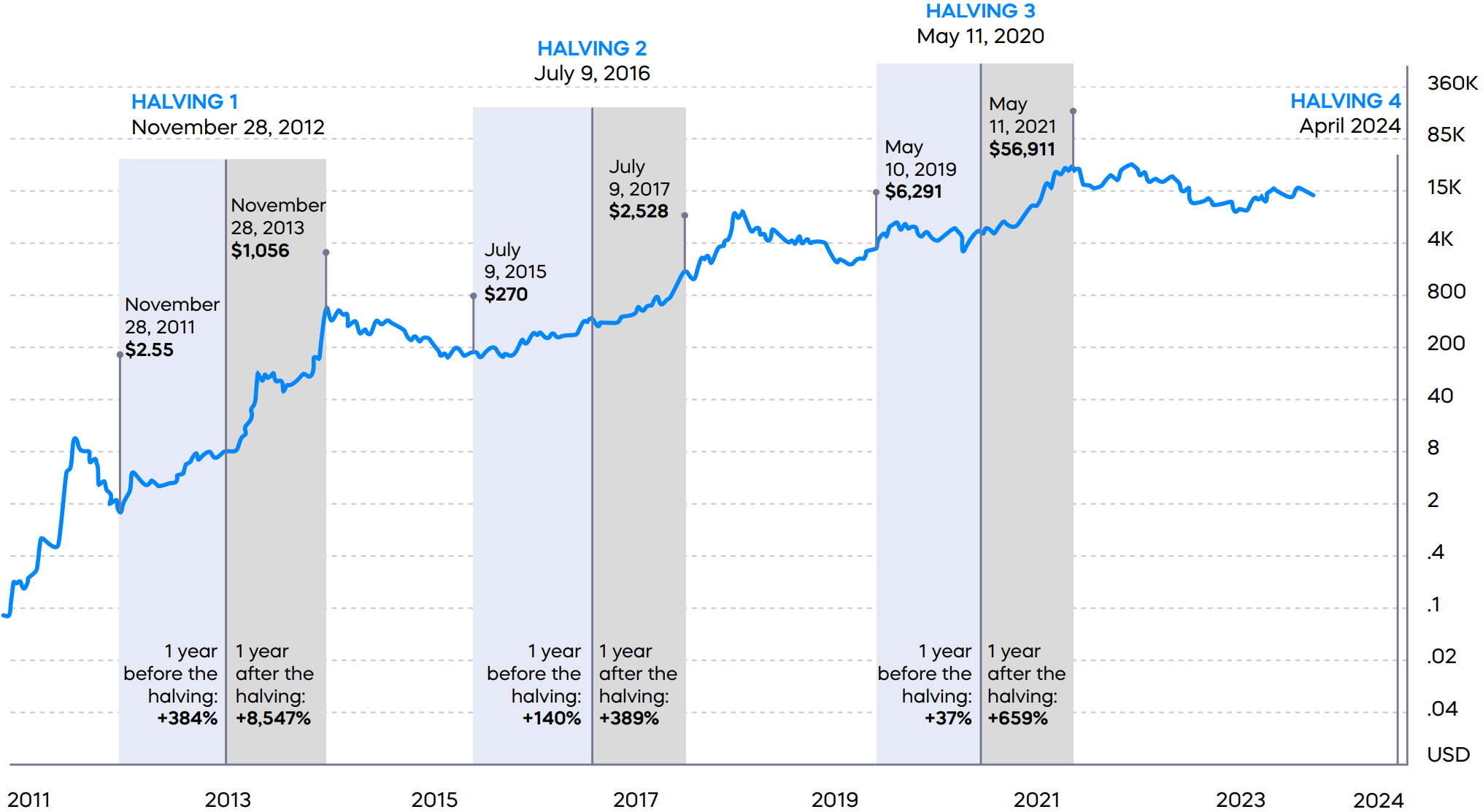

Let’s delve into the performance of the three previous Bitcoin halving events.

Bitcoin halving 2012

November 28, 2012, marked a historic moment in Bitcoin’s journey with its first halving event. As the block reward dwindled from 50 BTC to 25 BTC, Bitcoin underwent a significant transformation.

What ensued was truly extraordinary. Bitcoin’s price surged from a humble $11 to an astonishing $1,110 by December 2013, showcasing its revolutionary potential as a digital asset.

This meteoric rise not only captured the attention of investors but also propelled Bitcoin into the mainstream spotlight, laying the groundwork for its ascent to prominence in the financial realm.

Bitcoin halving 2016

Fast forward to July 9, 2016, and Bitcoin encountered its second halving event.

With the block reward slashed once again this time from 25 BTC to 12.5 BTC Bitcoin embarked on another remarkable journey.

Soaring from approximately $650 prior to the halving, its price skyrocketed to an astounding $19,500 by December 2017, marking a 30-fold increase in just six months.

While Bitcoin basked in the limelight, the cryptocurrency landscape witnessed the emergence of altcoins and the proliferation of initial coin offergins (ICOs), indicating a surge in interest and investment in blockchain technology.

Bitcoin halving 2020

Amid the global upheaval caused by the COVID-19 pandemic, Bitcoin’s third halving event unfolded on May 11, 2020. Despite the economic uncertainty, Bitcoin adhered to a familiar pattern.

Its price surged eight-fold in less than a year, climbing from around $8,900 before halving to over $64,000 by April 2021.

This period also witnessed significant institutional endorsement, with notable investors like Paul Tudor Jones and Michael Saylor publicly backing Bitcoin, further solidifying its status as a reliable store of value.

Looking to the future Bitcoin halving 2024

As we stand on the brink of the fourth Bitcoin halving event, the stage is set for another captivating chapter in the Bitcoin saga.

With the block reward poised to drop to 3,125 new BTC, the cryptocurrency world eagerly anticipates what lies ahead.

Drawing insights from past halvings, we can forecast certain trends.

Pre-halving rally

Historically, Bitcoin has witnessed significant price rallies preceding halving events, fueled by investors’ anticipation of reduced supply and potential price appreciation.

Post-halving correction and consolidation

Following the halving, Bitcoin typically undergoes a period of correction and consolidation as the market adjusts to the altered supply dynamics.

This phase often manifests heightened volatility as market participants navigate the new landscape.

Next bull run

After the initial adjustment period, Bitcoin tends to embark on a major bull run, propelling prices to new highs.

This phase commonly reaches its zenith approximately 18 months after the halving event, as Bitcoin gains momentum and attracts renewed interest from investors.

Institutional interest

With each halving cycle, we’ve observed a surge in institutional interest in Bitcoin.

Institutional investors recognizing the potential of digital assets play a pivotal role in driving sustained price appreciation as they seek exposure to this burgeoning asset class.

In conclusion, while past performance is not indicative of future results, historical data shows that Bitcoin halving events are catalysts for significant price movements and increased market activity.

As we approach Bitcoin halving 2024, investors and enthusiasts will be closely monitoring developments and awaiting the next chapter in Bitcoin’s evolution.

Esin Syonmez is a content writer at Morpher, a company which strives to make trading accessible to all, where she contributes to the company’s mission of financial inclusion and democratizing trading worldwide.

Follow Us on Twitter Facebook Telegram

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Swill Klitch/Sensvector

The post Bitcoin Halving 2024 – Insights From Historical Performance appeared first on The Daily Hodl.