Fewer Bitcoins entering circulation post halving will be met with an increased demand from spot Bitcoin ETF issuers, which will lead to a “continuous, but volatile upward grind” in price, a mining analyst says.

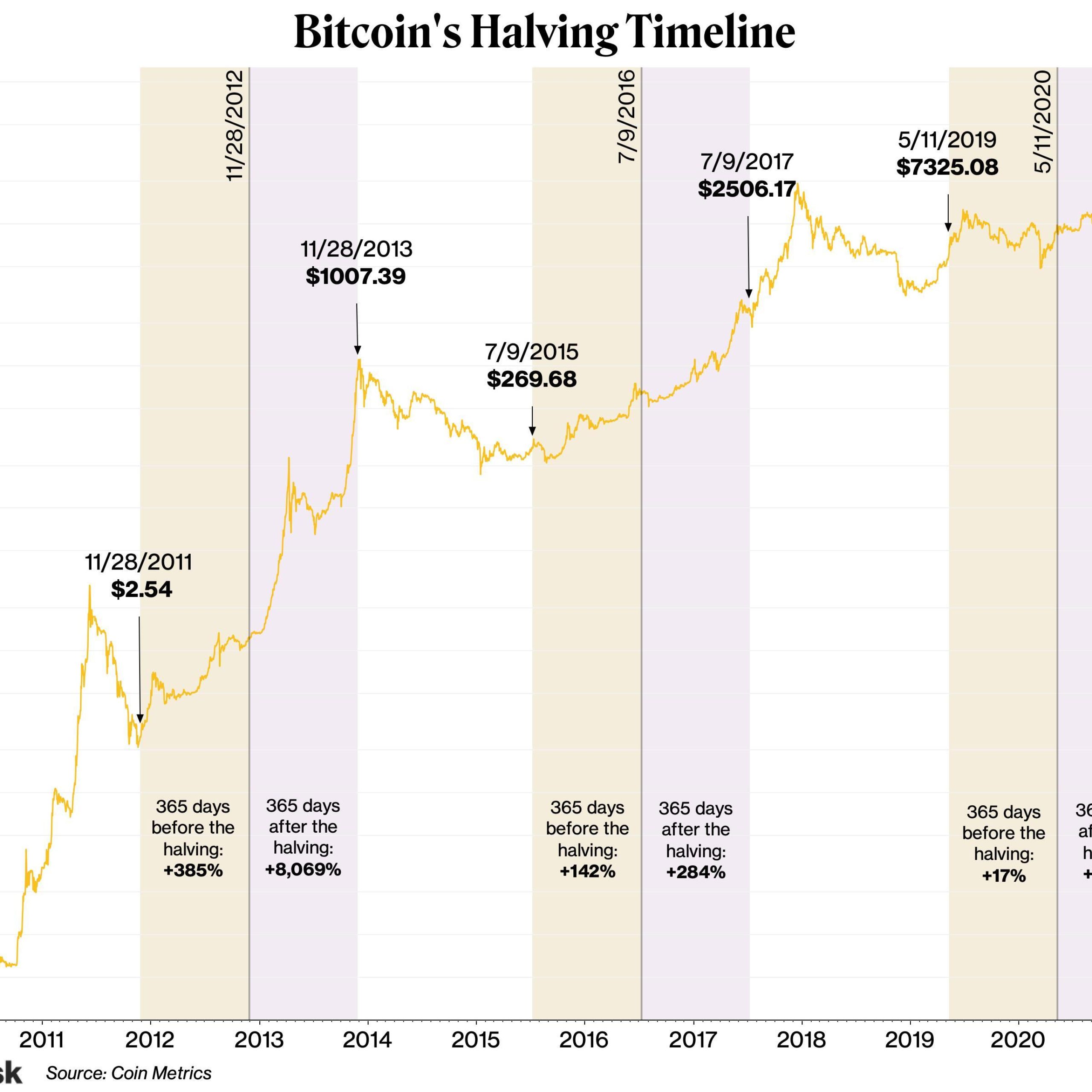

However, Bitcoin’s supply-demand dynamic will be even more favorable than previous halvings in 2012, 2016 and 2020 — thanks to the recent launch of spot Bitcoin exchange-traded funds (ETFs) in the United States.

Halvings result in Bitcoin miner rewards being halved each cycle. It occurs every 210,000 blocks, which is approximately every 48 months.

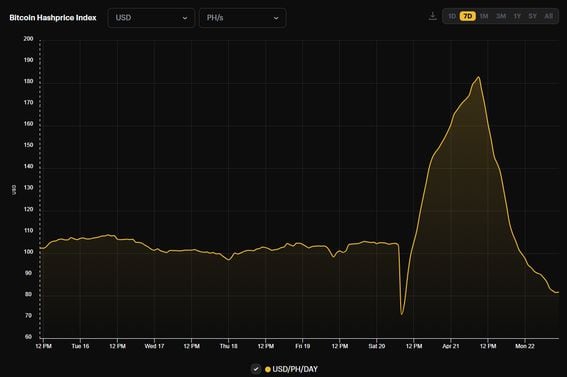

This halving event will occur at block 840,000 — expected to take place on April 20 — which will see mining rewards reduced from 6.25 BTC ($418,800) to 3.125 BTC ($209,400).