The Open Interest in Bitcoin is now 30 times higher than it was 11 days before the 2020 Bitcoin halving.

The supply shock of the Bitcoin halving won’t be as shocking to Bitcoin’s (BTC) price as many investors anticipate, says a new research report from crypto analytics firm CryptoQuant.

“We argue that the effect of the halving has been diminishing, as the new issuance of Bitcoin gets smaller relative to the amount of Bitcoin selling from long-term holders,” CryptoQuant wrote in an April 9 research report — viewed by Cointelegraph.

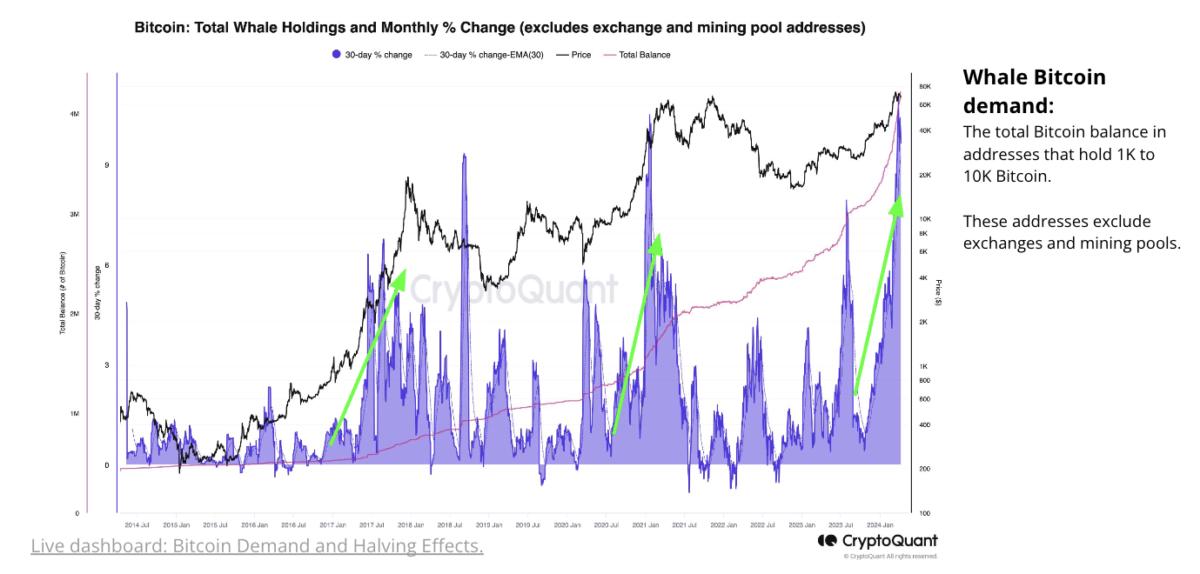

Instead, the “key driver” affecting Bitcoin’s price following the halving this time around will be the increase in demand from investors with sizeable holdings of Bitcoin.