The CEO of on-chain analytics firm CryptoQuant has explained why the supply shock due to the Bitcoin halving could be significant this time.

The Reason Why Bitcoin Halving Could End Up Being Significant

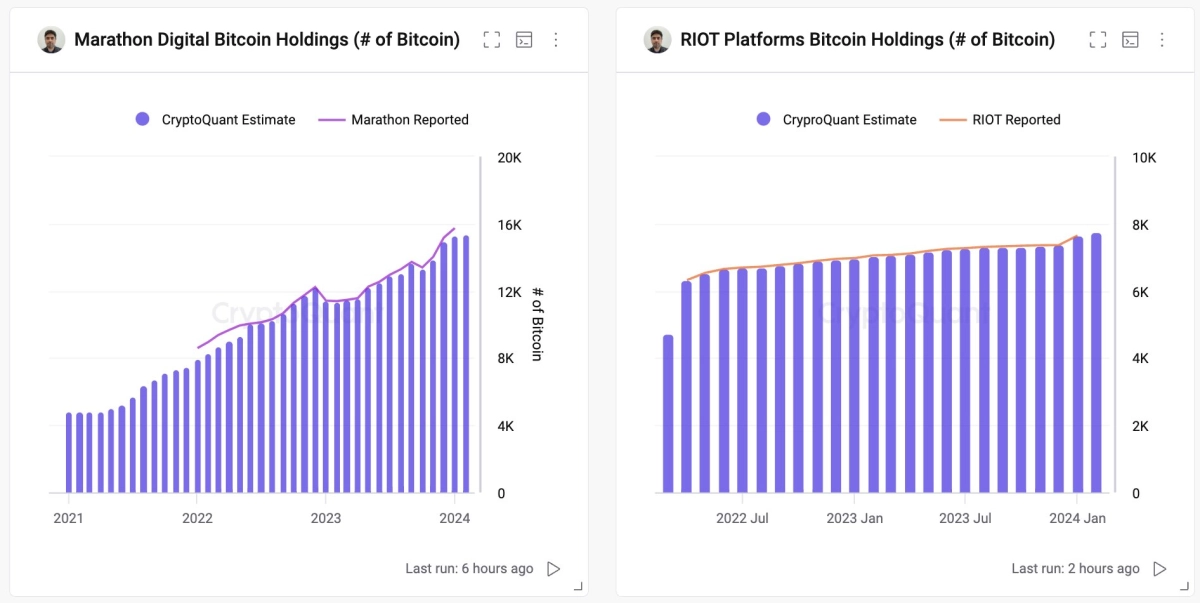

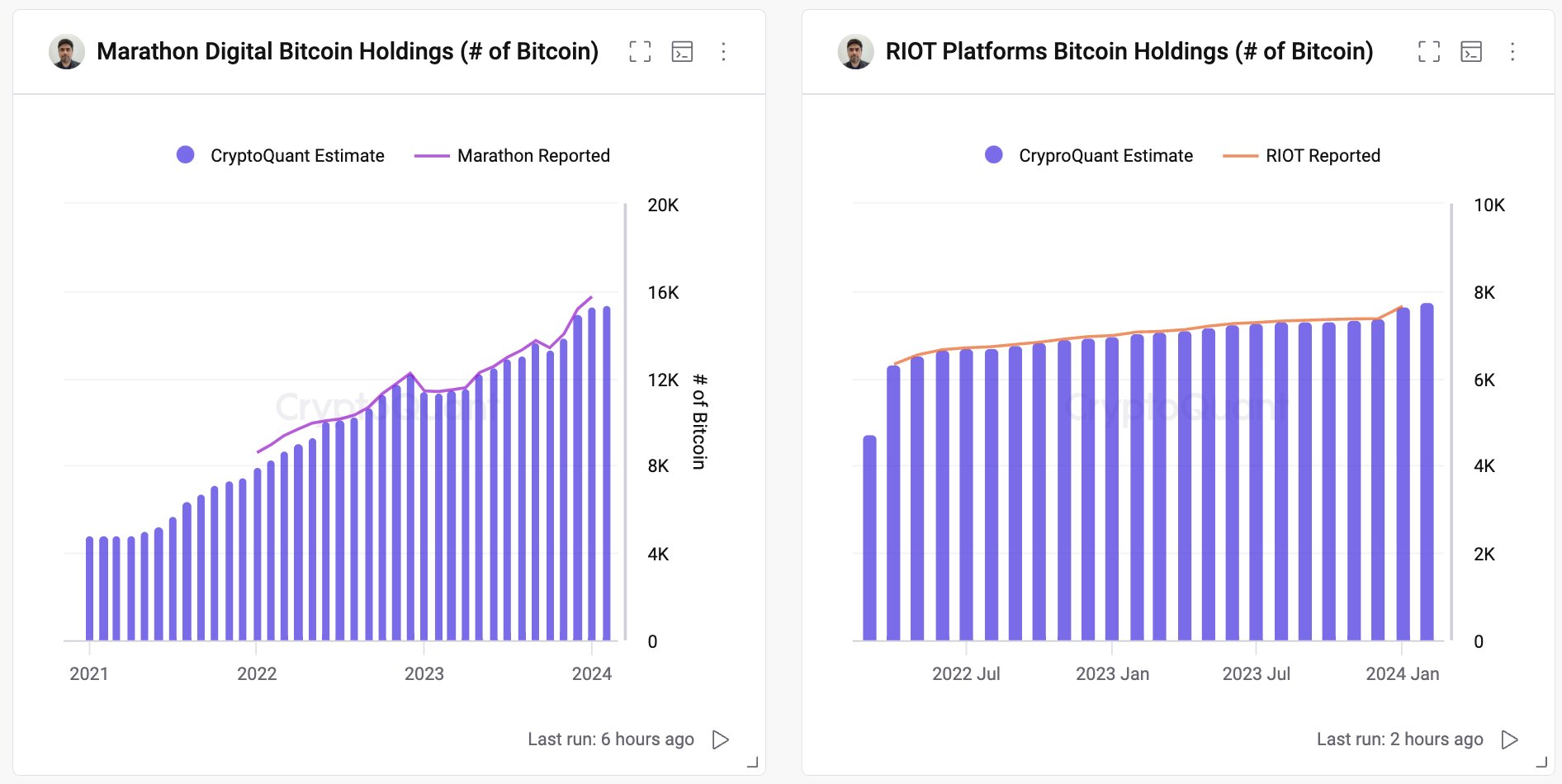

In a new post on X, CryptoQuant CEO and founder Ki Young Ju has talked about how the US-based Bitcoin miners are behaving so far in the leadup to the upcoming halving.

The “halving” here refers to a periodic event for Bitcoin in which the cryptocurrency’s block rewards are permanently slashed in half. This event occurs every four years; the next one is estimated to happen this April.

The block rewards are the BTC rewards miners receive as compensation for adding blocks to the network. Since these rewards usually make up for most of the miners’ revenue (as the transaction fees have historically remained low for the coin), the halvings profoundly impact mining economics.

It would appear that despite the halving coming up soon, the US public mining companies have decided to HODL their Bitcoin for now instead of selling it.

“U.S. publicly traded mining companies are retaining their Bitcoin holdings without showing significant selling pressure, as seen by their wallet activities,” notes Ju.

The CryptoQuant CEO explains why these miners are holding onto their coins for now: the supply shock effect halving events have on cryptocurrency.

“Bitcoin halving is a supply shock event where the new supply gets reduced by half,” says the analyst. “If demand remains the same while supply decreases, the price goes up.”

The asset has felt this supply shock effect to some degree throughout the cycles, but according to Ju, the effect could be particularly significant this time around.

This is because big players like Blackrock and other spot ETF providers are in the space now, and these entities have to purchase their Bitcoin through well-regulated means.

As the mining companies, which could be one of the sources to obtain Bitcoin for these institutions, are keeping their holdings tight for now, these mega whales would have a limited amount of supply available to buy from.

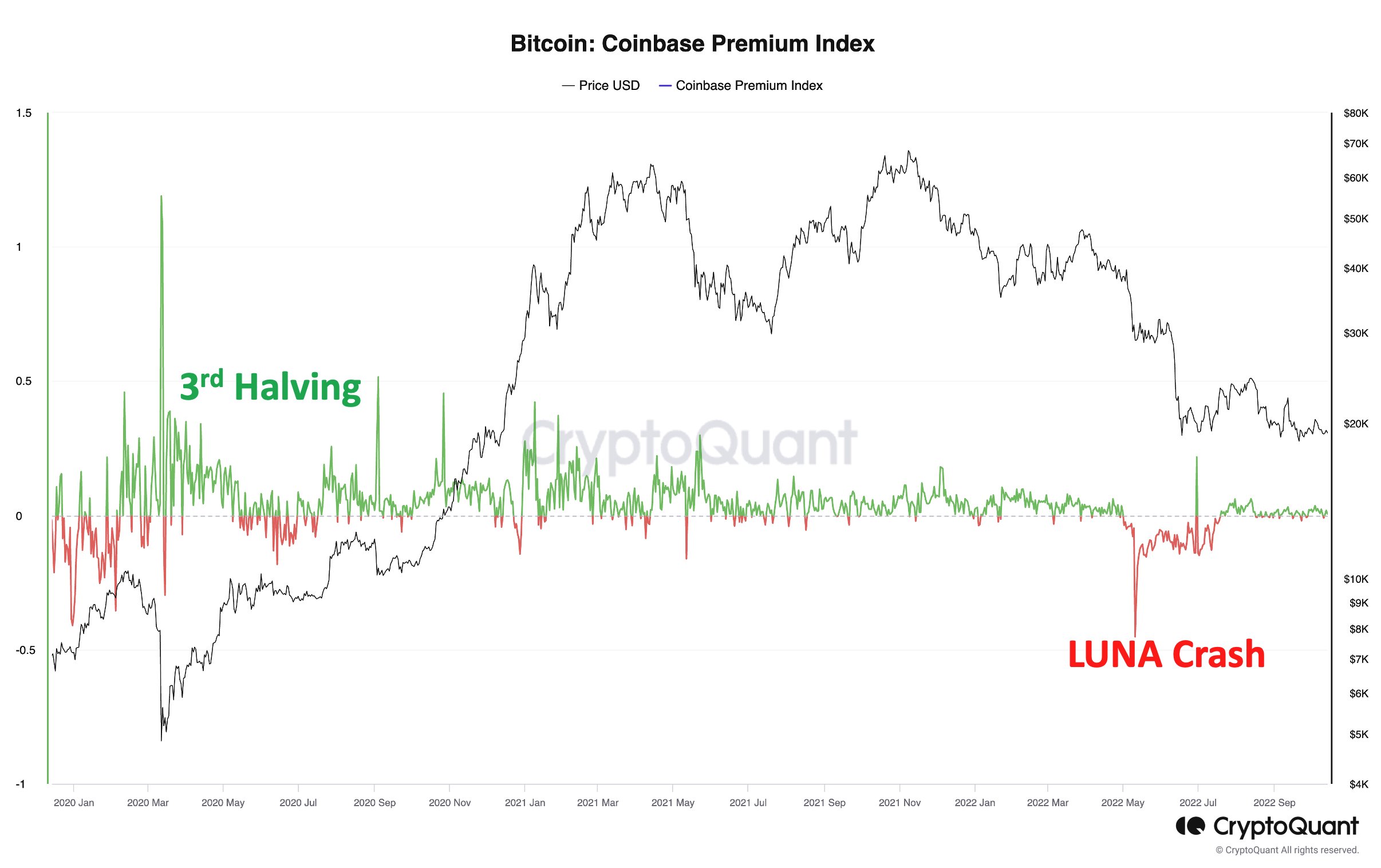

An indicator that may help signal whether these institutions have started applying significant buying pressure can be the Coinbase Premium Index. This metric keeps track of the percentage difference between the BTC prices listed on cryptocurrency exchanges Coinbase and Binance.

Coinbase is known to be the preferred platform of US institutional traders, so the positive premium (that is, the price is higher on the platform than on Binance) can imply the presence of relatively high buying pressure from these big players.

“I expect the CB premium to stay positive for a few months after the next halving, as it did during the 2020-2021 bull run following the March 2020 halving,” says the CryptoQuant founder.

BTC Price

Bitcoin has been stuck inside a range recently, as its price is currently floating around the $42,900 level.