One crypto analyst believes Bitcoin (BTC) still has more room to run to the upside despite its already impressive rallies this month.

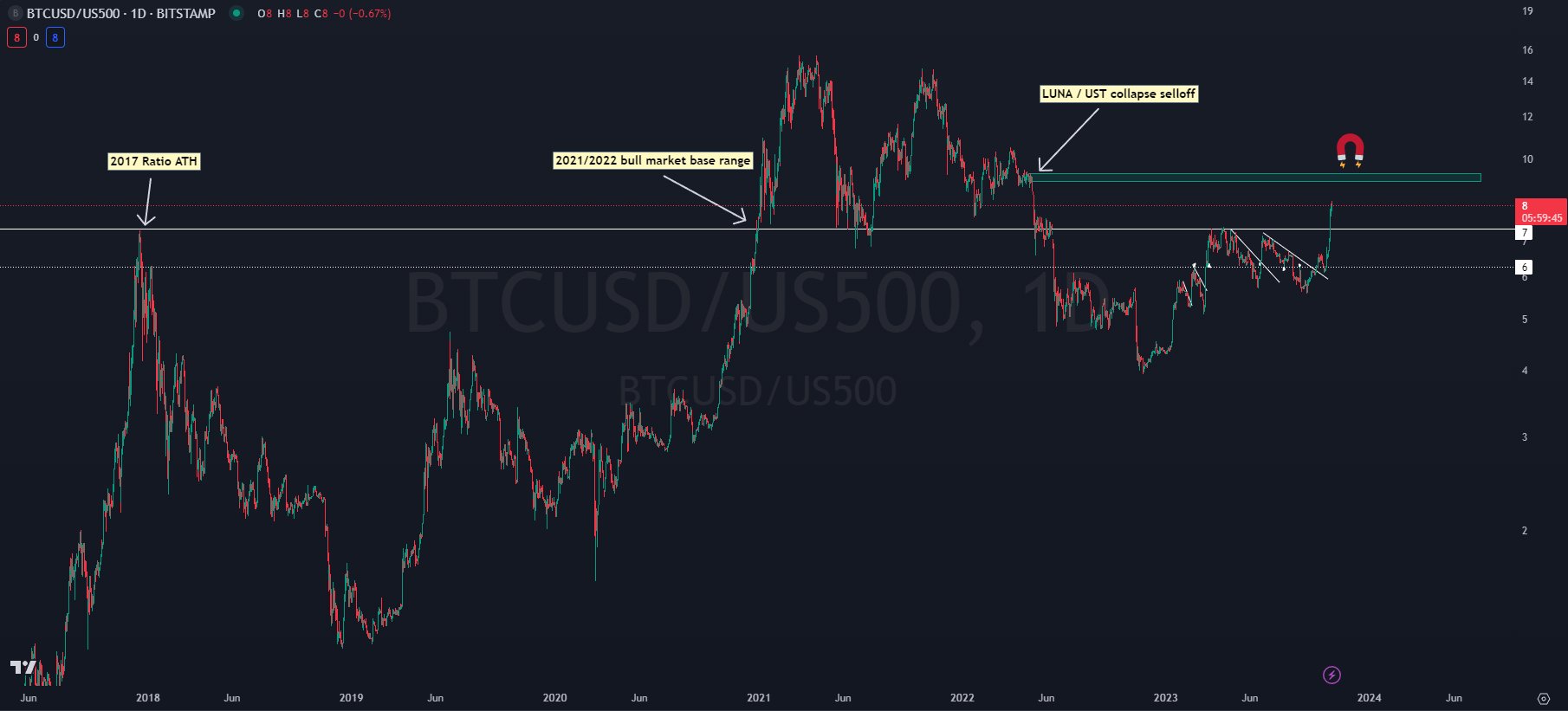

Pseudonymous crypto analyst Kaleo says Bitcoin’s relative performance against the S&P 500 Index (SPX) is part of a growing stack of evidence that BTC has decoupled from the stock market.

According to the analyst, BTC has more gas in the tank for a further move to the upside.

Kaleo says that based on BTC’s historic performance against SPX, a move to the next main resistance supply area of $40,000 is now a likely scenario.

“Over the course of the past month, we’ve finally seen ‘the bullish decoupling’ for BTC from equities that everyone was waiting for.

While BTC is up only 36% vs USD from the September lows, BTC is up 48% vs. SPX.

This chart is one of the reasons I still think there’s plenty of fuel left in the tank for a move higher to $40,000. The solid white line that marks the 2017 ratio ATH [all-time high] has been a significant pivot level for BTC price action the past several years.

It served as solid baseline support for the 2021/2022 bull market, and when it was finally broken, served as the pivot point for the real momentum shift into the liquidation cascade to the lows we experienced in the second half of 2022 into the early part of this year.

Now that we’ve cleared that level, we’ve got clear skies without any major resistance levels until the level where BTC sold off due to the LUNA/UST crash, which correlates to a BTC price of ~$40,000.”

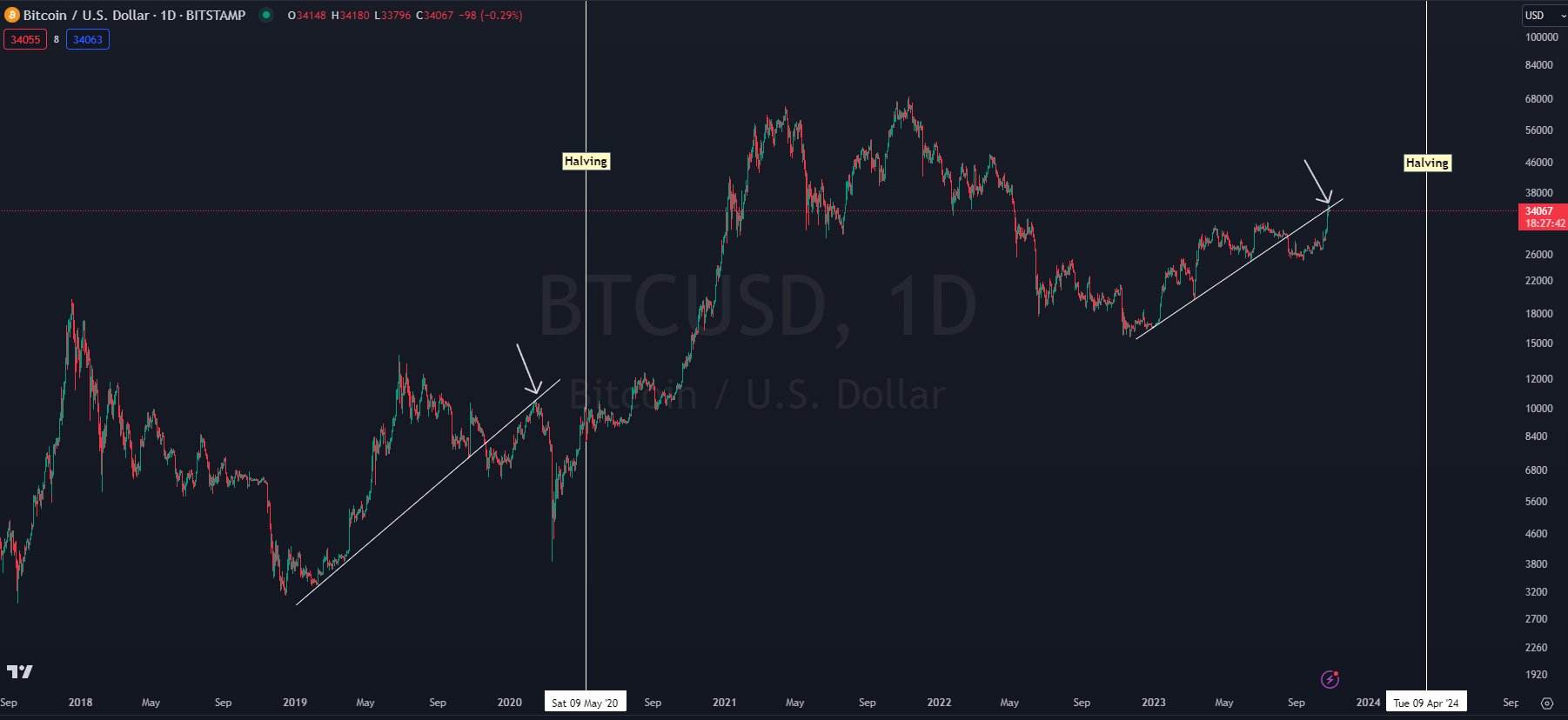

While currently a Bitcoin bull, Kaleo says to play devil’s advocate, there is a bearish scenario that he thinks is worth being prepared for. He says that a March 2020-style crash to the downside that liquidates leveraged traders is still a very real possibility.

According to the analyst, a time horizon that focuses on a 2024-2025 market top is a safer bet than trying to trade the shorter-term moves.

“Although I lean bullish right now, I have infinitely more confidence in a longer time horizon than I do in a short-term continuation. So as fun as this run is, and as much as I hope it continues, I’m prepared for the possibility that it doesn’t. How? I’m just stacking the spot.

If we get a nuke like we did in 2020, guess what – I’ll stack more! I refuse to even give the market the slightest opportunity to make me repeat my same mistake twice. And I have a high level of confidence a year from now – whether I buy here, $20,000, or $40,000 – they’ll all be solid buys.

2024 / 2025 are gonna be lit. Don’t get shaken out before the fun starts.”

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: DALLE-3

The post Bitcoin Has ‘Plenty of Gas Left in the Tank’ After Decoupling From Stocks, Says Analyst – Here Are His Targets appeared first on The Daily Hodl.